Black Friday Download Trends Signal a New Era in Mobile Shopping

This is a single insight from This Week in Apps - A New Era for Shopping Apps. Check out the full article for more insights.

Black Friday felt different this year. Not bad, with US downloads in the Shopping category rising 10% in November vs. last year, but different.

I looked at the most popular shopping apps this November and compared their downloads to last November to see if the bigs continued growing and the answer isn't exactly what I expected.

Let me show you how shopping changed in 2025.

Before we get to the new trend though, let's talk turkey.

I compared downloads of all shopping apps on Black Friday in November because it seems like that's when Black Friday deals have been starting in the last few years.

According to Appfigures Intelligence, downloads in the shopping category rose to 69M in the US in November, a 10% increase from November 2024. Downloads on Google Play grew a bit more than on the App Store (11.5% vs 10.5%), but the App Store drove more than double the downloads.

Actual Black Friday downloads were a bit different. Shopping app downloads from the App Store grew by 8.2% while downloads on Google Play dropped by 2.2% in the US.

Where did these millions of new downloads go?

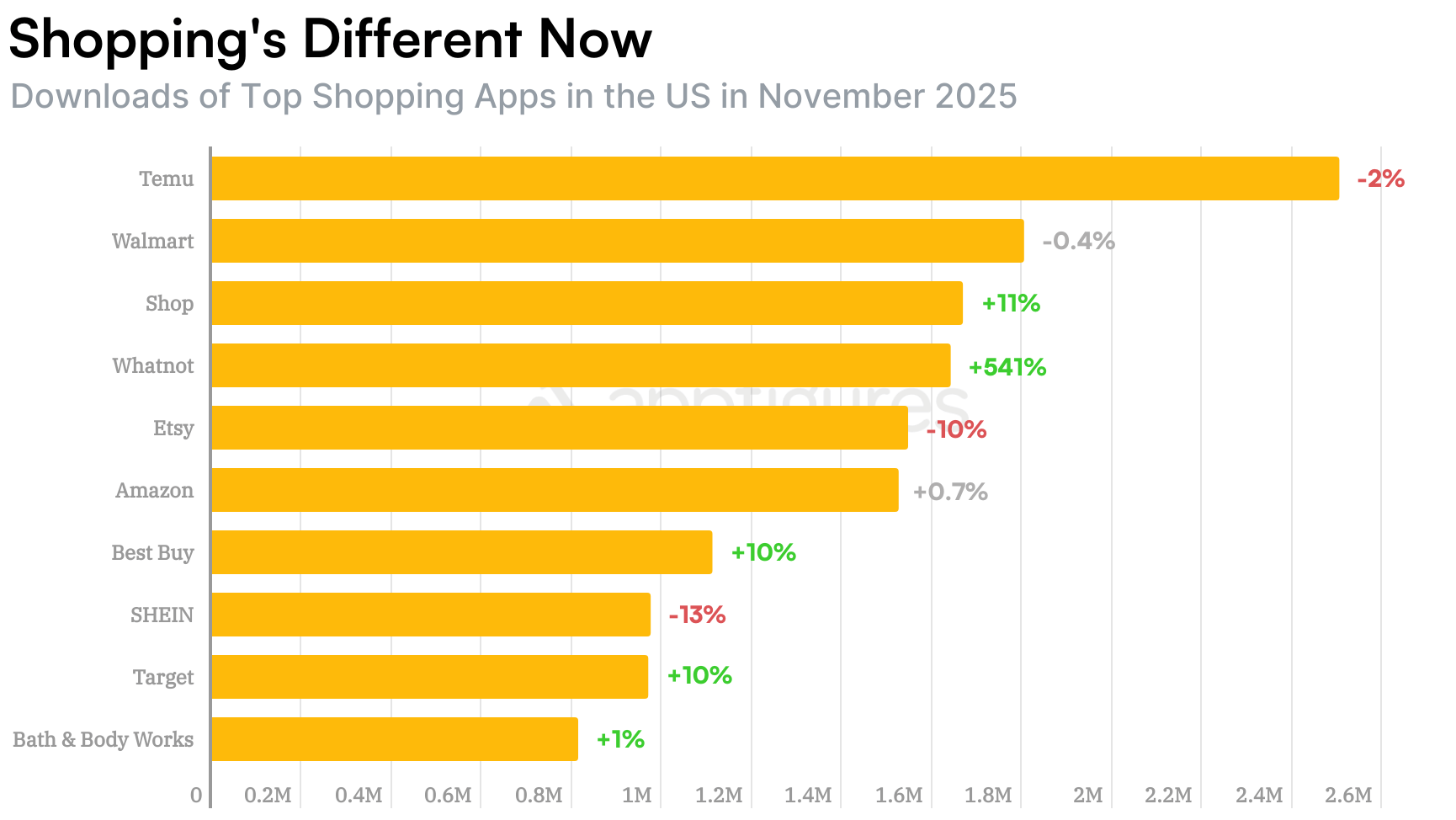

I analyzed the top 10 shopping apps in the US, which include Temu, Walmart, Shop, Whatnot, Etsy, Amazon Shopping, Best Buy, SHEIN, Target, Bath & Body Works.

Comparing offline retailers and online marketplaces might feel like an apples to oranges comparison, but it really isn't. Any app that offers you a discount to take your money and deliver a good is competing for your attention and your wallet. Both are finite for most.

Can you guess which app grew the most?

No, it's not Temu. Or Etsy. Or even Amazon.

It's... Whatnot.

Yes, the least known app from this entire set saw downloads in the US rise a whopping 541% in November when compared to last year.

At the same time, downloads of Temu, SHEIN, Etsy, and Walmart declined in the US.

Best Buy, Target, and Shop all rose double digits, while Amazon kept up with last year. But it's Amazon so it's okay.

Shopping Goes Social

So, what's Whatnot, the shopping app that our app intelligence shows grew from just 254K downloads in November of 2024 to a massive 1.6M new downloads in the US this year?

Whatnot is a live-streaming shopping platform where sellers broadcast themselves opening trading card packs, showing off collectibles, or auctioning vintage items in real-time. Think QVC meets Twitch. Buyers watch, chat, bid, and buy—all within the app.

It's shopping as entertainment, and it's working.

The platform taps into the same psychology that made unboxing videos massive on YouTube: the thrill of discovery, the fear of missing out, and the social connection of experiencing it together. But instead of just watching, you can actually buy what you're seeing in real-time.

What This Means for Shopping

Whatnot's explosive growth signals a shift in how people want to shop on mobile. Traditional e-commerce feels transactional. Whatnot makes it social and spontaneous.

This isn't just about collectibles. Live shopping has already taken off in China with platforms like Taobao Live, and we're starting to see it gain traction in the West. TikTok Shop is betting heavily on it. Amazon Live exists. Instagram has experimented with it.

The common thread: shopping is becoming less about searching for what you need and more about discovering what you didn't know you wanted through engaging, interactive experiences.

And it's not stopping there!

AI and LLMs like ChatGPT are already starting to reshape shopping in a different direction—personalized shopping assistants that understand your preferences, answer questions, and help you make decisions without the pressure of a live seller.

The future of mobile shopping isn't one thing. It's fragmented: some people will love the high-energy, social experience of live shopping. Others will prefer the quiet efficiency of an AI assistant. Both are growing, and both represent a move away from the static product listings that have dominated e-commerce for the past two decades.

Whatnot's 541% growth is just the beginning.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.