I forgot to check in on X's revenue last month. Too many interesting trends and not enough newsletters. So in this one I'll cover two months + look to the future because November could be a special month for the platform.

X's Black Friday campaign last year was a positive surprise that worked very well, but before we get into what that could mean this year let's start with the numbers.

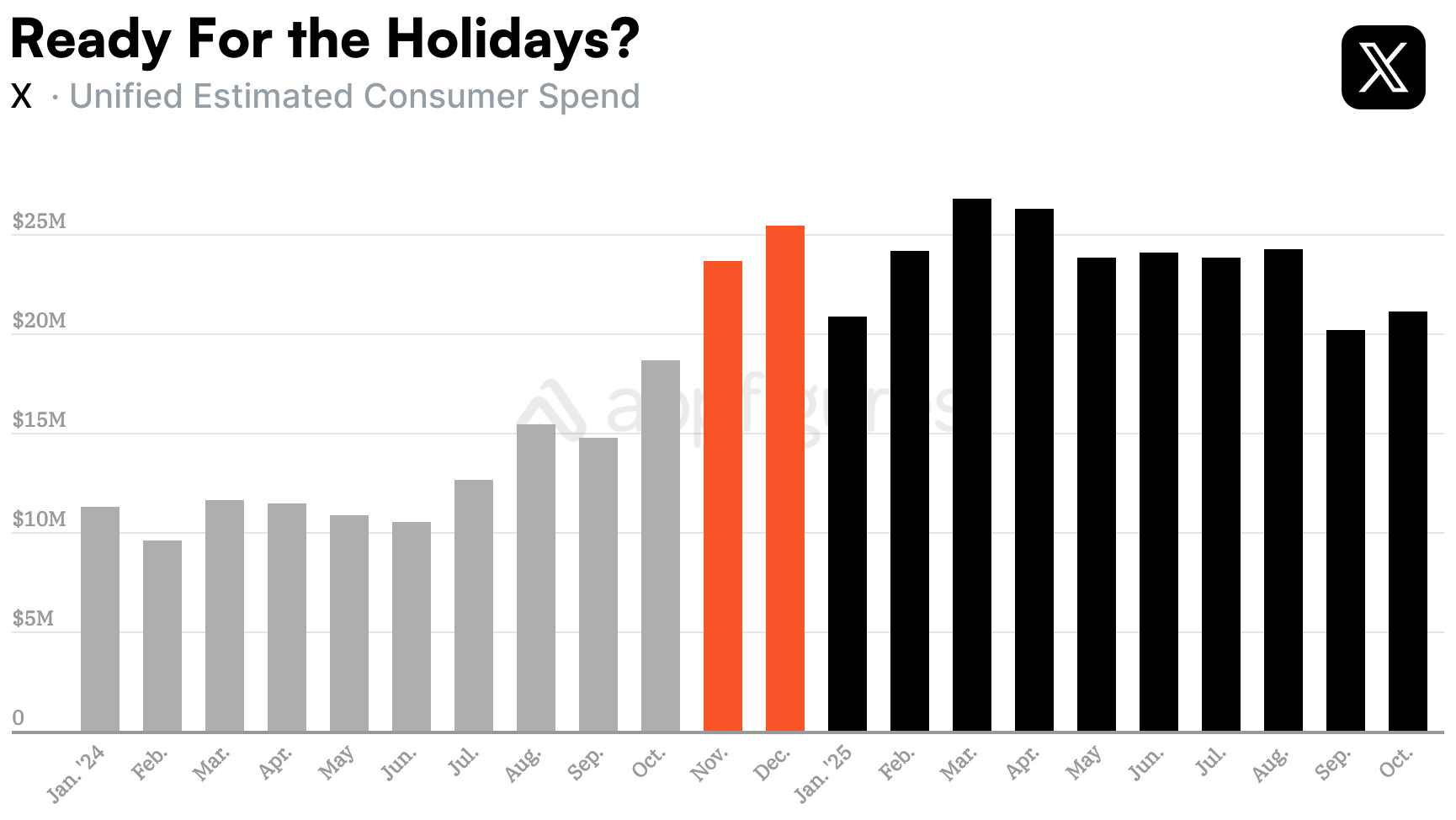

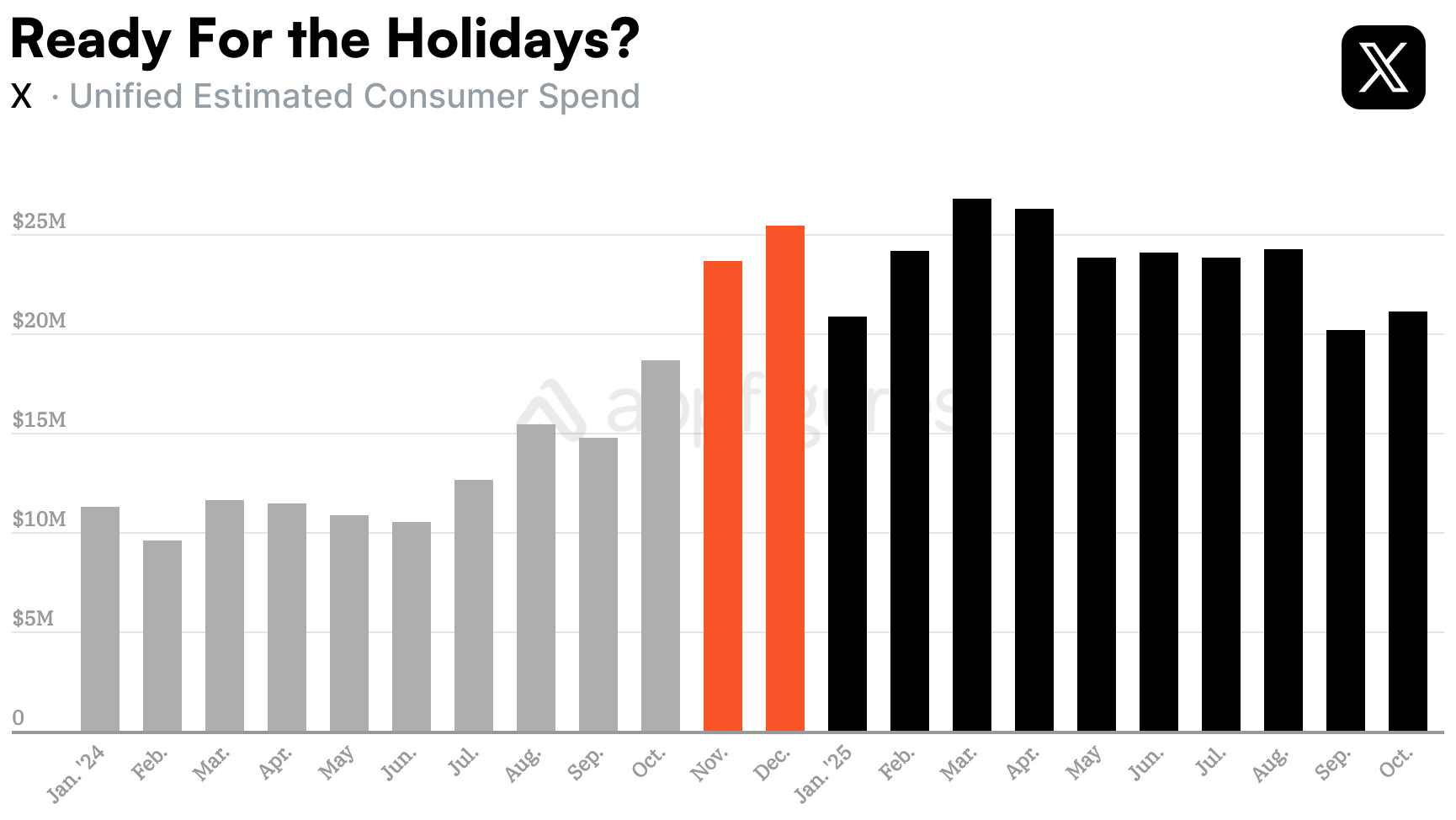

According to Appfigures Intelligence, consumer spend in X was $20M in September and $21M in October. This is significantly higher than revenue in 2024, which we estimate to be $14M in September of 2024 and $19M in October. All of these amounts are before fees (what users paid).

That's good growth. Nothing to brag about, but we're also talking about an increase of several millions.

But...

When compared to previous months, it's actually a massive decline.

When you look at the trend, September was actually X's lowest month of revenue in 2025. October ranked third from the bottom. All the way at the top of the list was March, which drew $27M in consumer spending.

I suspect the drop we're seeing is a result of natural churn combined with Grok-only subscriptions happening on the Grok app and new subscribers holding off until the Black Friday promotion lands in a few weeks.

The Black Friday Effect

Black Friday promotions are a great way to get subscribers, which is why we'll have a very sweet offer on Appfigures Intelligence soon, but they also alter the economics for the entire month. I know this from experience.

I don't know if X will run a Black Friday campaign this year, but if they do, based on the growth from the last year, I expect it to drive revenue to an all-time high, beating March's $27M estimate by roughly $2M. All before fees.

December saw a curious split: downloads dropped 2% while revenue sat at $1.3B. ChatGPT and TikTok dominated both charts as the mobile industry enters a new maturity phase.

Wall Street bet $2 billion on Polymarket, and downloads surged 1,172% in December. The prediction market banned in 2022 is now where Wall Street looks for signals.