Electric Scooter Rental Downloads Grow 3.5x as Bird, Lime, and Spin Returns to Cities

Scooters are returning to cities after some of the popular companies hibernated their fleet early into the lockdown. And as they return, so does the demand for this solution to commuting while social-distancing.

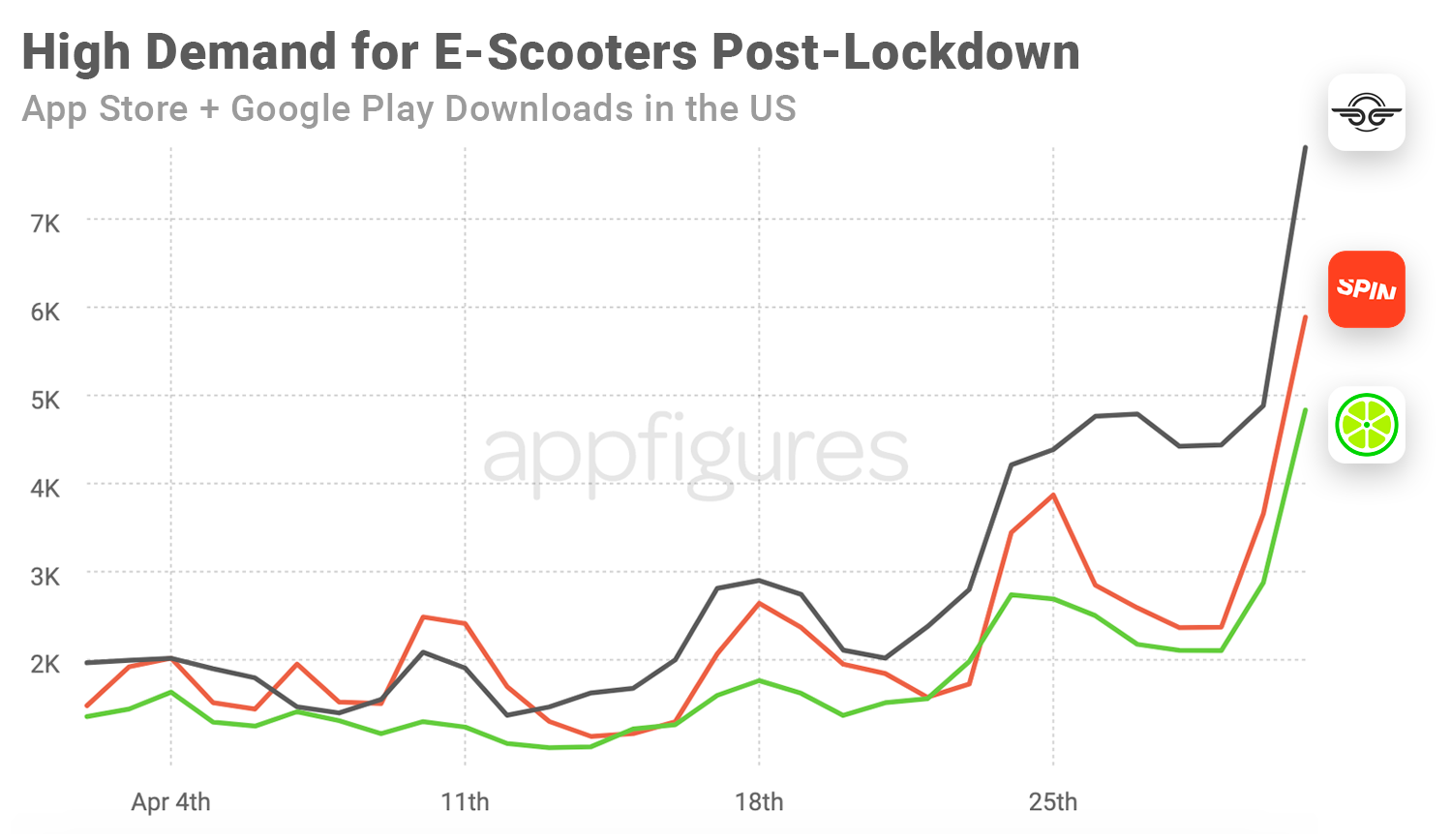

Downloads Jump 3.5x

With scooters hitting the streets, and most cities in the process of reopening, new demand for electric scooters has grown almost over-night. This instant growth is a great sign for the industry, which has seen nearly 80% of new downloads erased because of the lockdown.

Combined new downloads of Bird, Lime, and Spin have gone from about 4,000 per day during lockdown to over 18,000 last Friday in the US. That's an impressive jump akin to the ones the apps experienced pre-lockdown. Possibly a sign that this alternative mode of transportation will become more popular as big cities try to keep commuters apart.

Uber Jumps Out of the Scooter Game, Kind of

If you follow the e-scooter market, you know that Uber was also in the game for quite a while with Jump. Yesterday that changed after Uber reported it was losing $60M per quarter and sold Jump to Lime.

Using download estimates from the App Store and Google Play in the US for all of 2019, we can see Jump never really took off. Downloads being just roughly 1/6th of Lime and 1/5th of Bird, millions burned, and Uber's other issues, it's not a surprise.

Uber, however, isn't entirely out of the game just yet. Although Jump will probably disappear, Uber has invested $85 million in Lime and placed Jump's ex CEO on Lime's board, which means they still see e-scooters being a part of the future.

Will They Make It?

There's certainly an opportunity for scooter rentals, and potentially an easier "sell" to cities of the benefits. But as the lockdown hit, both Bird and Lime cut staff to stay afloat. Can they scale up fast enough to meet this new potential demand? Or, can they be nimble enough to capitalize on it without scaling up and without increasing their burn rate?

We're keeping an eye on the segment, and also on up and coming competitors such as Veo, Skip, and Tier.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.