This Week in Apps - No Vision...

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. ChatGPT's Mobile Revenue Trades Stagnation for Growth

Has ChatGPT's revenue hit double digits yet? Yes. Is revenue still growing? Yes! Double digits? Yes!

March was a good month for ChatGPT's revenue, and even to its downloads. And also for its competitors.

Let's have a look at the numbers:

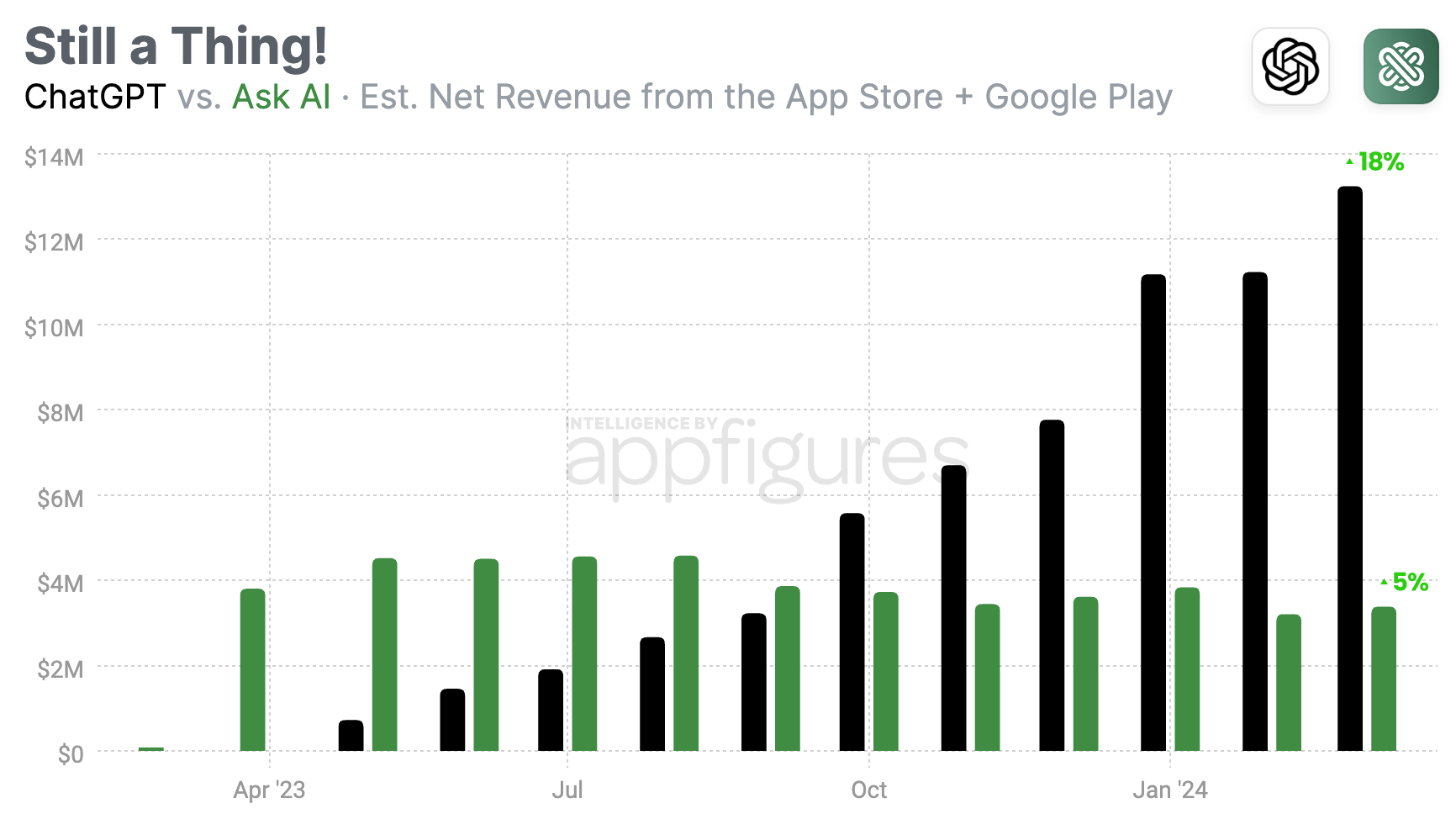

According to our App Intelligence, ChatGPT ended March with $13.2M of net revenue from the App Store and Google Play - growing at a rate of 18% month-over-month. That's great news after growth flattened in February.

Net means what OpenAI gets to keep after giving Apple and Google their fees.

Looking at the monthly downloads trend, you wouldn't even notice OpenAI turned off new subscriptions for a month at the end of last year because this growth is so consistent.

The US continues to be ChatGPT's biggest money maker and was responsible for 41% of the total. The next biggest country, in terms of revenue, is Germany, with a 6% share of the total. That means there's a lot of opportunity out there.

What about the competition?

Before ChatGPT's mobile app came out, a third-party app called Ask AI dominated the App Store and Google Play. Ask AI was one of the first to leverage OpenAI's APIs to offer ChatGPT on mobile, and thanks to aggressive advertising, became the most successful.

Early on, it was even earning more than ChatGPT, but that changed in October. Five months later, is Ask AI still making money?

Yes, which surprised me a bit.

According to our estimates, Ask AI is still generating monthly revenue in the millions. It earned $3.4M in net revenue in March. Not as much as it earned at its peak ($4.8M in August), but not that far from it. And in March, Ask AI's revenue rose 5%.

What Ask AI does differently is it gives its users ways to leverage AI beyond a textbox. I talked about the concept of tools powered by AI vs AI a bunch over the last year and I think that's something ChatGPT's app is still lacking.

When OpenAI can figure that out it'll simply be unbeatable.

2. It's Green, Grouchy, and Growing! The Highest Earning Apps in the March

March is behind us and even though it feels like we just finished analyzing February's results, which we did last week, I already have March ranked so we can analyze the highest-earning apps across the App Store, Google Play, and combined.

Let's have a look at the winners:

TikTok was the highest-earning app in the world in March, earning a whopping $206M of net revenue, according to our estimates. Net means after fees, so Apple and Google made a nice chunk of change from TikTok as well. Another reason why I don't think it'll get banned any time soon.

Crossing the 200M mark is an amazing milestone for TikTok because that revenue comes from users paying creators while TikTok takes a cut. So not only is TikTok adding money to its bottom line it's also becoming the dominant platform for creators.

YouTube came in second with an estimated haul of $119M of net revenue in March, which is a tiny bit higher than February but not enough to get excited over. The gap between the two has really opened up lately with TikTok leaving YouTube nothing but dust.

Disney+, with its new Turquoise icon, remained in third place with an estimated increase of $3M in March. Nothing too shabby, but at least it grew.

Tinder and Max round out the top 5 in March with Tinder keeping up with revenue while Max's revenue rose 20% from February!

Green grouch (aka Duolingo) managed to make it into 10th place on the overall chart. Duolingo is doing an amazing job growing and monetizing its users. I'm sure this isn't the last time we'll see it on our list.

Our App Intelligence shows that together, the top 10 highest-earning apps in March added $776M of net revenue to their bottom lines. Compared to February, that's an increase of 6% month-over-month, flipping February's drop.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

3. Facebook is What??? The Most Downloaded Apps in March

This isn't an April's fool's joke - Facebook was the most downloaded app in the world in March.

I crunched the numbers and ranked the most downloaded apps in the App Store, Google Play, and combined in March and here are the results:

Facebook was the most downloaded app in the world in March, bringing in a combined 59M new downloads from the App Store and Google Play, according to our App Intelligence. The vast majority of those, 52M (88%), came from Google Play.

The cause for the spike was not Facebook becoming cool overnight, or nostalgia, but rather Facebook going down for a few hours. That gives us an interesting insight into how Facebook is used these days - The web!

Because we're looking at an estimate of new installs, downloads going up when the platform goes down means web users downloaded the mobile app to see if they can get access that way.

This aligns with a similar theory I had about Bluesky's usage after it opened up to the public back in February.

I looked at the daily downloads trend for Instagram, the second most downloaded app in the world in March with 58M estimated downloads - which also went down on March 5th - and didn't see a spike because you can't really use Instagram on the web.

TikTok came in third in March with 46M estimated downloads, a smidge up from February.

WhatsApp and Telegram round out the top 5 in March, both finishing strong with more downloads when compared to February.

And here's an interesting tidbit - With Threads, ranked 6th overall, Meta now owns 6 of the 10 most downloaded apps in the world.

Our App Intelligence shows that together, the top 10 most downloaded apps in the world added 345M new downloads in March from the App Store and Google Play - roughly 10% higher than February's total.

4. There are No New Apps for the Apple Vision Pro...

There's no easy way to say this but the Apple Vision Pro isn't the hit we all wanted it to be. I'm sure that'll change with time, but right now it's not a user destination and in turn, isn't even a developer destination.

Let me show you why I say that with such certainty:

Using Explorer, I counted the number of new Vision-only apps released by week since Apple started accepting submissions back in January.

But before we start analyzing the trend - there are currently 523 Vision-only apps available for download using eye movement. Before you say "But Apple says there are more", I'll clarify that I'm focusing on apps dedicated to the Apple Vision Pro and not counting apps that are released for the Vision along with another platform, like iOS. There are 1,288 of those, and they are existing iOS apps that added support for the Vision. Nice, but not relevant to this analysis.

Utilities, Entertainment, and Productivity are the categories with the most apps with Games tied for 3rd place right now. For context, on the App Store, it's Utilities, Entertainment, and Productivity. And Games are a proper fourth.

But here's a bigger difference - price. Right now, about half of all Vision-only apps are paid. Half! On the App Store, paid apps are just 4% of all apps and games. The two aren't comparable.

When Apple opened up submissions back in January, developers shipped 73 new apps and games in the first week. That actually aligned with releases on the Mac App Store (71 that week) so I plotted those, too.

New releases rose to 82 in week two and then nearly doubled to 150 in week three as developers coveted the day-one release rush and Apple's review team prioritized Vision apps. And then the Apple Vision Pro came out. That's where the trend changed.

Once the actual device started thipping new app releases started slowing down exponentially, ending with just one new app in the last week of March.

Apple's review team had to get back to other apps so that slowed things down. But that's probably not it.

Everyone I know has a theory for why this is, but I have a few. Here's what I think is choking the Vision right now and whether it even makes sense to develop for the Vision right now:

- Having a device made it easier for developers to see why some of their simpler ideas simply won't work, which wasn't possible before it shipped, and that's why there are a bunch of little apps no one will ever download on the Vision.

- The device is so expensive many developers won't be able to reason buying one and if they aren't buying it the odds of having enough consumers to buy apps drop pretty fast, making it not worth the effort.

- The Vision isn't great for the general population at all. The camera quality might be amazing for watching movies but terrible for interacting with reality. I say that from my own experience + what I'm seeing online. That means app usage time and retention are going to be low.

Most developers are waiting to see what will happen. And I think that's the best approach right now for most. There are use cases that make the Vision amazing, and building for those specific use cases can be great. That's just not many of those.

As a developer, do you agree? If not, please tell me why and what you're building.

5. March was a Good Month for X

I've been analyzing Twitter's (now X's) revenue ever since Twitter Blue came out. That feels like a lifetime ago in internet time, doesn't it?

March just ended which means it's time to take a look at X's performance in terms of app downloads and revenue. Last month downloads were trending up while revenue trended down. March is a bit different.

According to our App Intelligence, X ended March with $8.2M of net revenue - that's what Elon and co get to keep after paying Apple and Google their fees.

That's roughly 4% higher than the previous peak aaaaaaall the way back in January. February was a bit of a downer, which wasn't the case last year, but standard market conditions don't seem to apply to Elon things, so I'm not going to try to explain it.

Downloads also rose in March as X continues its recovery after the abrupt rebranding cut its downloads in two. But downloads didn't grow much.

According to our estimates, downloads rose 3% to 10M. That's still much lower than the 15M downloads it saw back in January of 2023, but it's much higher than the 7M downloads it got in September, right after the rebrand.

While X is recovering, rival Threads continues to grow. Not that fast - 7% in March - but it started with more downloads so the numbers are bigger. According to our estimates Threads made it into 23.7M devices in March.

Both are gaining the most downloads from Android users in India, a trend we see across all social media apps and a big challenge for TikTok, which is still banned in India.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.