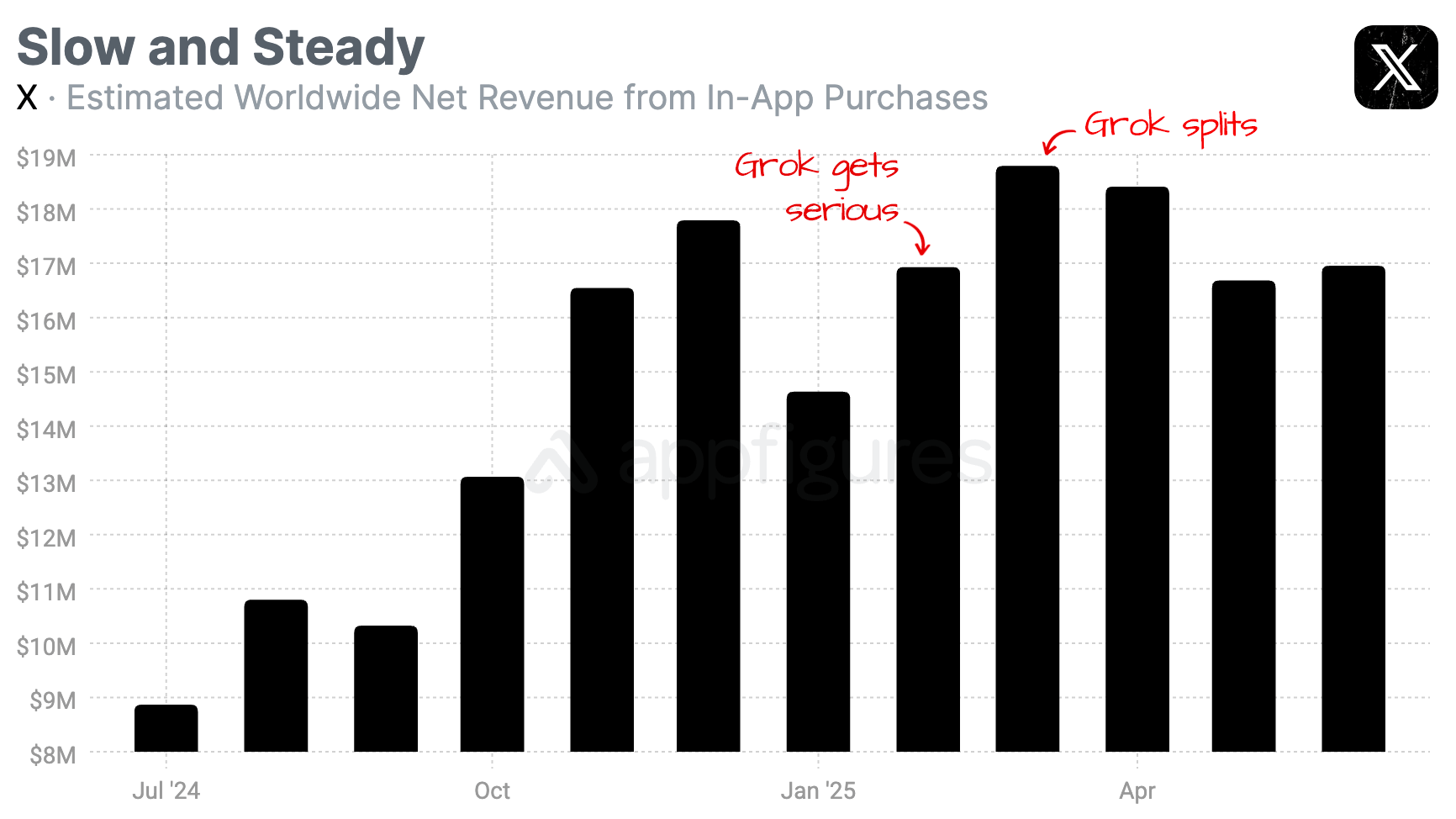

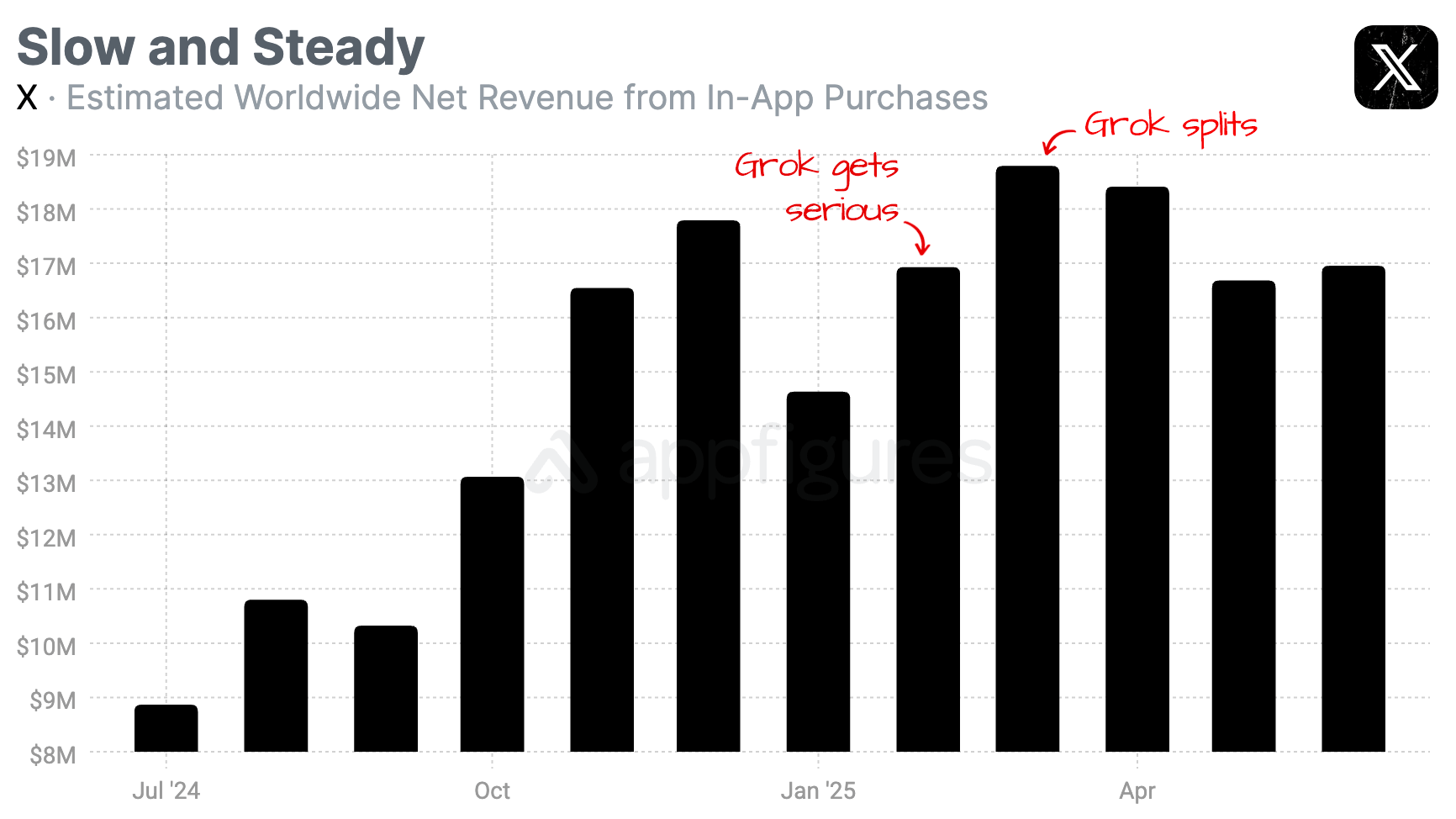

June is behind us which means it's time for my monthly check-in on X’s mobile revenue. The gist: revenue is up a bit, but still under the highs we saw earlier this year.

And I think I know why.

According to Appfigures Intelligence, X ended June with $17M in net revenue from the App Store and Google Play. That's a smidge higher than May's $16.7M, and overall a welcome direction shift after May's slump.

But it's also a good chunk lower than April's $18.8M haul.

A lot has happened this year that could impact X's revenue, so the fluctuations we're seeing aren't all that surprising. But I don't think this is only a matter of politics. Instead, I think it's strategic.

If you've been following my monthly check-ins, you probably remember the spike in revenue that started late last year and carried into Q1. That lift started with price hikes and aggressive promotions, but another component of it was Grok - X's ChatGPT competitor which started getting serious last year.

Grok gave X users a reason to upgrade and many did.

But starting in February, Grok officially became its own app with its own in-app purchases. That shifted revenue growth away from X, and that's why April's revenue slumped. Our App Intelligence shows Grok's net revenue rose from $2.8M in March to $3M in May. Add those back to X's revenue and the story changes.

The other thing, which I mentioned in last month's check-in, is that even after the split, X's mobile revenue is higher when compared to this time last year. That's a good sign for the platform.

December saw a curious split: downloads dropped 2% while revenue sat at $1.3B. ChatGPT and TikTok dominated both charts as the mobile industry enters a new maturity phase.

Wall Street bet $2 billion on Polymarket, and downloads surged 1,172% in December. The prediction market banned in 2022 is now where Wall Street looks for signals.