This Week in Apps #128 - Instagram Wants to Be Real...

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

Education Download Index 🇺🇸 (30 Day)

Insights

1. BeReal is Now Posing a Clear Threat to Instagram's Growth

Instagram is prototyping a new feature that'll ask users to take pictures at a specific time and share them with their friends. If you think this sounds exactly like BeReal, the most downloaded app in the US for the last few weeks, you're correct!

When BeReal started growing, I hypothesized that if they could maintain enough momentum that big rivals would take note, the simple concept could become sticky.

Fast forward not-so-many-months, and this is happening.

So, why is Instagram copying BeReal?

And the answer, as you can imagine, is...

Downloads!

BeReal has gone from an unknown name to the #1 app in the US App Store, and in the process, has been downloaded more than Instagram in the US in July - For the first time.

When the year started, Instagram was getting roughly 100x the downloads of BeReal. That's not too hard, considering BeReal didn't start getting popular until April.

BeReal's first big week came at the end of April, and with it, 486 thousand downloads in the US App Store. Instagram dipped around the same time to 384 thousand downloads, according to our estimates. Instagram regained the lead the following week.

Looking at the trends for both, it's clear Instagram's dip was a result of BeReal's rise.

But BeReal continued to grow, and by July, it had taken the lead again. This time it wasn't temporary.

According to our estimates, between July and August, BeReal dominated Instagram in the US, adding 6.5 million new downloads from the App Store. That's a whopping 2 million more downloads than Instagram.

FYI - I focused on the App Store because that's where BeReal is most popular. I'll get to why that matters in a few sentences.

I'm only slightly surprised that BeReal has gotten so much traction so quickly and consistently. Instagram hasn't really done anything interesting in the last few years, and people are bored. It went into war with TikTok, the only new thing to happen in the space, but that's no longer news.

Combine that boredom with the ever-shrinking attention spans of today's mobile users, and BeReal fits right in.

Overall though, this isn't good news for BeReal...

The app is really nothing more than a "feature" and hasn't found a good way to monetize. Its downloads are high in the US but only on the App Store, and aren't really comparable to Instagram anywhere outside of the US. I see it as an opportunity for BeReal, but also an existential threat if the team behind it can't figure it out fast enough.

Now that Instagram is after them, the clock is ticking.

2. Peacock's Revenue Continues to Grow, But Not as Fast

Streaming apps are in a weird place right now. The last few years have been very kind to those who tried, but recently things changed. Movie theaters are trying to get people in seats again, and that led some streamers like Disney and HBO to skip streaming launches and go back to theaters first.

The entire market has also matured. Streaming is no longer a "new" thing, and because lockdowns are gone, fewer people stay at home as much as they used to.

But! Peacock's revenue continues to grow.

According to our estimates, Peacock's revenue continued to grow in July. Even after the tiny dip it experienced in June.

Peacock's monthly net revenue, meaning what they get to keep after Apple and Google take their fee, rose above $12 million for the first time ever.

That's not a surprise considering Peacock's revenue has grown every single month since the app launched in 2020. With two tiny exceptions that are safe to ignore.

In absolute terms, this isn't HBO Max or even DIsney+ revenue, but we have to keep in mind those are very different in many ways.

This isn't great news for Peacock though...

While there is growth, there isn't too much of it. Not enough, in my opinion, for a service like Peacock.

The main reason isn't Peacock, though but rather the market. HBO Max and Disney+ are some of the highest-earning apps in the US because they offer content that rivals movie theaters, which cost more at the end of the day.

For all the nice things Peacock offers, it simply doesn't have that kind of advantage, and that's why the revenue is so different. But that also means that movies going back to theaters won't impact it as much. That's why I expect to see revenue continue to grow at a moderate rate for now.

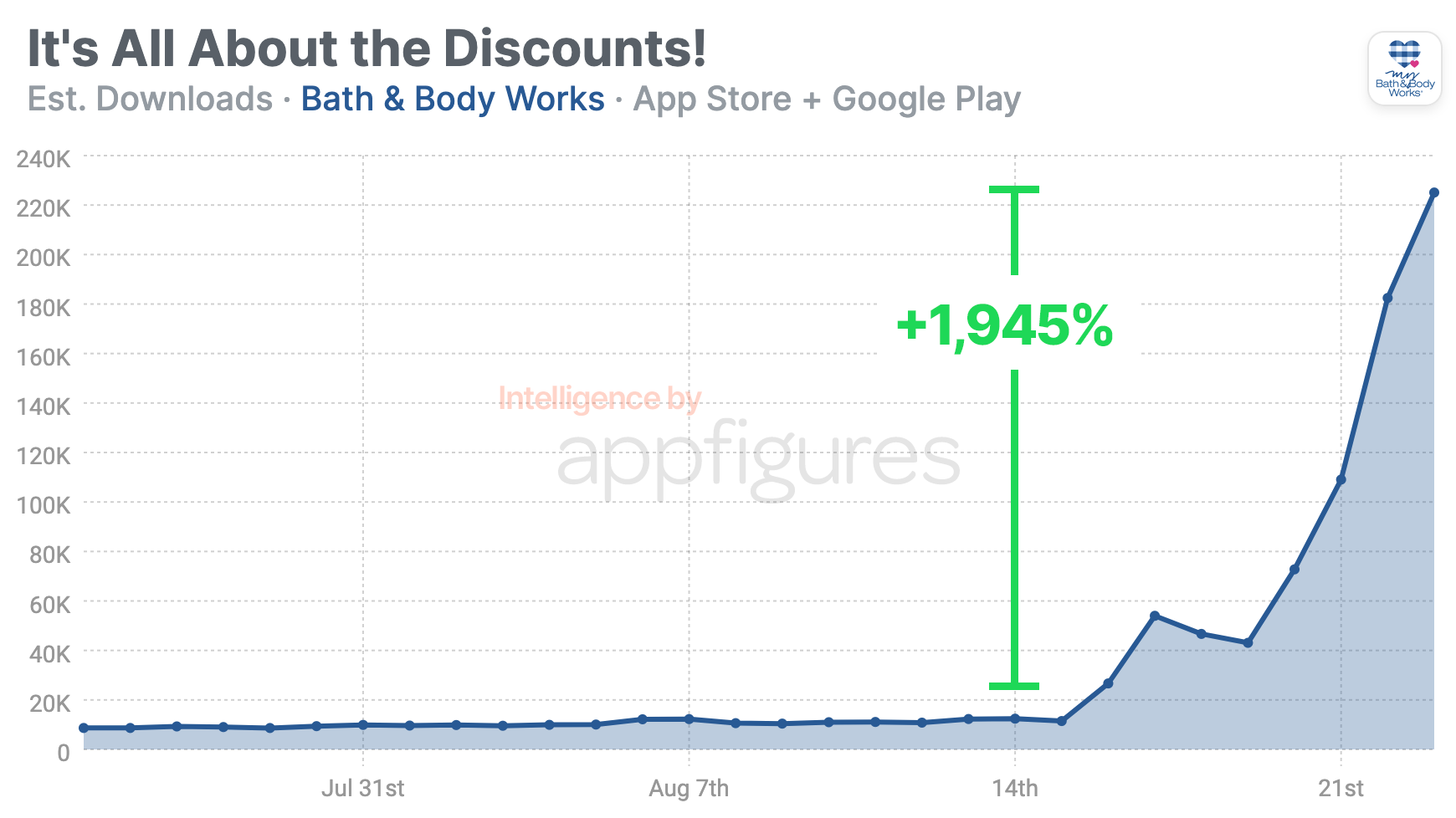

3. This Retailer (Finally) Figured Out Mobile, and Downloads Exploded!

Discounts are a great way to get people to take action. I looked at how restaurants do that more than once. Not all do it right, but that's a different problem altogether.

This week, I noticed my favorite soap store was sitting at the top of the App Store, a place retailers don't normally show up in, so I had to take a closer look.

You can probably guess what it was – a new rewards program to get discounts. Bingo!

Bath & Body Works' app, which isn't new, is now the home of the store's new rewards program that offers points for every dollar spent, along with other fun perks.

Looking at downloads, people really want to be rewarded for their soap purchases. Over the last 10 days, downloads have gone up nearly 2,000%, from around 11 thousand per day to more than 225 thousand on Tuesday, according to our estimates.

Wow!

Lots of apps have gained momentum over the last few months by offering promotions. Not all stuck, but the visibility is an amazing multiplier for downloads, and downloads can translate into sales for a retailer like Bath & Body Works, which far outweigh the discounts.

User acquisition is the name of the game for apps, and ads aren't the only way to win.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Why is Amazon Ending Its Telehealth Service?

Amazon announced it's ending its Telehealth service, Amazon Care, this week. This is a big move for a service that was born right before the pandemic - which made telehealth popular and more accepted.

Amazon said the service wasn't complete enough to be competitive, and that's why it's being shut down. But what does that really mean?

Telehealth, which is a fancy name for a doctor's appointment over FaceTime, is best done by mobile phone, so looking at downloads may give us a better idea of what's going on.

Looking at the downloads of the top apps in this space, downloads certainly paint an interesting picture. Interesting for the top apps, though, not for Amazon.

I say that because the trend for the top three, which include Teladoc, SimplePractice, and Doctor on Demand, has been fairly flat for the most part.

And fun find - SimplePractice knows how to do App Store Optimization!

It's clear covid has a massive impact on this space, and that's not something Amazon expected when launching Care back in 2019 for their employees and very large enterprise customers. But, that sounds like an opportunity.

Looking back, SimplePractice saw the most growth in early 2020, going from just a handful of downloads in Q4 of 2019 to more than 423 thousand downloads in Q1 of 2020.

But back to the trend and its impact on Amazon - the rise of SimplePractice and Teladoc has made it very difficult for others to enter the market. We can see that by looking at downloads of Doctor on Demand, which shows fairly flat growth vs. the other two.

Another thing to keep in mind is that the market for telehealth is now fairly large. I chose the top three because we can clearly see the division between the top two and the third, and it makes my point very clear, but there are many many other apps that attempt to compete now.

The bottom line here is that this market, although fairly new, is already dense enough. So when Amazon says their offering isn't complete, they really mean it isn't competitive enough... And if we add the regulatory headache involved, that might be why they don’t want to complete it.

5. Back to School & Back to Normal

There's an app a lot of schools here in the US use to communicate with students called Remind. Every year around back-to-school time, Remind's downloads shoot up and it takes to the top of the App Store.

It's a cycle I've been seeing every year for many years.

It sloped down during covid, though, as schools became virtual and communication moved to Zoom and other such tools. But I was pleasantly surprised to see Remind hitting the top charts again this week, and even happier to see how many downloads it's getting right now.

Remind held on to the #2 spot in the US App Store for several days over the last two weeks thanks to more than two million new downloads, according to our estimates. Roughly 80% of those downloads came from the App Store, with the rest from Google Play.

What I found more interesting, however, was the trend over the last few years. When I zoomed out our App Intelligence dashboard all the way back to 2017, I noticed that this year's spike is significantly larger than the last few years.

When we look at the peak for each year we can clearly see the impact of covid and lockdowns, which cut Remind's downloads in half.

But that's all behind us because 2022 is on par with 2019, pre-covid.

Just the peaks:

- 2017: 758K

- 2018: 955K

- 2019: 916K

- 2020: 546K (Just the summer peak)

- 2021: 454K

- 2022: 900K

Covid isn't completely gone and probably won't be for a while, but some things, like going back to school, are putting it behind them, much like many of the other IRL apps I've looked at in the last few months.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.