This Week in Apps #127 - It's (Almost) All About the Money

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Games Revenue Index (30 Days)

Insights

1. Diablo Immortal Hits a New Milestone Sooner Than Expected

A few weeks ago, Diablo Immortal, the mobile version of the game that shaped many childhoods, hit a new milestone.

It did it faster than another childhood favorite (for the younger generation), Call of Duty, which launched back in 2019.

The milestone I'm referring to is $100,000,000 (yup, million) in gross revenue on the App Store and Google Play.

According to our App Intelligence, Diablo Immortal's gross revenue reached the $100M mark on August 5th, 66 days after the game's official rollout in June of this year.

Call of Duty took 142 days to reach this goal. More than twice as many days!

Looking at where downloads are coming from, the US is in the lead with 51%. South Korea contributed 10% to this total, and Japan added another 7%.

As for platforms, unlike many apps and games I've looked at recently, Diablo Immortal drew a similar amount from both platforms. Wild. I know! But that's not all. Google Play actually drove more revenue for the game. Just a tiny bit more than the App Store, at $51M vs. $48M of gross revenue, according to our estimates.

And this is gross revenue, meaning before Apple and Google take their fee, the opposite of what I usually look at.

Normally, such even revenue would be a surprise, but considering how engrained Diablo is into the lives of most people who had a computer in the 90s, I find this normal and somewhat expected.

The real important bit here is that there isn't less money on Google Play. It's just harder to get.

2. Audible's Revenue is Skyrocketing in 2022

Are you an e-reader or a physical book kind of person? I'm the latter. There's something about paper that makes it easier for me to read. But!

There's a category of books that's neither paper nor e-ink that's been growing like wildfire this year.

Audiobooks!

Audible, the most popular app for audiobooks these days, has seen demand go through the roof over the last few years, but 2022, in particular, has been extra growy.

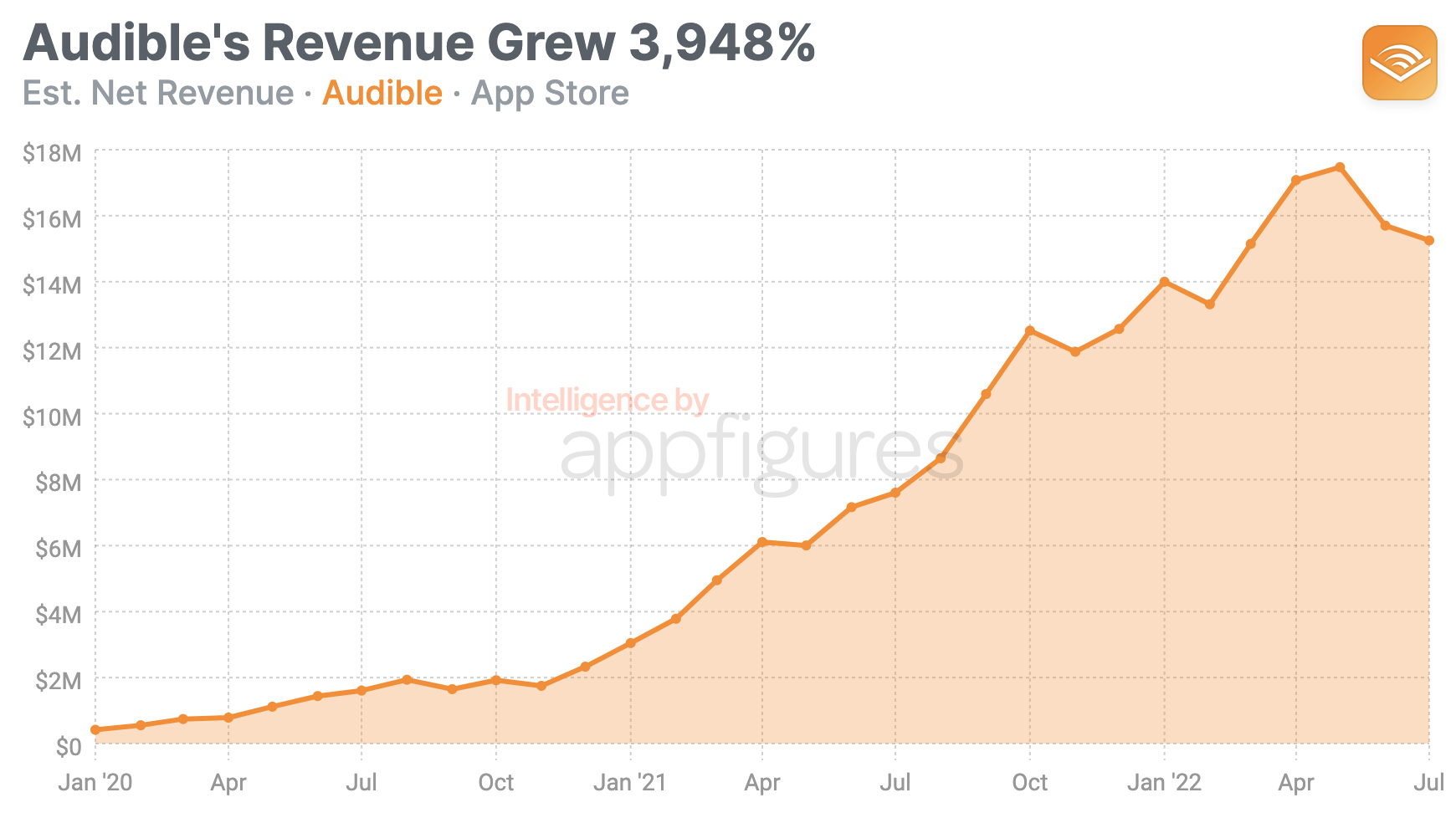

In January of 2020, just a couple of years ago, Audible's in-app net revenue from the App Store was estimated at $417K. That's after Apple takes its fee, and I'm only looking at Apple because Audible's revenue on Android didn't exist until earlier this year.

Heading into the pandemic, our estimates show net revenue was already at $3 million by January of 2021, and by January of 2022, it ballooned to $14 million. No, that 1 isn't a typo!

And that's not the end. Audible's App Store peaked in May, hitting $17.5 million.

Growth reversed course and revenue dropped a bit as the economy shifted into rough waters, but June and July both ended with more than $15 million in net revenue.

A lot of "physical" things are moving into our phones. Streaming. Shopping. Fitness. And books joining the list makes perfect sense. That + the overall growth in money spent in the App Store + Audible's unique positioning, and lack of competitors allowed it to grow 3,948% in two and a half years.

3. It's Renewal time for Snapchat's New Subscription – Will They Renew?

Snapchat's new subscription service Snapchat+ has hit a critical moment in its short life – renewal time.

The honeymoon month is over and now it's time to see if those who subscribed before they knew what they'd get, continue to want it.

And the verdict is... Nope!

And if you remember my reaction when I first looked at it a few weeks ago, I'm not surprised at all!

Revenue from Snapchat+, which launched in early July, quickly rose and its first Monday in the App Store, resulted in $634K of net revenue in a single day! It went on to earn nearly $7M of net revenue in its first month, according to our estimates.

Renewal day, or the first day of the second billing cycle for the early subscribers was due August 7th, giving us a glimpse into how many people were still excited by Snapchat+.

In case you didn't know, Snapchat+ is Snapchat's premium tier which gives users who pay access to beta features first, along with some profile customization. In other words, bragging rights.

I was shocked at how many people subscribed when I first looked at it a few weeks ago, but looking at the renewal rate, I'm happy to say I'm not insane.

According to our estimates, Snapchat's in-app revenue in month two is about half of what it was in its first month. In more absolute terms, the peak, which crossed $600K in July, barely got to $300K in August. And that's net revenue.

The month isn't close to over, but if we look at the trend of July, revenue dropped pretty quickly after that peak, so I'm not expecting the rest of August to make up for the difference.

Now... I don't think this is bad news for Snapchat. I say that because the first month of something new and seemingly exciting that also isn't that expensive is likely to get interest from those who aren't expecting to keep it for a long time and are just curious.

Add political turbulence, a weird job market, and the word recession getting tossed around a bunch, and luxuries like being a paid beta tester for Snap are no longer a top priority for money burning.

Converting about half of the original group is still nice and still big. Now the question is – will Snap coast or will they rethink their strategy...

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Strava's Revenue is Growing Faster than Ever this Year!

Apps buying apps is usually interesting news, so when I read that Strava bought another app, I immediately got excited. Fitness has become a serious business on mobile, so this was going to be interesting.

It wasn't. But!

When I loaded Strava into our App Intelligence dashboard, I noticed a very interesting unrelated trend.

Strava's revenue has grown substantially in 2022!

Since 2018, Strava's mobile revenue has grown more than 10x, from under a million in monthly net revenue up to over $11 million.

Looking at the trend, it's pretty clear revenue started spiking in 2020. Lockdowns were a mega catalyst for the growth in demand for fitness apps. Peloton was one of the first to see this, but many other fitness apps rode the wave.

But for Strava, these were short-term spikes in 2020 and in 2021. Great spikes that saw revenue balloon 8x for a month, but it was only for a month or two.

And then 2022 hit.

Those spikes I highlighted were in August of 2020 and 2021. August isn't even done yet and Strava's monthly revenue has already crossed both previous spikes.

In May, Strava's net revenue jumped to $9.8M, and in July, it crossed $11.7M. What do you think will happen in August?

If you aren't convinced already, this should help you see two things. The first is that there's money in the banana stand, and by banana stand, I mean the App Store and even Google Play. And also that those two stores are becoming where people start their search for things they need – be it something to read, watch, or a way to keep active.

And guess what's powering all of this growth? Subscriptions!

If you're monetizing with subscriptions please help my next live stream by answering this short survey, and join me on 8/23 for an AMA on doing subscriptions right.

5. Some Food Delivery Apps are Hitting Pandemic-Level Downloads

Back in April of 2020, when the pandemic hit and forced the US into lockdowns, demand for food-delivery apps hit new highs. DoorDash was the winner in the US, doubling its downloads instantly.

Grubhub also grew, and so did Uber Eats (and even Postmates)!

But fast forward two years later and this excitement has (almost) all but cooled off. For some.

Things reopening, consolidation in the market, and most notably the end of free delivery and the introduction of fees (gasp!), have caused demand to shift.

Each of the popular apps saw demand change in different ways. Our estimates show that Uber Eats continued to grow steadily, Grubhub lost about 73% of downloads, Postmates beat it by losing about 78%, and market leader DoorDash was about 37% down – but still ahead in terms of absolute downloads.

That's as of the end of June, because July was something else!

All apps, except for Postmates, jumped significantly in July!

According to our estimates, DoorDash and Grubhub got very close to their April 2020 numbers, adding 3.2M and 1.3M downloads, respectively. Uber Eats also jumped but not as high, adding 1.7M new downloads. Even Postmates grew in July, but very little.

Postmates has been dying for a while, ever since it was acquired by Uber, which is an interesting strategy for retaining the users without cannibalizing Uber Eats' lunch. Pun partially intended.

The one thing to keep in mind here is that most of these apps are spending a lot on user acquisition and retention, and much of it comes in the form of one-off discounts. This isn't a sustainable strategy and I expect it to end at some point.

I think that point isn't too far, considering today's investment climate.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.