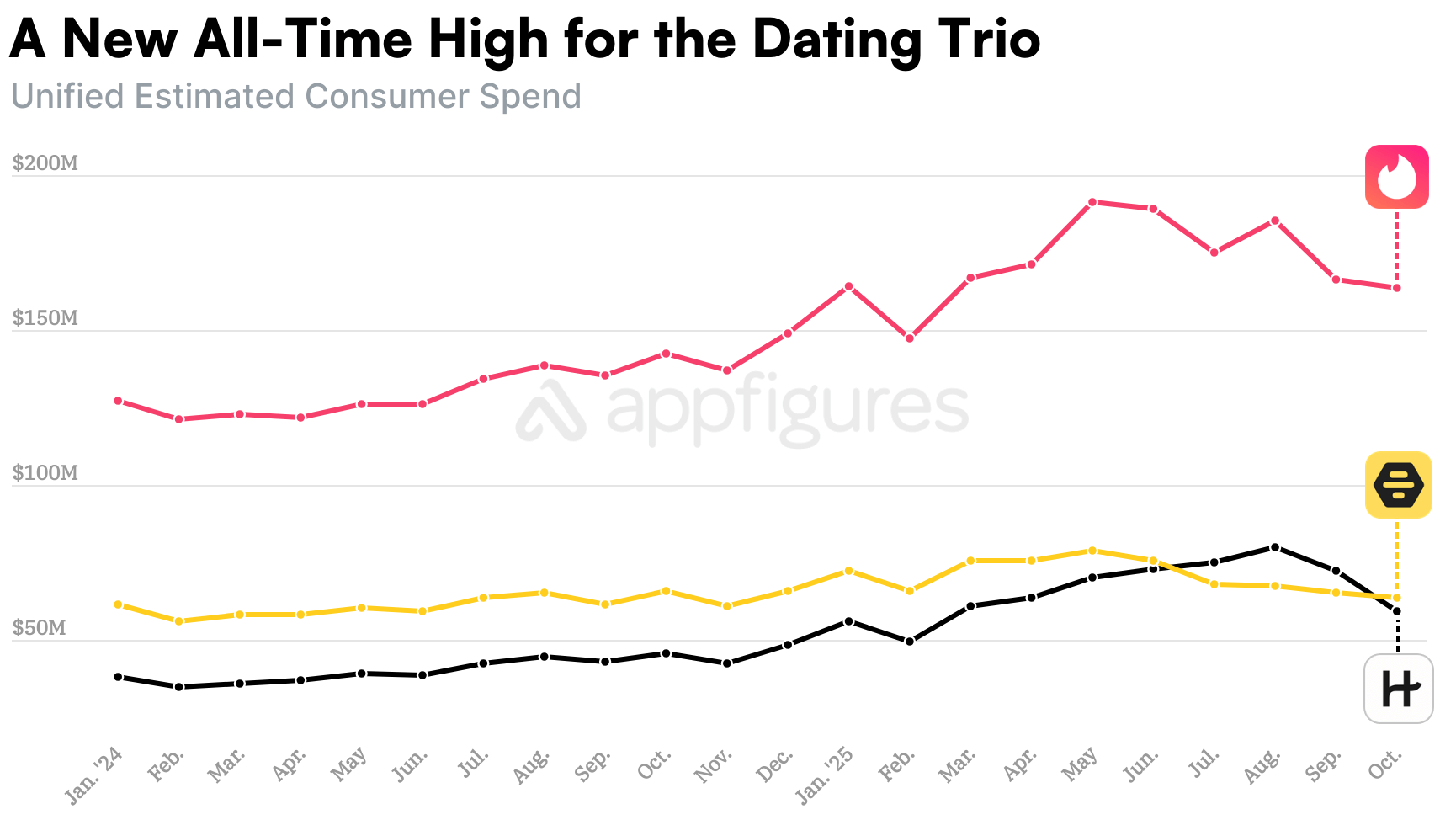

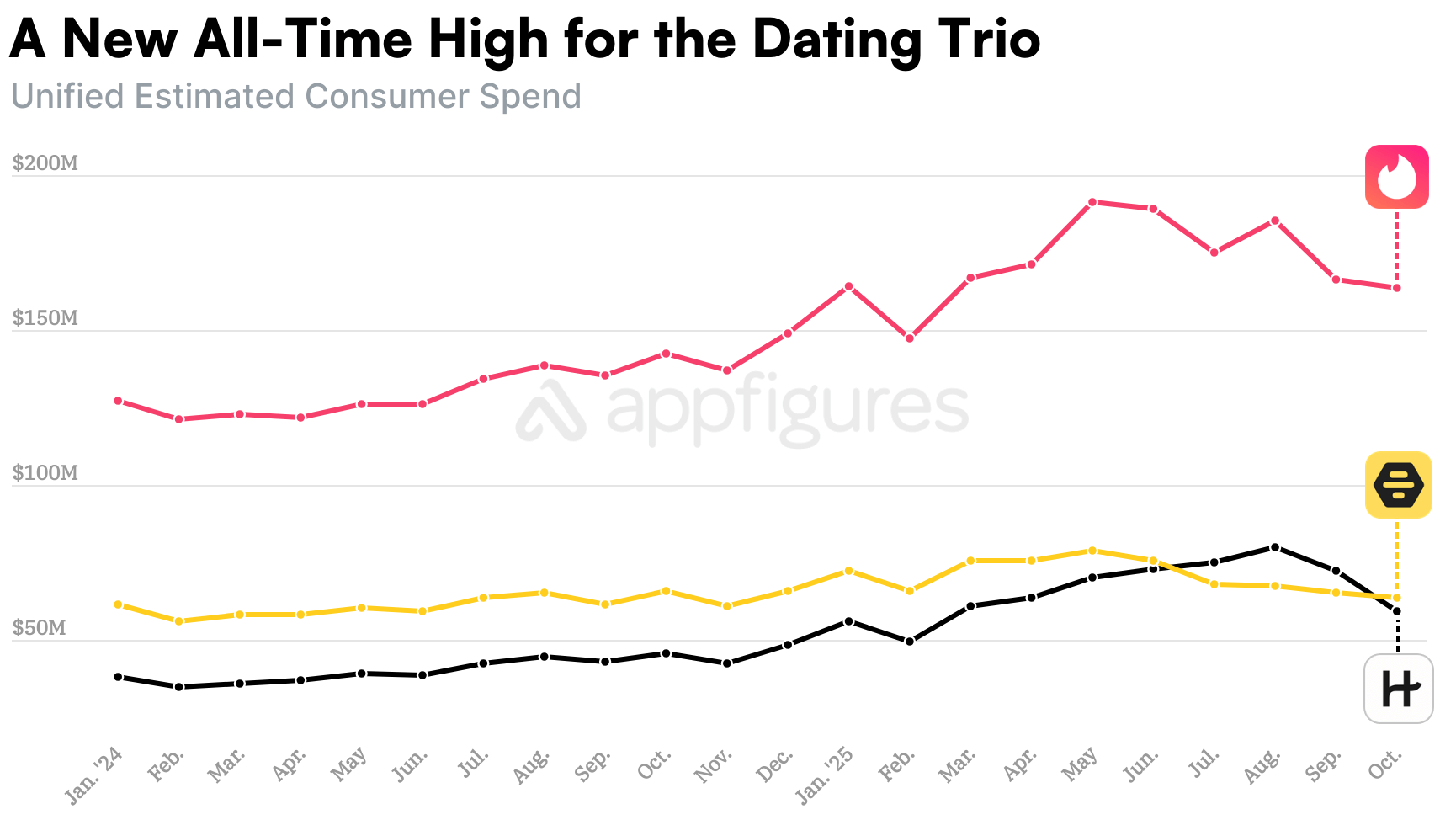

The dating app charts have been pretty predictable for years: Tinder → Bumble → Hinge. To my surprise, that changed this summer. And that happened right after all three hit a new all-time revenue high.

And we're talking a lot of money!

I started out by looking at the niche dating apps to see if their growth rate changed, and it didn't. I started with the niche dating apps because it's common knowledge at this point that the top three are holding steady.

But that wasn't the case. A combination of Bumble slowing down and Hinge pushing harder flipped their positions, putting Hinge on top for three consecutive months.

According to our estimates, Bumble's gross revenue from the App Store and Google Play dropped a whopping 20%, roughly $16M, since hitting an all-time high in May. Hinge's revenue nearly matched Bumble's in June, then beat it in July, August, and September.

I looked all the way back to 2020 and this is the first time that happened.

Hinge's push ended and its revenue dropped in October down a smidge below Bumble's - $41M vs. $44M before fees, according to Appfigures Intelligence.

Category leader Tinder continued its slow growth this year. Like Bumble, it hit an all-time high in May, reaching $134M before fees, according to our App Intelligence, for the first time ever.

We estimate that users spent a whopping $340M across the trio in May, the most we've ever seen in a single month and it's not even cuffing season yet.

Bumble's app revenue decline aligns almost with its battered stock price, which has lost over 30% this year and has been on a downward slope since the summer. And while that's continuing, I expect to see Hinge try harder. If not, they should.

December saw a curious split: downloads dropped 2% while revenue sat at $1.3B. ChatGPT and TikTok dominated both charts as the mobile industry enters a new maturity phase.

Wall Street bet $2 billion on Polymarket, and downloads surged 1,172% in December. The prediction market banned in 2022 is now where Wall Street looks for signals.