This Week in Apps - The Ban That Isn't Coming

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

Insights

1. The US Won't Ban TikTok Any Time Soon - Here's Why.

The US has been talking about banning Chinese-owned TikTok for a few years now. It got tense there for a minute in 2020, but it wasn't banned after all.

Congress continued to try, but no ban was in sight until the end of 2022 when the US banned TikTok on government devices. A small but interesting move that serves very little to prevent usage data from leaving US borders as TikTok's data collection extends far beyond its flagship apps.

Things started looking a bit grimmer yesterday, after Congress, again, highlighted the tight relationship between TikTok and China.

But just like in previous episodes, I don't expect a ban to actually take place for one very big reason.

Money!

Money talks, and in politics, money screams. TikTok makes a lot of that from the US. Not only that, the rate at which revenue from its iOS apps is growing is so high it's as if the company is printing money.

According to our app intelligence, TikTok's App Store net revenue, not including revenue from China, was just a rounding error away from $1,000,000,000 in 2022. That's a billion dollars. And that's after TikTok pays Apple for the privilege of being in the App Store.

I specifically chose to focus on the App Store and include all countries except for China because TikTok's main revenue driver is the US, and if it's banned here it'll likely get banned in other countries. We've seen that happen with the government ban which was quickly picked up by the UK and immediately after, New Zealand.

But that's not all. In 2021, TikTok's net revenue from the App Store was "just" $256M. I say "just" because while very high, that's only a quarter of 2022's haul.

That kind of growth gives TikTok a lot of "flexibility" in dealing with a potential ban + a big incentive to not let it happen by any means.

Note - This insight only looks at the revenue TikTok earns directly through its app which is a fraction of its total revenue. The conclusion isn't any different though.

2. AI Chatbots Are Flooding the App Store and Google Play

In a very short span of four months, AI has made its way into the mainstream thanks to the magic of ChatGPT. It's become so mainstream that it's now a political issue.

From a developer/entrepreneur standpoint, there's something even more interesting than the black box that ChatGPT is, and that's how seemingly everyone is now building AI into their products, or even whole products, using OpenAI's technology.

I'm a builder at heart, and seeing so many thin-wrappers that have little competitive advantage will be a very interesting case study in a year, when first-mover advantages disappear and the hype dies down.

But right now what I'm watching is the number of new "AI" apps that are shipping to the App Store and Google Play.

According to Explorer, our search engine for apps, 398 apps with "chatbot" in their name were released since January across the App Store and Google Play.

For comparison, only 70 apps that match these keywords were released in 2022 and 20 of those were released in December as part of the ChatGPT craze so they don't really count.

Developers tend to react to new things like this quickly but this is even faster than before.

From a developer standpoint, it's interesting to see the power a platform can offer when it builds the core functionality but not necessarily the end product. OpenAI's APIs are now powering apps, platforms, and features across products OpenAI just wouldn't be able to make all on their own in the short amount of time that those products took to launch.

In a way, I see that as the competitive advantage OpenAI has over rival Google who's clearly in panic mode but obviously has a lot invested in the end product more than wanting to be the API that powers other apps.

3. This is Why Short Sellers are Targeting Block's Cash App

News broke yesterday that Cash App, which is owned by Block (aka Square), is in trouble thanks to a variety of shady business practices. The report came from notorious short-seller Hindenburg Research, which managed to drop Block's stock by as much as 15% nearly instantly.

There are a lot of allegations in the report, which Block rejects, but putting both of those aside, a short seller targeting a company can only mean one thing - growth.

Is that the case? Let's have a look at Cash App's downloads:

I normally prefer not to skip to the conclusion right away, but this is an exception. Since 2017, Cash App's downloads rose nearly 10x according to our estimates.

Starting at around 500K in 2018 and rose nicely year over year, but the real growth started in mid 2021 with downloads more than doubling between June of 2021 and July of 2022.

Such growth in a fairly static niche where PayPal is still popular, is a good way to earn a big target. But... Hindenburg's report talks about fraud related to fraud around covid stimulus payments, which happened in that same period. Maybe there's more to it?

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Prayer App Hallow's Subscription Time is Here. And It's Big.

Last month I looked at the "overnight" success of prayer app Hallow. Thanks to a massive Apple Search Ads campaign, celebrity endorsement, and Lent, the app soared to the top of the downloads chart in the US App Store for a short bit and added almost a million new users.

That's downloads. Interesting but not as interesting as revenue, so let's talk about money.

Hallow charges a monthly subscription of $8.99, and now that we're a month after its downloads spike, we can see how those downloads turned into revenue.

The easy answer is... very well!

According to our revenue estimates, Hallow's App Store Revenue rose to $780K on Wednesday, a month after the big downloads spike. And that's net, meaning what Hollow gets to keep after Apple takes its share.

Given its subscription price, this is an amazing trial conversion rate.

Hallow is doing something interesting with its subscription I don't see many developers doing.

Instead of just offering a free trial, Hallow offers a free 7-day trial and a 50% discount on the first full month for the user to decide.

Discounted subscriptions are very powerful, and when used correctly, can do much more for a company than free trials. The psychology of deciding between the two is really interesting and I'd love to see a writeup from companies who try this!

5. LinkedIn is Turning Into the Next Instagram

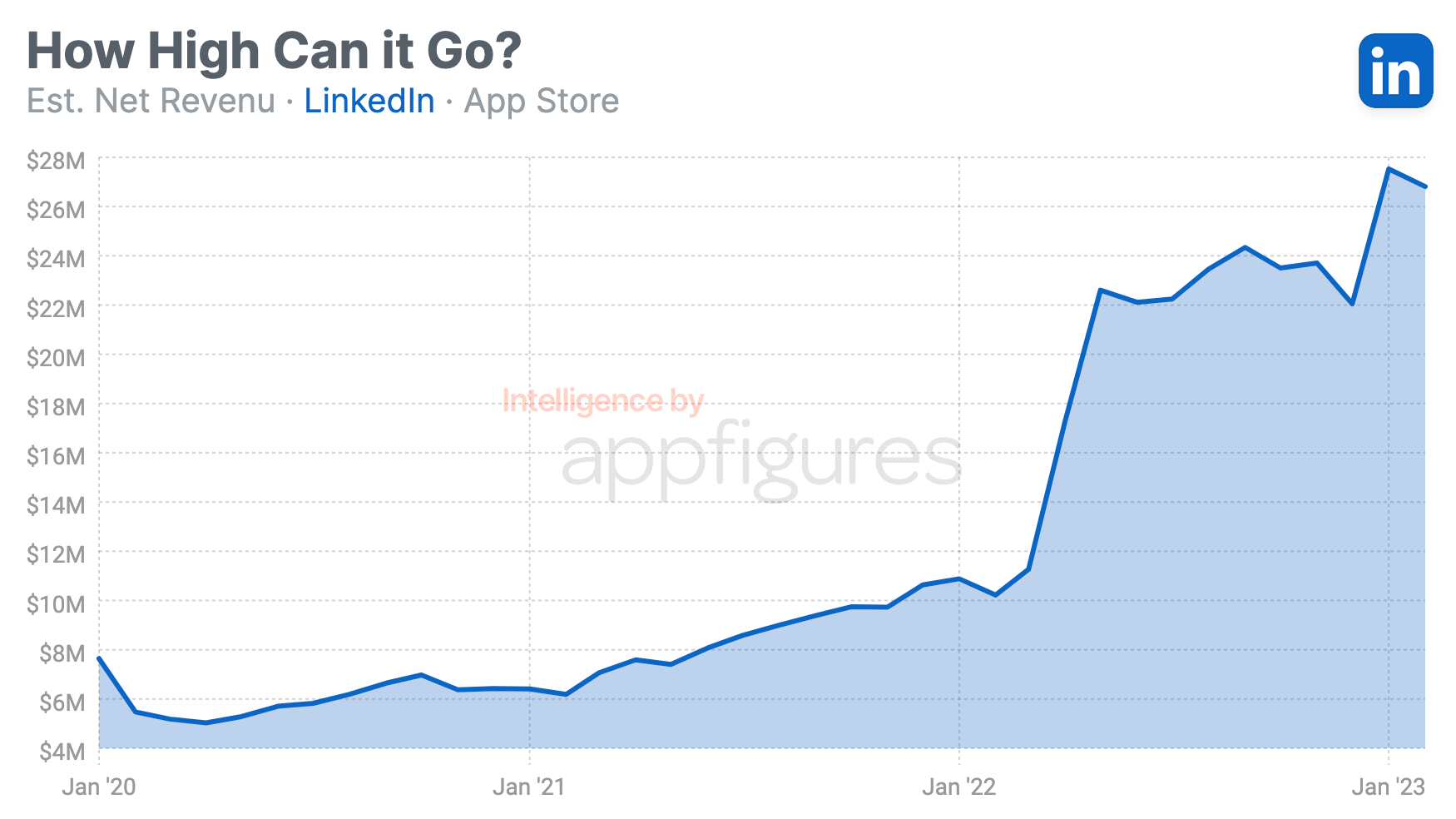

LinkedIn's mobile revenue app has been on an up-and-to-the-right journey for several years now, growing as much as 5x since 2020.

I wrote about LinkedIn's growth a few times in the last year, but its continued revenue growth which I don't see making the news, is nothing short of amazing considering what it's up against.

It's hard to think of LinkedIn as social media, but that's really what it is. Although it started as a network for professionals, LinkedIn today looks and feels a lot like every other social media platform out there.

And much like Twitter, Instagram, and TikTok, LinkedIn is in a league of its own that can't easily be duplicated.

But back to revenue for a moment so you see what I mean.

In April of 2020, right as covid took over, LinkedIn's iOS app brought in $5M in net revenue from the App Store, according to our estimates. It was earning a bit more in January, but not enough to significantly change my conclusion.

Revenue was growing but not by much throughout 2020 and 2021, but in 2022, growth moved faster and the trend was steeper.

Working from home changed things for many employees and also changed how employers hire. Both benefit LinkedIn, which has been owned by Microsoft since 2016.

According to our estimates, LinkedIn's net revenue from the App Store rose from a little over $10M in January of 2022 to more than $27M in January of 2023.

2.7x growth in a single year, and that's net, meaning what Microsoft gets to keep after giving Apple its share.

And now that we've established LinkedIn as another social media platform, I have to say it's the best at monetizing. Compare these numbers to Twitter Blue and Snapchat+, the latest attempts at monetizing a social network, and you see they pale in comparison.

Before you tell me that's because Twitter Blue and Snapchat+ don't give nearly as much value as LinkedIn's Premium subscription, I'll pause you and say, I know.

And that's all I have for you this week. I hope you've learned something new.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.