Polymarket's Downloads Explode as Wall Street Bets $2B on Prediction Markets

Wall Street doesn't use polls anymore - it's watching where people put their money. And right now, they're watching Polymarket, a betting platform that just saw downloads surge 1,172% after gaining US regulatory approval.

The platform lets users bet on anything, from elections to geopolitics to financial markets and even the App Store, and those bets have become signals for what's coming. In 2025, as uncertainty dominated everything from the stock market to AI and global politics, Polymarket became the place where people put real money behind their predictions.

Polymarket started as a crypto-based betting platform in 2020. After running into regulatory trouble and getting fined by the Commodity Futures Trading Commission (CFTC), it shut down US betting.

But when it relaunched in October 2024, demand was immediate.

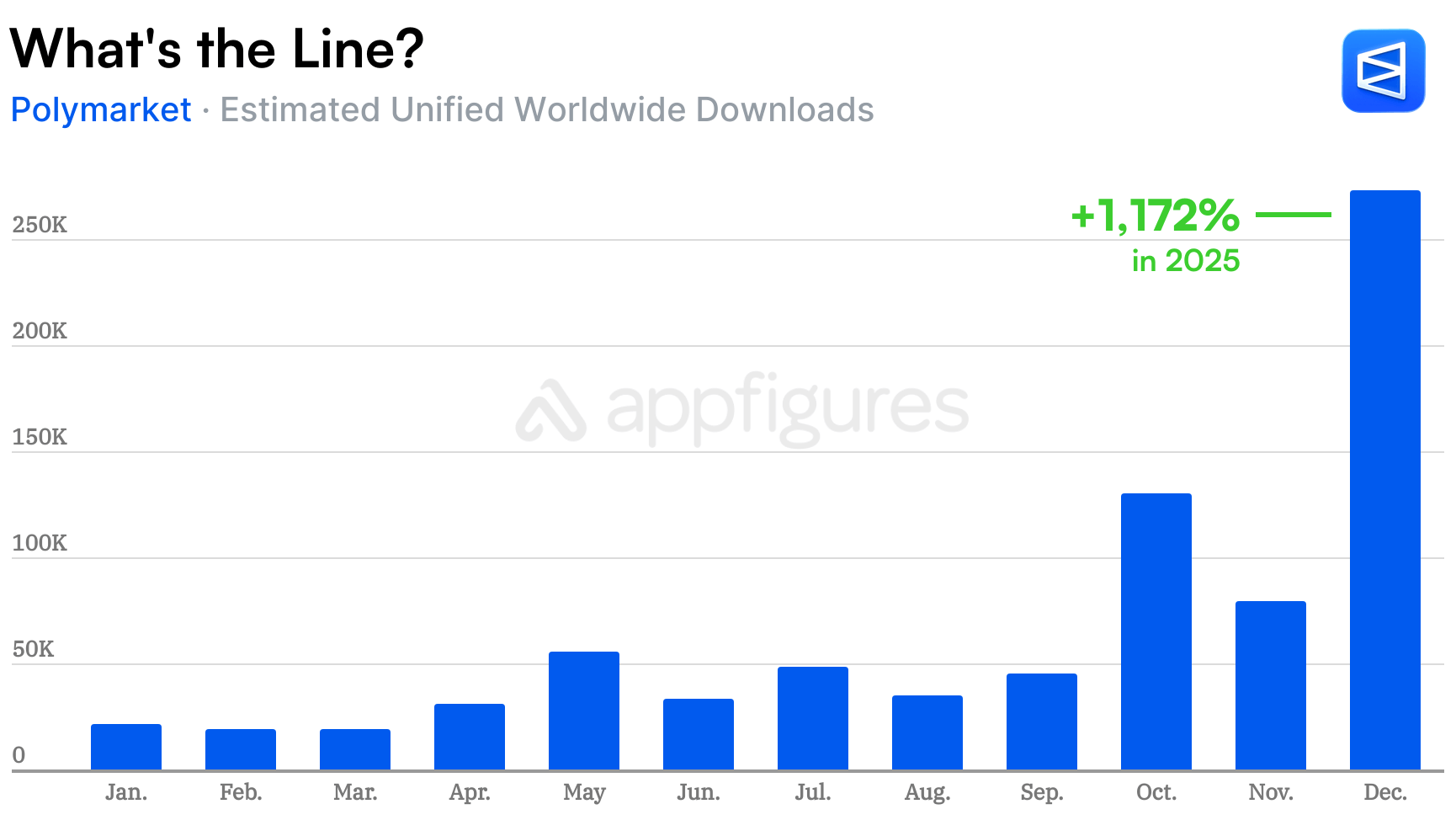

Our estimates show that Polymarket's release led to 600K downloads between October and December of 2024, most of which came from the US and likely due to the many bets placed on the US elections. That ended fairly quickly, but demand was still there. According to Appfigures Intelligence, Polymarket saw 20K - 30K downloads/mo for much of the year.

Geopolitics and financial markets drove demand up again at the end of 2025, but then something significant happened.

In October, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced a $2 billion investment in Polymarket, valuing the platform at $9 billion. The deal wasn't just about money - ICE would become a global distributor of Polymarket's event-driven data, turning betting trends into sentiment indicators for Wall Street.

Traditional finance took a bit bet on prediction markets.

To actually re-enter the US market, Polymarket needed more than investor confidence. Polymarket needed regulatory approval, which is got by acquiring QCEX, a CFTC-licensed derivatives exchange and clearinghouse, for $112 million. That acquisition, combined with CFTC approval in November, gave Polymarket what it had been missing since its 2022 ban: the legal foundation to operate in the US with real money (fiat, as some might call it). A year of uncertainty and people using bets on the platform as signals + Wall Street validation + regulatory approval meant downloads were coming. And they did.

Our estimates show Polymarket was downloaded 273K times in December, up 1,172% compared to January and a total of 1.4M times since its release in October 2024. Wall Street's $2 billion bet and regulatory approval were paying off in downloads.

It wasn't a big ad campaign or a viral tiktok that drove these downloads but rather reality, and that means this trend will only get stronger for Polymarket.

There's a small twist that's helped momentum, too. Polymarket is using a phased release, so you can't just sign up and start betting right away. Instead, signing up places you on a waitlist and asks you to share your link to advance. That's a tried and true strategy used by many popular apps to generate hype.

And it's working.

But Not Without Competition

The "bet on everything" niche is small but does have competition.

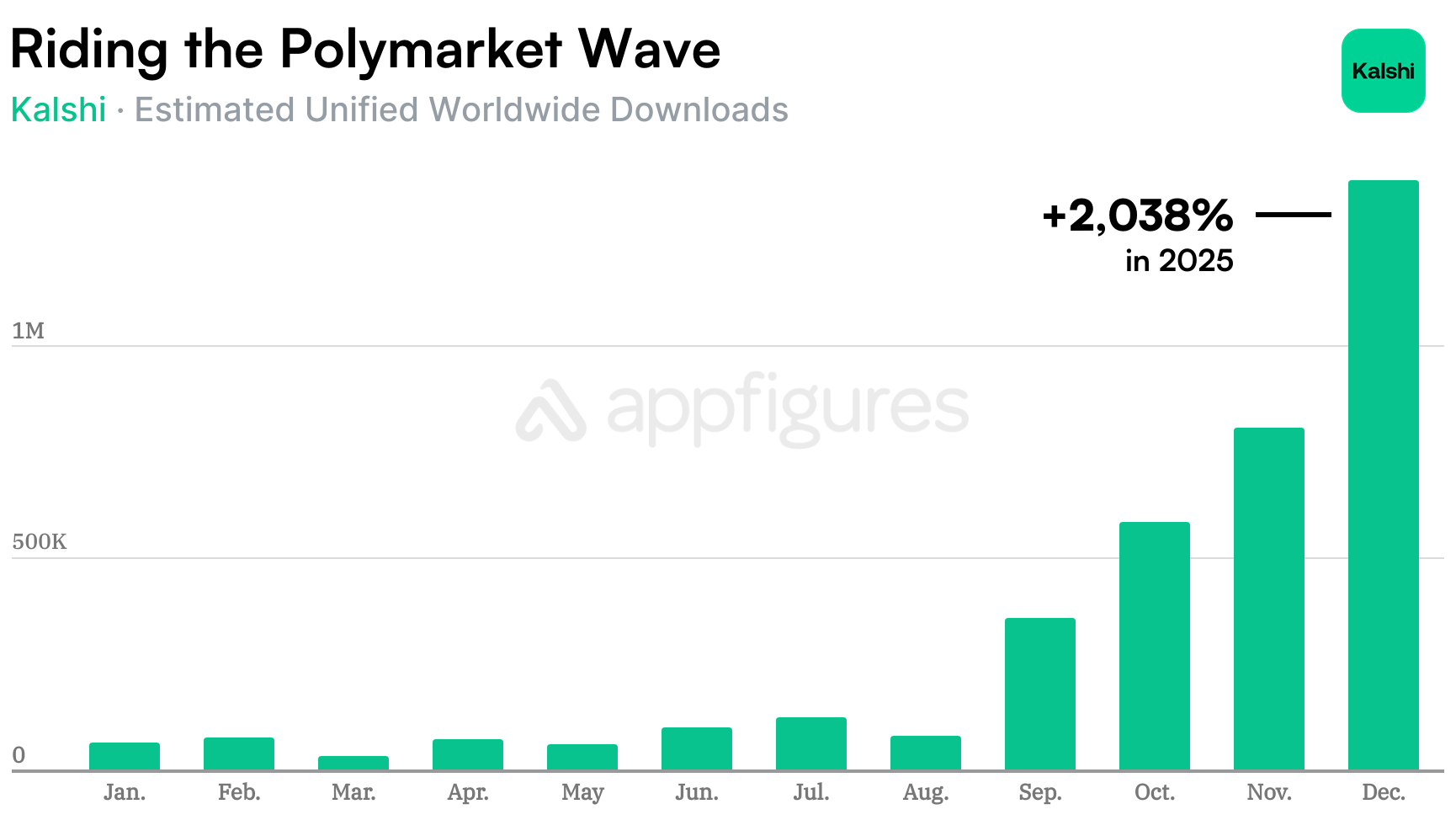

Kalshi is Polymarket's main competitor and it's been approved in the US since the summer of 2024 giving it a massive leg up, however, it didn't gain as much popularity by those looking at bets as a signal as much as Polymarket.

It did get more downloads, 3.7M in 2025 according to our estimates, but looking at the trend, it's clear the popularity of Polymarket is also spilling over to Kalshi, likely because it was available for US users ahead of Polymarket.

That may slow down now that Polymarket is legal in the US, and solidifies my prediction that downloads will grow significantly in 2026. I'll keep watching this trend as it evolves.

P.S. - I'm #617,769 on the waiting list. If you have an invite code you can spare please send it my way.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.