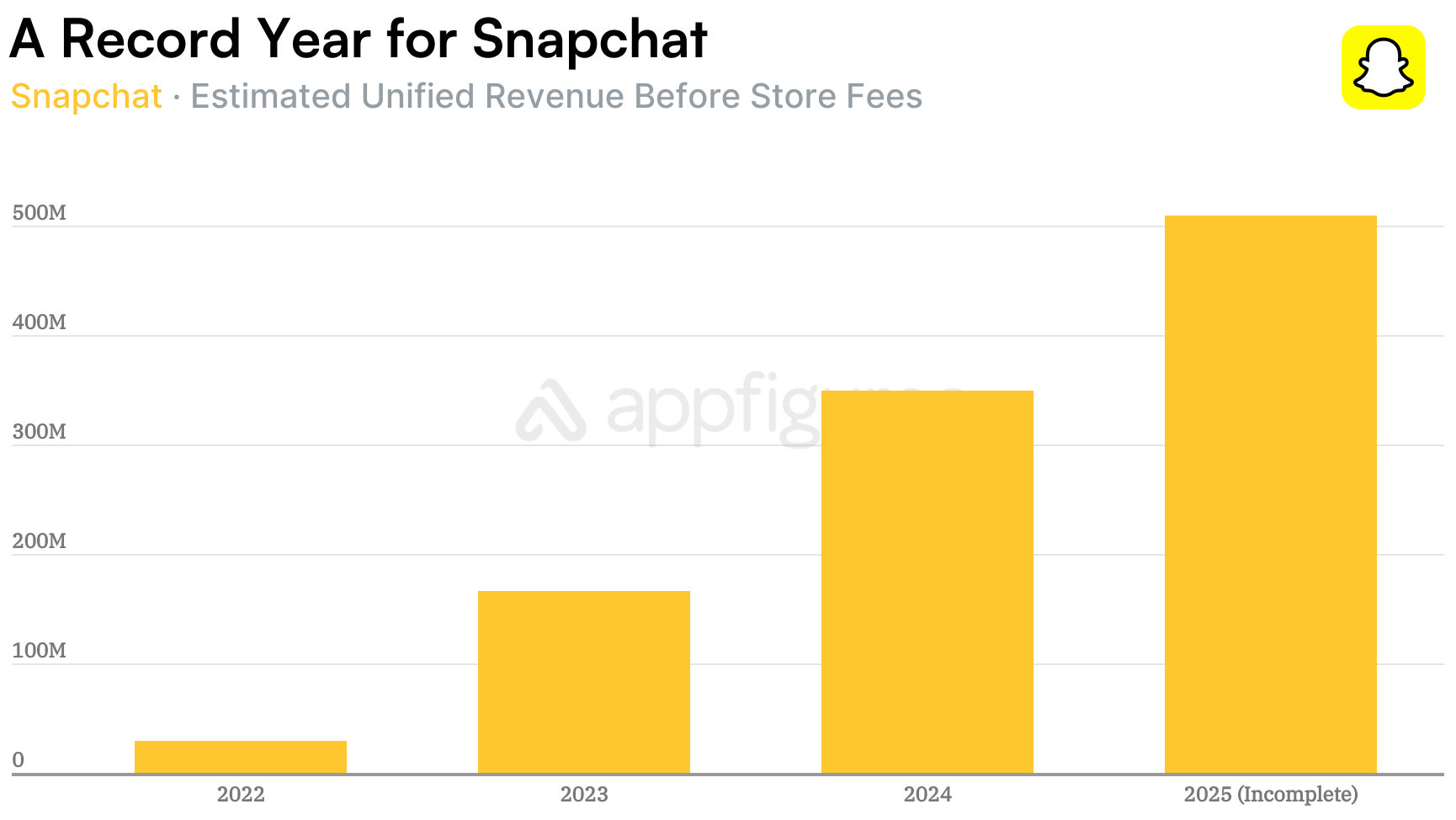

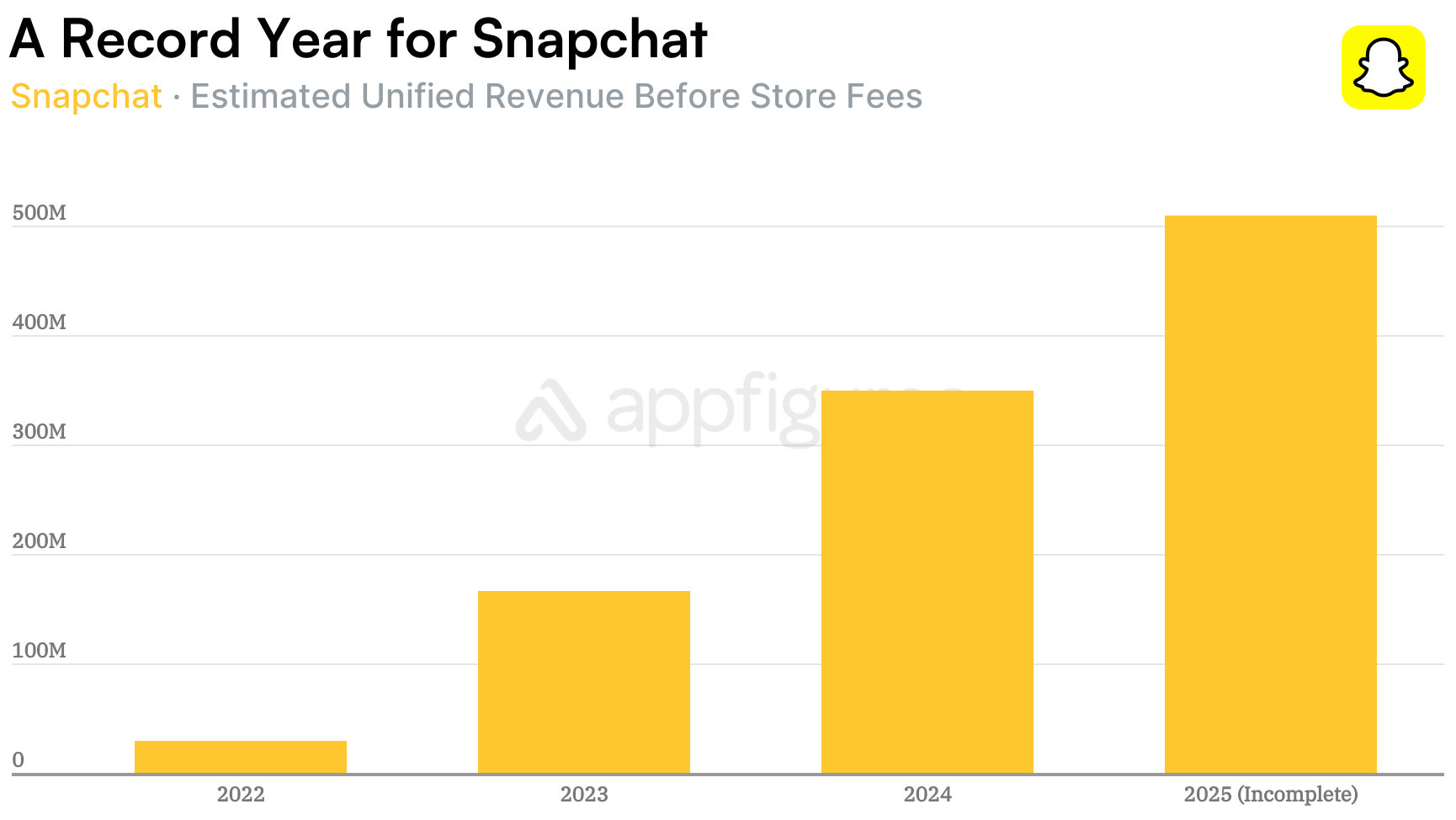

Looking at Snapchat's revenue trend, it's very clear something snapped (pun intended), and Snap really figured out monetization in 2025, sending its revenue soaring even though downloads declined.

I've been following Snapchat's revenue ever since it started monetizing its then-free user base. It took some time for things to align, but once Snap started making money, the trend was almost consistently up and to the right.

It moved even faster this year!

Snapchat ended November with $62M of after-fee revenue, according to our App Intelligence, a whopping 63% higher than January's revenue. And that's not all.

Between January and November, our estimates show Snapchat earned $552M from the App Store and Google Play after store fees. That's 58% higher than all of 2024 and more than 2023 and 2024 combined.

Downloads, on the other hand, dropped to 16M in November, down 30% from January, according to our estimates.

Clearly, something's working with Snapchat's monetization.

When Snapchat started charging a subscription, I hypothesized that revenue growth would correlate with the release of features users actually want. It's not that big a stretch, and this year, Snapchat did a lot of that with AI and AR.

But they didn't stop at features, they also released a new subscription called Lens+ that unlocks more of the AR and AI features users already like - and it worked.

Revenue rose faster in 2025 than in any other year, and as a result, Snapchat's after-fee revenue since the introduction of subscriptions has now crossed $1B.

While other social media platforms are still looking for the right feature mix, Snap figured it out and is heading into 2026 with momentum.

Anthropic bet big on a timely Super Bowl ad that mocks ChatGPT for Claude. The data shows it worked even better than they expected.

What does it look like when AI apps dominate both the download and revenue charts? January 2026 gave us a pretty clear answer.