This Week in Apps - End of an Era

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

Insights

1. This is Why Spotify is Shutting Down Spotify Live, its Clubhouse Clone

Earlier this week, Spotify announced in an email to users that Spotify Live will be shutting down at the end of the month. The email was short, simple, and unapologetic making me feel like whoever wrote it was excited to let go of this property.

In case you're not familiar with Live, and you're probably not the only one, Live was Spotify's attempt to compete with Clubhouse over audio-first social media. The app was initially launched by Betty Labs in 2020 exclusively for Apple devices, just like Clubhouse. Spotify acquired the company and app in 2021 and added an Android version which started seeing downloads in 2022.

So, why is Live going away so fast?

I'm sure you can guess it, but I'll point out the obvious - Live never took off. Not only that, it didn't even manage to get close to Clubhouse's success, even after that success faded.

Since launching in 2020 and up to the end of 2022, Live, which started life as Greenroom but was renamed later, made its way into 580K iOS and Android devices, according to our estimates. The majority of downloads, roughly 77%, came from the App Store. And similarly, country-wise, a similar percentage came from the US.

Considering all the excitement about audio around that time, not even hitting a million downloads is a failure when you consider Spotify's scale. And that's not all.

Looking at the trend, it was very obvious Live wasn't going to be a great success. Before the Android version started seeing downloads, the iOS app dropped so low downloads hit the very low hundreds in February and March of 2022.

Even with the Android version, Spotify Live is seeing under 1,000 downloads per day, according to our estimates.

And for context, Clubhouse saw 35M downloads in the same range and even though its peak is long gone, our estimates show it's still seeing close to 10,000 downloads daily.

When Clubhouse first came out, I didn't expect it to really take off. There are just so many challenges to live audio that weren't sorted out in the first iteration, and many are still unresolved, that I'm not surprised that Clubhouse faded away nor that even a giant like Spotify couldn't make it happen.

Twitter is the only place where audio is still happening. Very low-key, but that's probably the extent to which live audio can serve, as a feature of a fuller product.

This isn't really Spotify's failure, they had to try it. I applaud them for cutting the cord.

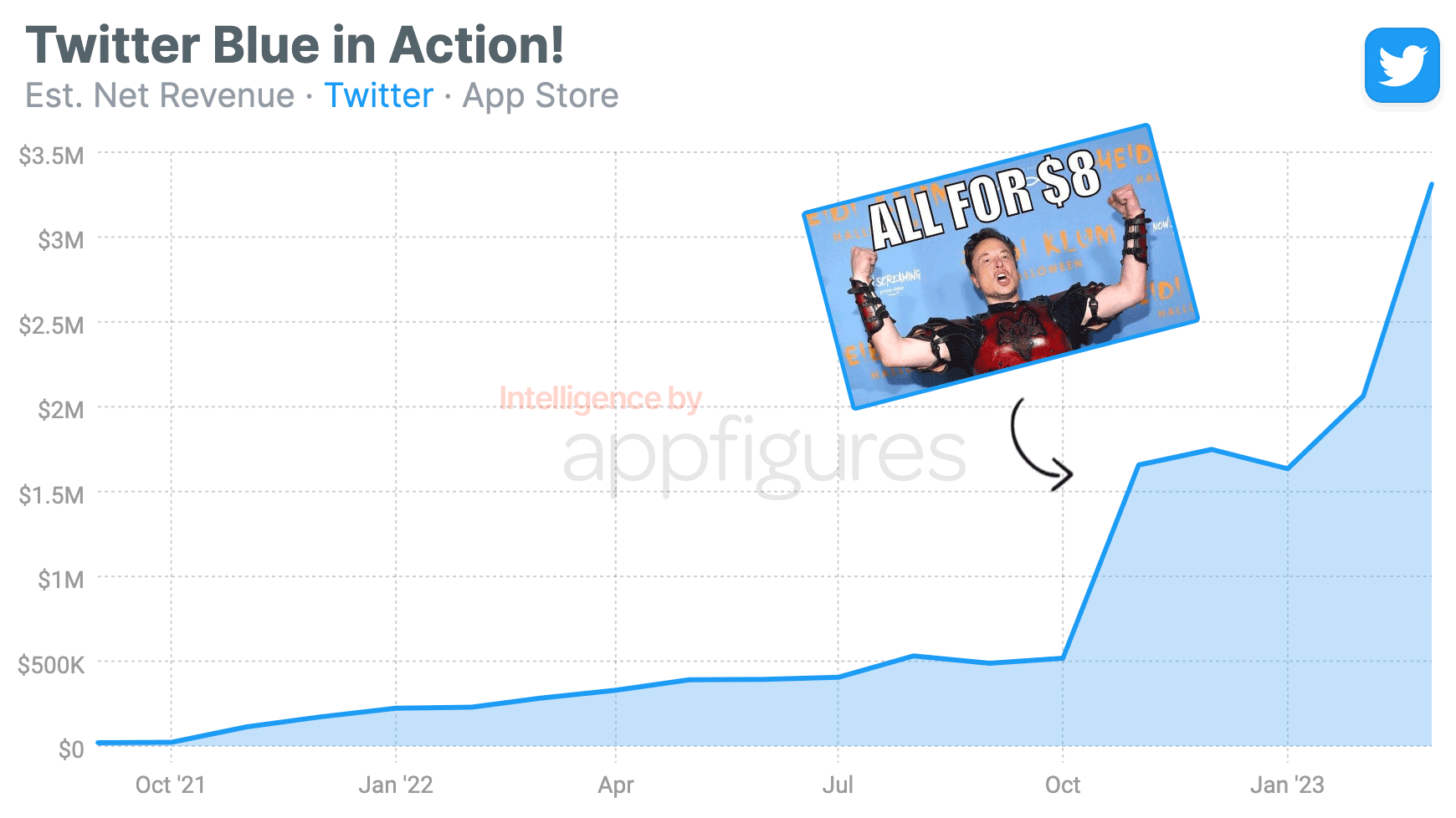

2. Twitter's Mobile Revenue Grew 60% in March, the Most Since November

March is behind us which means it's time to look at Twitter's mobile revenue, the tradition that started with Blue back in 2021 and continues to be interesting to me both as a developer and an entrepreneur.

March was extra interesting because it saw the most growth since $8 Blue rolled out in November!

Twitter ended March with $3.3M in net revenue from the App Store, globally, according to our estimates. Net meaning what Elon gets to keep after paying Apple its fee. I'm focused on the App Store here because Google Play contributes an almost irrelevant share at this scale.

Compared to February, that's an increase of 61%, the highest amount recorded since December of 2021 and not including the move to $8 Blue in November of 2022.

Say what you will about Elon, but Twitter's mobile revenue is finally starting to look like what I'd expect from a company of that scale.

And one more number that's interesting - monthly net revenue grew 540% when compared to pre $8 Blue.

I'm treating what's going on with Twitter right now as a case study, one I'm sure will be taught in business schools in the future. Not every move is positive, but the overall direction is, in my opinion.

3. Robinhood's Downloads Fall to Three-Year Low

Robinhood, the investing app with no fees, was everything everyone talked about for quite a while in 2021. Pandemic woes and funky stocks made it the place to invest and shot it to the top of the App Store multiple times.

But all of that popularity is now gone.

A few PR mistakes mixed with stock-market stability have led to the lowest downloads Ronhood has seen in a loooong time. I had to go all the way back to 2017 to find monthly downloads so low!

Robinhood ended 2022 with 321K downloads in December from both the App Store and Google Play, according to our estimates. That's the lowest downloads have been since June of 2017.

There was a single Dip in early February but it recovered quickly.

321K may sound like a lot but if we compare it to December of the previous year, it was nearly a half, and that was already on the negative side of the trend. Comparing it to Robinhood's peak, which came in January of 2021 with 2.2M downloads, December is tiny.

Comparing all of 2022's downloads, all 4.1M of them, to that one month, shows a bad trend for Robinhood.

And I'm not surprised. I haven't seen Robinhood trying to do anything about it, and I'm a user so I should know.

I was a big fan of Robinhood for a very long time. The idea of simplifying the process and taking away the industry jargon excited me enough to jump on the bandwagon, but for some reason, Robinhood never became my primary trading app. Maybe it oversimplified the process...

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Apple's Weather App Went Down Pushing One App's Downloads 566% Up

It's not every day that Apple's services crash, but this week they did and it was epic. Almost every day since the weekend Apple's built-in weather app showed no data to someone around the world.

People still need their weather, so instead of waiting for Apple, people headed to the App Store to resolve the issue on their own!

Although downloads for a few weather apps rose this week, The Weather Channel saw the highest increase, growing 566% and hitting the highest day of downloads this year and the second-highest since 2020.

Number-wise, that growth translates to roughly 80K new downloads on top of the expected downloads, according to our estimates.

I don't expect this wave to continue as Apple fixes its back end, but it's interesting to see how responsive users are to something like weather.

If you're a developer of a weather app, that means there's still room to grow in this category. Take advantage of this by optimizing your app.

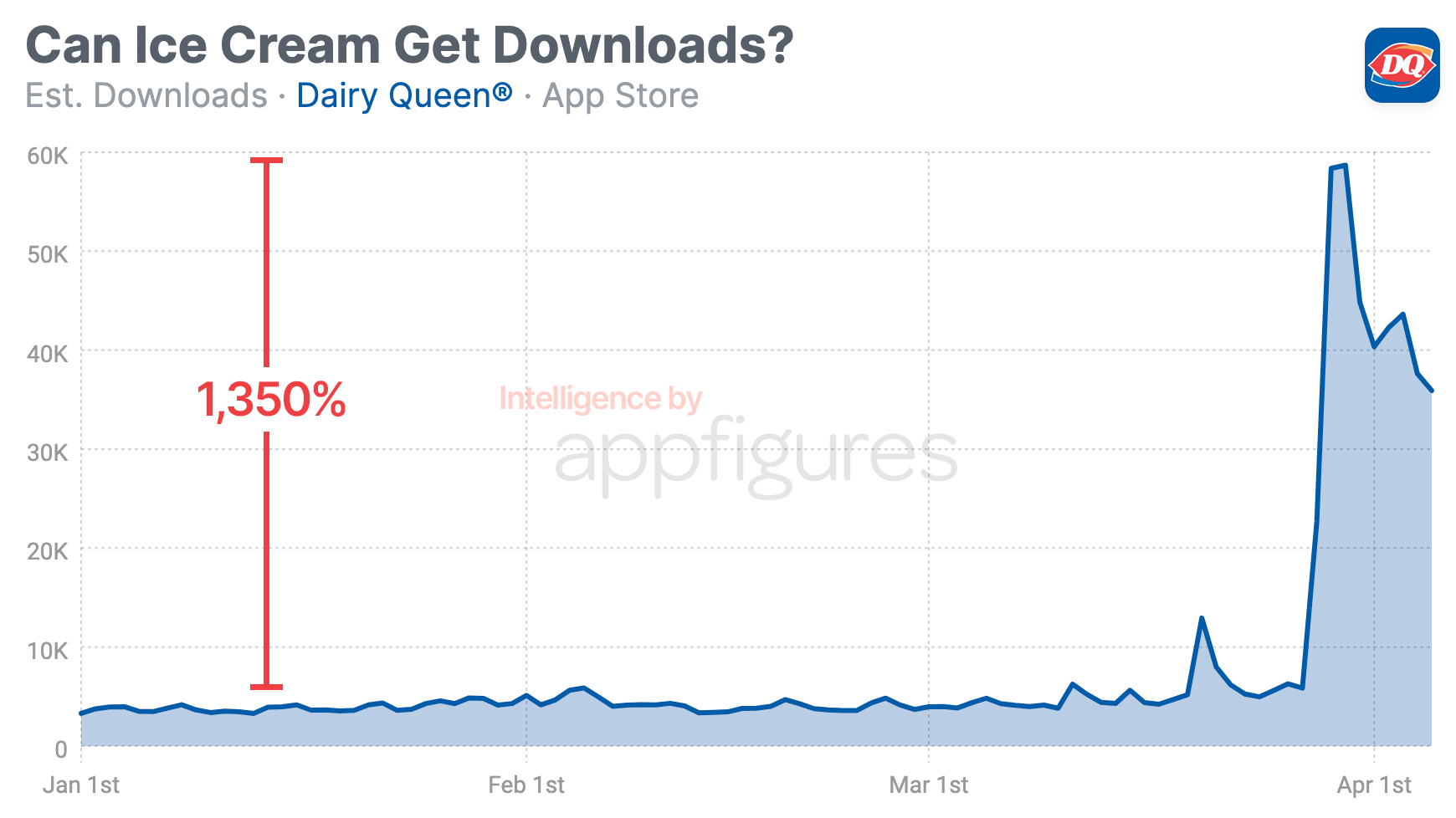

5. Is Dairy Queen's Spring on Food for Downloads Working?

Spring is officially here which means summer is around the corner which means it's almost free-food-for-downloads season.

Dairy Queen is kicking off this year's sure-to-come chain of promotions with a discount.

In honor of the debut of the Blizzard in 1985, Dairy Queen is offering a Blizzard (its ice cream) for $0.85 to app users starting next week until the 23rd of April.

Considering most other promotions we've seen in the last few years involved getting food for free, this is an interesting approach. Can almost free food get Dairy Queen serious downloads?

Well...

According to our estimates, even though the promotion hasn't kicked off yet, the mobile app is already seeing a significant increase in downloads. Last week, downloads rose from about 4K/day to nearly 60K, the day DQ announced the upcoming campaign.

To answer my own question - yes!

Downloads have dipped a bit since, to 35K, which makes perfect sense since the campaign hasn't really started, but are still adding nearly 10x the users they would without the announcement. I expect downloads to return to at least last week's level once the campaign actually begins next Monday, and more likely grow beyond that sending DQ to the top of the App Store.

We'll see next week.

By the way, DQ ran a free campaign last month, giving a free ice cream cone to celebrate the beginning of Spring (March 20th).

The result of the campaign, which didn't require having the mobile app, were pretty unexciting. Downloads rose to 13K on the 20th, about 3x what they usually are, and dipped right back.

Given how early this is starting, I expect we'll be seeing many more campaigns this summer.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.