This Week in Apps - They Did It Again!

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

Note: Click on an app's name to see its profile with monthly download and revenue estimates for free. No login required.

1. Century Games Did It Again - Kingshot Hit $500M in Under a Year

Whiteout Survival was one of the biggest mobile game launches in 2023. It went from zero to $30M per month in under a year, eventually crossing $1B in total revenue. The studio behind it, Century Games, had a massive hit on its hands. The question was whether they could do it again.

They did. And they did it faster!

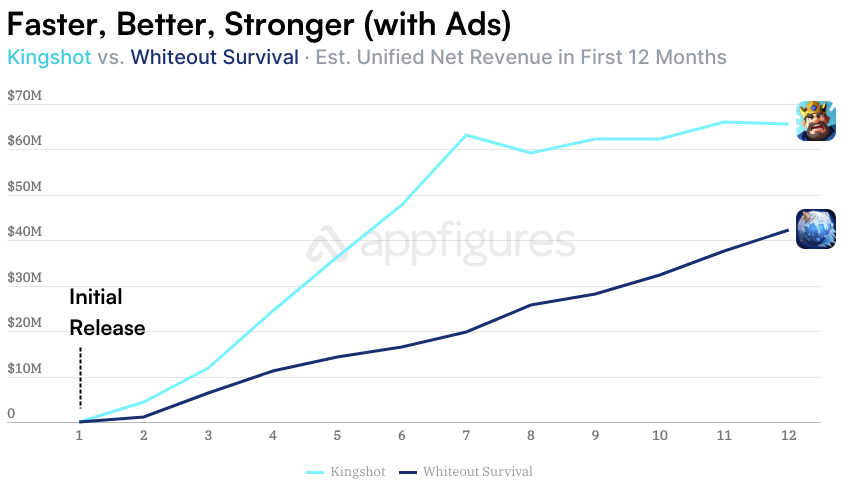

Kingshot, Century Games' follow-up, launched at the end of February 2025. According to Appfigures Intelligence, it earned over $500M in net revenue in its first 11 months on the App Store and Google Play. That's what Century Games keeps after Apple and Google take their cut. For context, Whiteout Survival took 14 months to reach that same milestone.

Same Formula, Faster Results

Kingshot isn't trying to hide what it is. It's built on the same 4X strategy foundation as Whiteout Survival. Base building, resource management, hero collection, alliances, and PvP. The difference is the skin and the onboarding.

Where Whiteout Survival drops you into an icy post-apocalyptic world, Kingshot puts you in a medieval kingdom under siege. But the bigger change is how the game hooks new players. Kingshot adds a tower defense layer that gives players a satisfying first win before introducing the heavier strategy elements. That early hook shows up in the numbers. By April, just its second full month, Kingshot was already earning $12M per month. By December it peaked at $66M.

Whiteout Survival's ramp was impressive too, but it took nearly twice as long to reach those levels.

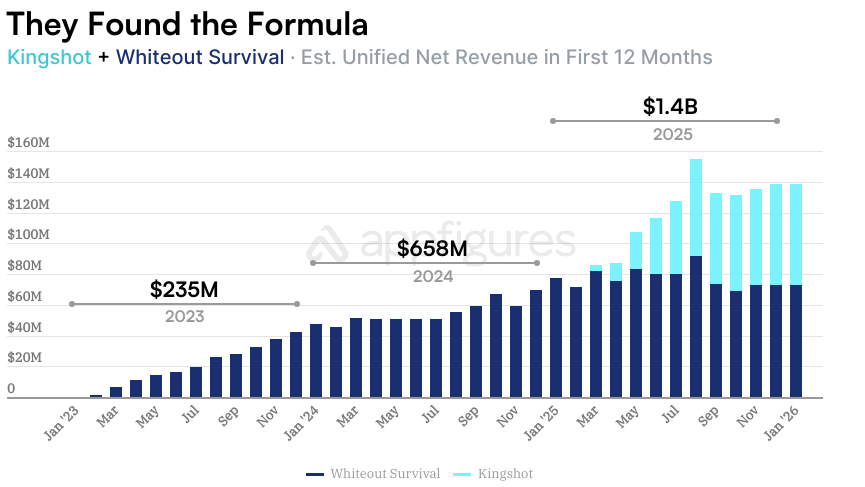

Two Games, $140M Per Month

Here's where the story gets really interesting. Whiteout Survival didn't slow down when Kingshot launched. It's still earning over $70M per month, making it one of the highest-earning mobile games in the world.

Together, Century Games' two titles earned roughly $140M in net revenue in January 2026 alone. That puts them in the same conversation as studios like Scopely (MONOPOLY GO!) and King (Candy Crush), and they got there with just two games.

The Machine Behind It

Century Games is a Singapore-based subsidiary of Chinese public company Zhejiang Century Huatong. They run massive, data-driven UA campaigns with thousands of ad creatives per day across Meta, TikTok, and YouTube. The ads range from AI-generated animated shorts to meme-based humor, always localized across multiple languages.

The US is Kingshot's biggest market at about 40% of revenue. Japan and South Korea follow, then Germany and the UK. Whiteout Survival shows a similar geographic spread. Century Games has clearly built a playbook for launching 4X strategy games globally and executing it at scale.

The 4X strategy genre has been quietly dominating mobile revenue for the past two years, and Century Games is at the center of it. It's hard not to wonder what would happen if they applied the same playbook to a third title. Whether the market has room for another 4X game from the same studio is an open question, but given how well they've executed twice, it wouldn't be surprising to see them try.

For now, the numbers speak for themselves. Two games, earning a combined $140M per month. That's not a fluke. That's a machine.

2. MONOPOLY GO! Is Back on Top – The Top Mobile Games in the World

I crunched the numbers and ranked the highest-earning and most download mobile games in the world in January. January beating December in revenue almost never happens, but that's exactly what the data shows.

The Highest-Earning Mobile Games in the World

MONOPOLY GO! was the highest-earning mobile game in the world in January, with $134M in after-fee revenue, according to App Intelligence. That's its best month since at least March 2025 and puts the title's total net revenue past $3.5B since launch. January coincided with a Wizarding World partner event. MONOPOLY GO!'s biggest revenue months consistently line up with IP collaborations. Fantastic Beasts in July drove an estimated $122M.

Last War came in second with $118M in net revenue, down from $137M in December, according to our estimates. Korean regulators are investigating developer Funfly over misleading ads and punitive refund policies. Revenue hasn't noticed, but it's worth watching.

Honor of Kings, Royal Match, and Whiteout Survival round out the top five. Honor of Kings is the story here. Revenue of the China-only title jumped 10%, fueled by 10th anniversary celebrations. A $15M month-over-month bump from a live event in a single market is a hefty increase.

Below the top five, the reshuffling gets more interesting. Gossip Harbor earned an estimated $79M, leapfrogging Candy Crush Saga at an estimated $77M. And Century Games now has two titles in the top 10 with Whiteout Survival at #5 and Kingshot at #9. Kingshot's rise has been one of the bigger stories in mobile gaming lately.

The top 10 earned an estimated $935M in January, up roughly 8%. January beating December is a signal that live ops and seasonal events are making traditional seasonality less relevant. When games can manufacture their own spending moments, the calendar matters a smidge less.

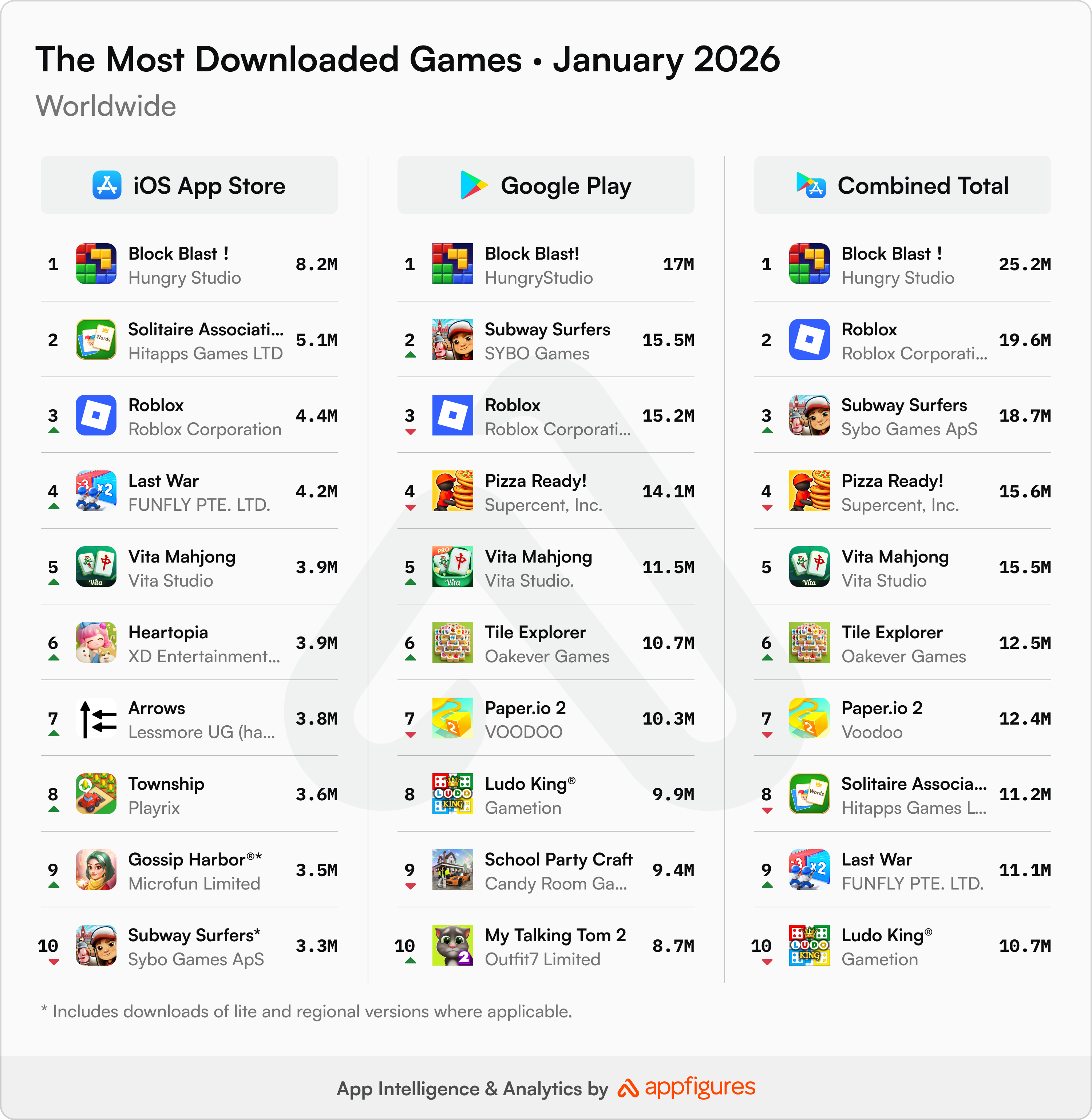

The Most-Downloaded Mobile Games in the World

Revenue is up, but downloads tell a different story.

Block Blast was the most-downloaded mobile game in the world in January with an estimated 25M downloads, down from 30M in December. Block Blast has held the #1 spot for months now, which is not typical behavior for a puzzle game. Most titles spike and fade. This one is sticking.

Roblox came in second with an estimated 20M downloads. Roblox is one of the few titles that consistently charts in both revenue and downloads, a combination most games can only dream of.

Subway Surfers, Pizza Ready!, and Vita Mahjong round out the top five. Subway Surfers and Vita Mahjong both grew downloads month over month, bucking the typical seasonal slowdown.

Notable absence: Gossip Harbor earned an estimated $79M in revenue, enough for #6 on the earnings chart, but didn't crack the download top 10. That's pure monetization muscle.

The top 10 combined for an estimated 152M downloads, roughly flat compared to December. The trend I've been talking about on the apps side is also happening for games.

What This Means

The revenue chart reshuffled dramatically in January. MONOPOLY GO! reclaimed #1, Honor of Kings surged, Gossip Harbor overtook Candy Crush, and the overall total beat December. Meanwhile, the download chart barely moved.

That contrast says something important about where mobile gaming is headed. Growth is coming from monetization, not just user acquisition. The games at the top aren't winning by getting more people to download. They're winning by getting existing players to spend more through live events, IP collaborations, and seasonal content.

3. Another Billion Dollar Month - The Top Apps in the World in January

January came in hot. Downloads rebounded, AI apps continued their takeover, and together, the top 10 highest earning apps generated $1.3B in net revenue. I crunched the numbers and here's what the first month of 2026 looked like.

Downloads Bounced Back, Led by ChatGPT's Biggest Month Ever

After December's dip, the top 10 most downloaded apps climbed to 338M combined downloads in January, a 6% month-over-month increase, according to Appfigures Intelligence.

At the top, again, is ChatGPT with 56M estimated downloads. That's its biggest month ever! OpenAI rolled out GPT-5.2 in January, and while the reviews are mixed, we already know new model releases tend to bring in a wave of new users and give existing ones a reason to come back. ChatGPT has held the #1 spot since March 2025, and nothing's catching it.

TikTok held steady at #2 with 43M estimated downloads. No sign of the ban scare slowing it down, but then again, the US isn't TikTok's biggest market. Can you guess which country is? (answer at the end)

Meta's Instagram and Facebook held #3 and #4 with 42M and 36M respectively, and Google Gemini dropped a spot to rounded out the top 5 with 32M estimated downloads.

Also, another short drama app joined the race. FreeReels landed on Google Play's top 10 for the first time with 21M estimated downloads. That's amazing for an app that only started getting traction in September.

On the App Store, Grok cracked the top 10 most downloaded apps for the first time, landing at #9 with 7M estimated downloads. Grok is definitely picking up steam.

Revenue is Growing Too!

Appfigures Intelligence shows that the top 10 apps across both stores earned $1.3B after platform fees in January, matching December's total.

The app economy isn't slowing down.

TikTok kept its grip on #1 with $284M in estimated net revenue, up a tiny bit from December. The $14B US ownership deal closed on January 22, removing months of uncertainty that had been hanging over the platform. It also generated some noise from unhappy users, but that seems to have settled for the most part.

ChatGPT earned $224M in estimated net revenue, a slight dip from December but still remarkable. OpenAI's new Go tier, a cheaper paid subscription below the existing Plus and Pro plans, is expanding the paying user base. Competition from Grok and Claude is getting tougher, but ChatGPT's revenue ceiling is nowhere in sight in my opinion.

YouTube, Tinder, and Google One filled #3 through #5. YouTube and Google One earning a bit more and Tinder a bit less, but not enough to worry about.

It's Duolingo's season so it makes sense that it inched up a spot in our overall chart, landing at #9 with $70M in estimated net revenue. Let's see if it'll hold this spot longer in 2026.

Appfigures Intelligence shows that together, the top 10 highest earners brought in $1.3B of net revenue - nearly 20% increase year-over-year.

The Big Picture

If January's growth holds we're in for a very good year. AI and streaming are still the big leaders, but the growth can be seen across every category. Now's the time to build.

4. The Company Squeezing Money From Apps You Used to Love

There's a company you've probably never heard of that now owns Evernote, Meetup, Vimeo, and AOL. Yes, that AOL. The company is called Bending Spoons, and what all of these have in common is that they're well-known products that are well past their prime.

Every time Bending Spoons acquires something, the same headlines follow: mass layoffs, price hikes, angry users. But I got curious. What do the numbers actually look like after Bending Spoons takes over?

I pulled the data on some of their most popular acquisitions using Appfigures Intelligence to find out.

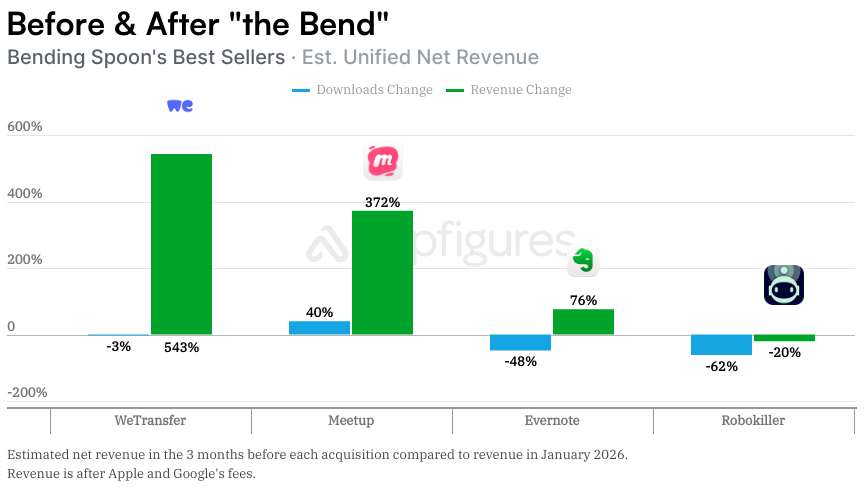

What the Data Shows

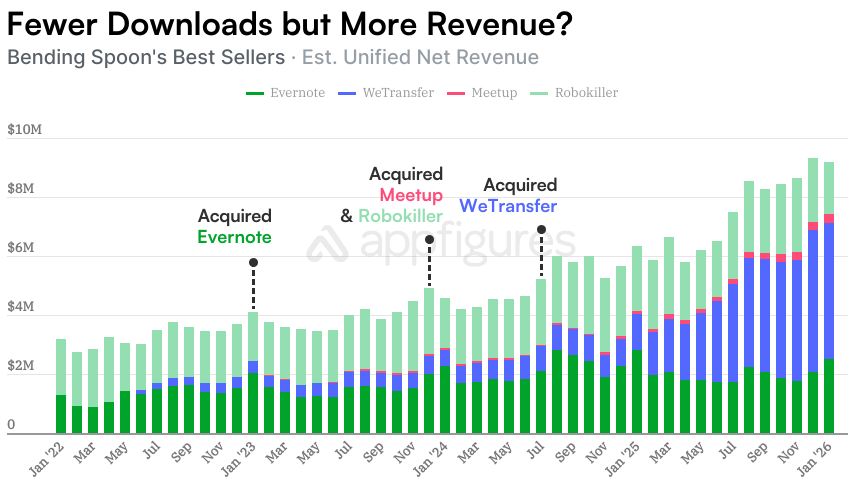

Evernote is probably the most well-known Bending Spoons acquisition. They bought it in early 2023, and within six months the entire staff was laid off and the company relocated to Europe.

Our estimates show that in the six months before the acquisition, Evernote was averaging about $1.5M per month in net revenue with about 254K monthly downloads. In the most recent six months, revenue averaged $2.1M per month while downloads dropped to about 92K. Revenue up 39%, downloads down 64%. How? Pricing has roughly tripled since the acquisition, and in November 2025 they introduced storage limits for the first time in Evernote's history, pushing power users to a $250 per year Advanced tier.

Meetup, the events platform, is another interesting one. Before the acquisition in early 2024, mobile net revenue was about $55K per month, according to our App Intelligence. For the first ten months after the acquisition, not much changed. Revenue stayed in the $40K to $60K range. Then in November 2024, price hikes started hitting organizer renewal cycles, and revenue jumped. By January 2026, it reached $291K per month even though downloads barely moved the entire time.

Robokiller, the spam call blocker they picked up through the Mosaic Group acquisition in early 2024, is a quieter story. Downloads dropped from about 115K per month to 45K, according to our estimates. Revenue held steady at around $2M per month the entire time. Just a smaller user base generating the same revenue "thanks" to price hikes.

WeTransfer is a different kind of acquisition. Unlike the others, WeTransfer wasn't a has-been. It was already growing when Bending Spoons acquired it in July 2024 and cut 75% of the staff by September. In the acquisition month, the mobile app was pulling about $830K per month in estimated net revenue. By January 2026, it hit $4.6M. Revenue was already climbing before the acquisition, but the pace accelerated dramatically after. Downloads stayed roughly flat the entire time.

Vimeo is the newest and biggest acquisition at $1.4B, completed in late 2025. It's too early to see revenue changes in the data, but as you'd expect, layoffs hit in January, similar to what happened at WeTransfer.

Bending Spoons' results vary. WeTransfer's revenue surged. Evernote's crept up. Robokiller's held flat. But the approach is consistent: take over, cut costs, raise prices, and ride an unhappy user base.

What Users Think

There's mostly negative sentiment in the press about Bending Spoons' acquisitions, but what do users think? It looks like they're continue to pay...

So I looked at reviews across these apps and things were not looking great. Evernote's average star rating from recent reviews is just 1.34 out of 5. 80% are one-star reviews, and here's the kicker - these reviews aren't from the acquisition three years ago, they're from this week.

- "Was one of the original users when the app was free and good. They've now held 20 years of my free notes hostage for $26 a month." Card

- "Aggressive paywalls and unskippable adds - I feel that my own data is being held hostage." Card

- "After using Evernote for what must be decades, I now must look for an alternative." Card

Meetup isn't far behind with a 2.06 average.

- "Since the buyout this app has gone way downhill. We need an alternative ASAP." Card

- "Insane prices. Do you think this will work in future?" Card

- "lol what’s this price. - 10 euro a week is insane lol" Card

These repeat again and again and again.

I did notice an interesting pattern. Evernote's users are most angry because unlike other apps, they can't just walk away. If you don't like a call blocker, you delete it and move on. But 10 years of notes are hard to leave behind and Bending Spoons knows it.

That has to be a part of this playbook.

And Then There's Remini

Bending Spoons' first acquisition was Remini, an AI photo enhancer they picked up from a Chinese developer in mid-2021 which doesn't fit the playbook at all.

Remini wasn't a has-been. It was a small app that caught a massive wave. When the AI photo trend exploded in mid-2023, downloads spiked to 23M in a single month. The hype faded, and downloads settled back to around 7M but revenue didn't come down. We estimate that Remini earned $7.5M in net revenue in January. More than 10 times what it was making in early 2022.

Bending Spoons didn't gut Remini. They invested in it, added features, and rode the AI wave with it. Remini is now running at a $93M annual pace (after store fees).

That's almost as much as Evernote, WeTransfer, Meetup, and Robokiller combined!

Whether that was deliberate strategy or just good timing, Remini is the engine that funds everything else.

The Bigger Picture

Bending Spoons isn't slowing down. They paid $1.4B for Vimeo and $1.5B for AOL. That's a company most people have never heard of casually spending billions on brands everyone knows.

The targets tend to fit the same profile. A well-known brand, past its peak, with users who are loyal but not growing. Products that most investors would look at and see decline.

Users aren't happy about the changes but the revenue data shows the model is working. And as long as it does, I'd expect Bending Spoons to keep buying.

Can you guess their next target?

5. Grok Earned Almost as Much as ChatGPT in Its First Year

Grok is about to cross 100 million downloads on the App Store and Google Play, roughly a year after its official launch. That puts it in a club with just ChatGPT and Gemini.

But downloads aren't what makes Grok's story interesting. The money is.

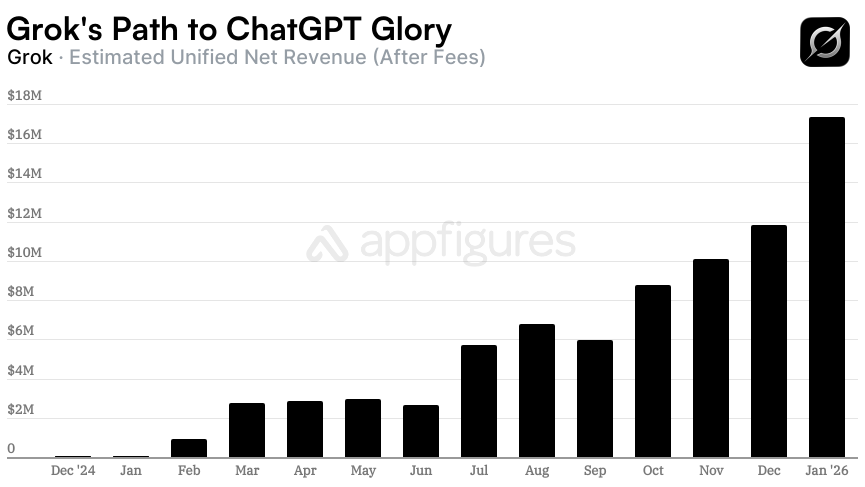

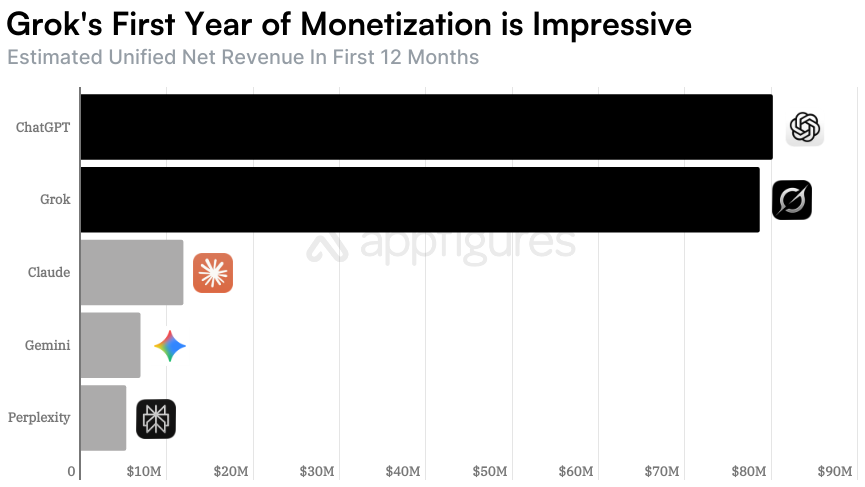

According to Appfigures Intelligence, Grok has earned about $79M in net revenue in its first 12 months of monetization. ChatGPT earned about $80M in net revenue in its first 12 months on mobile, which is essentially the same.

No other AI chatbot is even in the same ballpark.

What makes this impressive is the context. ChatGPT launched into an empty market. It was the first AI chatbot most people had ever used, and it had no real competition for months. Grok launched into a crowded field with ChatGPT, Gemini, Claude, Perplexity, and DeepSeek all fighting for the same users. And it still nearly matched ChatGPT's first-year revenue.

Grok's trajectory is also steeper. Our estimates show that this January was Grok's biggest month ever at $17M in net revenue. ChatGPT didn't hit that level until its 13th month.

The Split That Started It All

Last month I wrote about how X's revenue doubled when it split Grok into its own app. That article focused on what the split meant for X. But I didn't zoom in on Grok itself. Now that I have, the numbers tell a clear story.

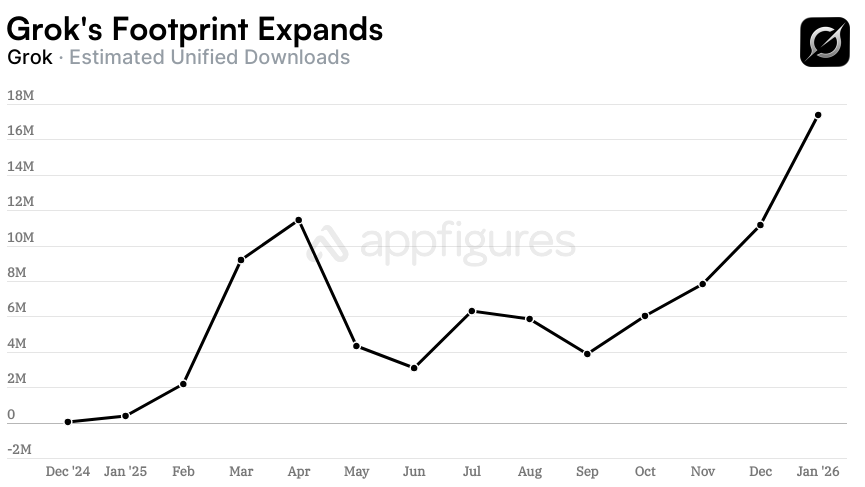

Grok's iOS app soft-launched at the end of December 2024, initially limited to a handful of countries. The Android app followed in early February 2025, and that's when things got real. xAI opened the app to the world and started monetizing with in-app subscriptions.

The first few months were modest, but by April downloads surged as xAI made Grok free on X, turning every X user into a potential Grok user overnight. Downloads cooled a little over the summer, but revenue kept climbing. By the fall, both were accelerating, and January set records on both fronts.

Android Downloads, iPhone Dollars

Most of Grok's downloads come from Android, with India and the US leading by a wide margin. But flip to revenue, and the story reverses completely. Our estimates show iPhones generate more than 3x the net revenue of Android. And the US alone accounts for more than half of Grok's total haul, while India, despite nearly matching the US on downloads, has contributed just 2%. Let that sink in.

The First-Year Race

To put things in perspective, I compared the 12 months of net revenue for the top AI chatbots:

ChatGPT is in a league of its own overall with nearly a billion downloads and an estimated $2.6B in net revenue. But rewind to its first year, and it earned about $80M. Grok is right there.

Gemini is the odd one out. Hundreds of millions of downloads but barely any revenue. That's by design. Google is pushing it aggressively through Android and doesn't use in-app purchases on Google Play, so we can't estimate that side. Google is clearly prioritizing distribution over monetization, showing just how competitive this race is.

Grok is the only AI chatbot to come within striking distance of ChatGPT's first-year pace.

Claude has the fewest downloads of the bunch at 22M, but has earned $59M after fees. That's $2.69 per download, the highest of any AI chatbot on this list, including ChatGPT. For comparison, Grok's is $0.89. Anthropic's users are paying.

Perplexity has 85M downloads and $44M in net revenue. For an app that's purely a subscription product with no built-in distribution advantage, that's a strong conversion rate.

Meta AI and DeepSeek get millions of downloads but don't monetize (yet?).

What I'm Watching

The real question is whether Grok can keep tracking ChatGPT's curve. January was a strong month for AI apps across the board, so I'm going to wait to see February and March before calling it a trend.

But what I can say right now is this: Grok launched into a market ChatGPT had mostly for itself, went up against a half-dozen competitors, including the massive launch of DeepSeek just weeks prior, and nearly matched ChatGPT's first-year revenue anyway. Gemini, with all of Google's distribution power, earned a fraction of that in the same timeframe.

Though that changed thanks to nano 🍌, so I'm watching that too.

The next frontier is agents. Let's see where Grok will fit in that race.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.