This Week in Apps #58 - It's the End of the App Store as We Know It

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Index (YTD)

Mobile Download Index: App Store 94.47 (-13.8%), Google Play 72.85 (-23.5%)

Insights

1. So, App Tracking Transparency...

What a week for Apple news! Apple delivered new hardware, podcast subscriptions, and... the end of days for advertisers. Kind of.

Tim Cook announced this week that iOS 14.5 will be dropping in a few days. In case you're not sure why that's significant, iOS 14.5 is the first version of iOS that will require apps to use App Tracking Transparency.

Last year Apple announced that developers who share user data or combine it with other non-app data will have to first ask the user for permission to do that. I can't imagine many people will tap the "yes, please" button.

On the surface, this is a "simple" change that falls in line with everything else Apple is doing to protect users' privacy, but for developers, this change has serious implications:

- The end of "free" analytics SDKs. In-App analytics are a must for any app or game that's trying to grow, and solutions from Google, Facebook, and old-timer Flurry are super popular because they get the job done and are completely free. But while they're free for the developer, they still have a cost, and that's your data, which is really your users.

All of these "free" solutions use the data they collect to feed their ad networks with knowledge. ATT limits this knowledge transfer, which in turn will limit the incentive those companies have to continue and provide this solution for free.

Don't believe me? Facebook already took the bold step of ending its analytics solution altogether. Just like that!

There are quite a few low-cost and very premium alternatives, but none are even close to the popularity of the big three. When they die, where will developers go? Not Apple's native analytics, I hope.

- Making money with ads will become even harder. If losing stats is okay, let's go a level deeper, money. Facebook has announced that once ATT rolls out, its Audience network, which is how 32K iOS apps monetize, will become extremely inefficient to the point they might end it as well. Inefficient for Facebook = inefficient for other networks = less money for developers.

The thing is, more than 180K apps and games use ads to keep going. That's a lot of apps that will need to either show (even) more ads to pay the bills or switch to subscriptions or in-app purchases, which isn't just changing a few lines of code.

- Apple Search Ads will become more expensive. Tracking, as Apple labels it, enables networks like Facebook and Google to provide advertisers with the ability to target users as those networks learn more about the users. Without this ability, advertisers will have to spend more money to be in front of more users because not all will be relevant.

How's this relevant for Apple Search Ads? Well, it's the only network that will have data that isn't siloed. I don't know how well this will fly with all the anti-trust challenges Apple is facing, but advertisers want results, and those search ads are very limited, so with the same supply and more demand, the cost of a single tap is going to increase.

Big budget apps and games will probably shift existing ad spend around, which will push out some of the smaller ones out of the running. If you're in the latter category, this is a good time to start investing in organic discovery in the form of App Store Optimization, which is free.

The bottom line - Apple's desire for privacy will cost many honest developers a lot of money. Games will suffer the most, and will likely result in even more decent games dying and ad-network owned hyper-casuals continuing to rise. Overall, I see that as a lose-lose.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

2. Monster week for HBO Max

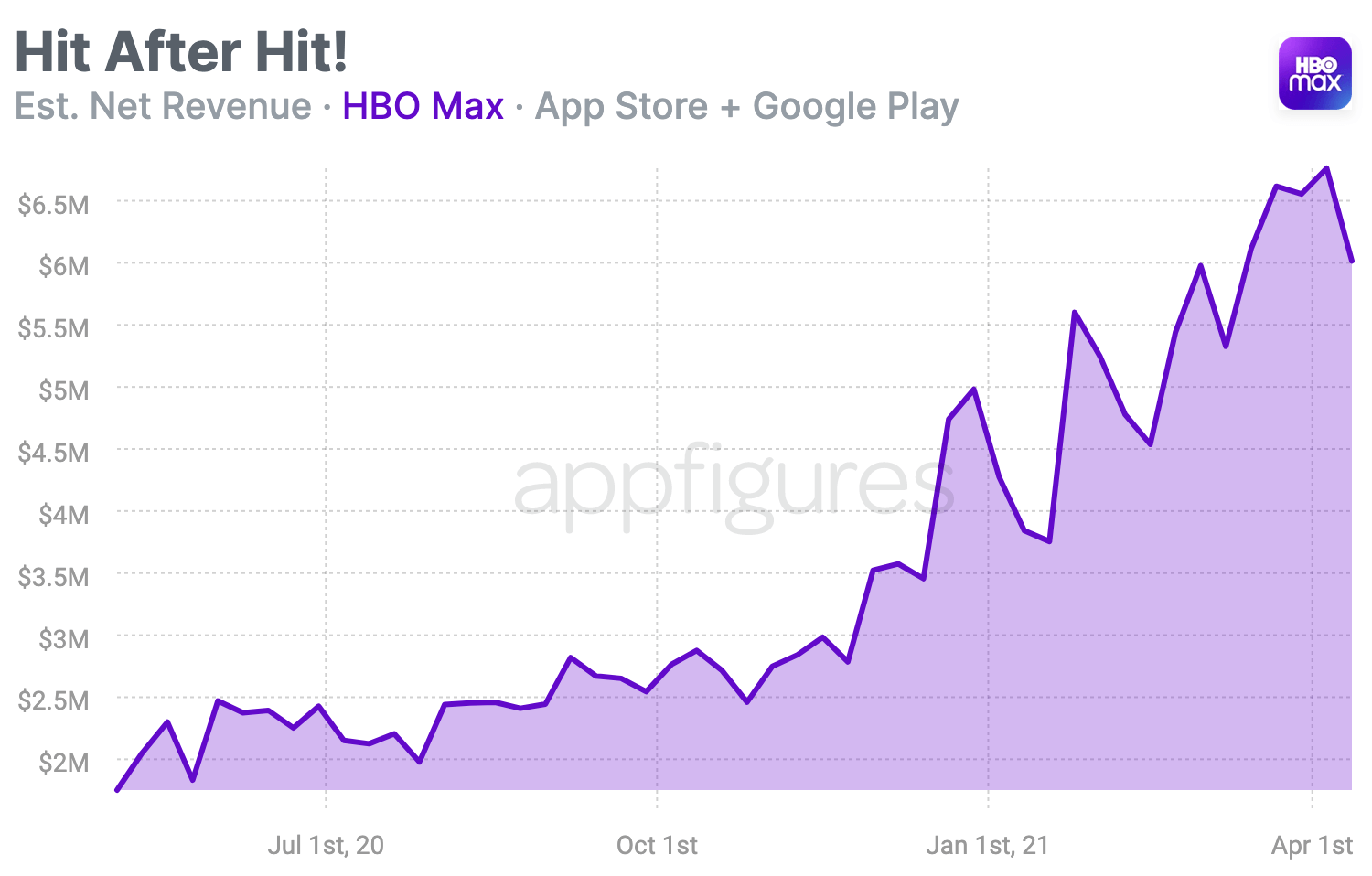

HBO Max has been cranking out a lot of original content, most hitting TVs and theaters at the same time, which isn't how this was done before. Why does HBO Max continue to do it? Because it works!

Since rebranding as Max, HBO's app revenue has grown at a rapid pace, and with every big title, added a significant number of paying subscribers.

We can see that clearly if we look at revenue estimates, starting with the first big release, Wonder Woman 1984, back in December, which was followed by a new Tom & Jerry, the Snyder cut of Justice League, and Godzilla vs. Kong right after to end the month of March.

These have pushed HBO Max's monthly revenue to an all-new high with $26.7M of net revenue ($38.2M gross), according to our estimates. That's 30% growth from February and 116% growth when compared to November, before the first big release.

Mortal Kombat drops this weekend, a title I've been waiting for myself, and in the coming months, a new Space Jam and a fourth installment of the Matrix are going to be released, so this trend isn't likely to change.

3. Snapchat's new ratio

Snapchat mentioned earlier this week that they're seeing big growth on Android, so I took a closer look at the data to see what that's all about and to verify their statements.

And verified they are!

Since 2017, the ratio of downloads from iOS devices to Android devices has grown drastically.

In the social media world, a ~2x ratio is pretty standard. Twitter, Instagram, and TikTok are all in that range. That means that for every download on an iOS device, there are two downloads on an Android device. This is pretty standard because Android is much more common outside of the US, and all of these services are popular enough that there's a lot of demand for them in most countries.

In 2017, Snapchat's ratio was 1.3x, which a bit low. It climbed since. Quite a bit. In 2018 it rose to 2x, in 2019 it got to 2.4x and in 2020 it peaked at 5.5x as downloads in India ballooned. It's since dropped a bit, mainly because demand in India dropped significantly in 2021, but is still ahead of the gang. In March, Snapchat's iOS to Android download ratio was 3.3x according to our app intelligence.

Why is this important? Snapchat might be chasing Instagram and TikTok, but has it's own fanclub that's very large but up until a few years ago was mainly made up of iPhone users. For Snapchat to grow, they have to stick in other countries, and Android downloads are a great proxy for how well that's going.

4. Not only Coinbase!

Last week Coinbase dominated the top charts because of its IPO and sharp increases in cryptos. But while that was happening, another cryptocurrency trading app rose as well.

Trust, a cryptocurrency wallet and trading app with a name that makes me suspicious, climbed to almost the top of the charts on both the App Store and Google Play this week.

That climb translated to quite a few downloads.

Our estimates show that downloads grew by a factor of 10, from a daily average of around 20K to more than 240K on Tuesday, across both platforms. For context, Coinbase had 200K downloads on those days.

The bottom line - More downloads of crypto wallets mean cryptocurrency is breaking into the mainstream like never before, and that has some serious implications for how we'll trade in the future. Although China is rolling out its own digital currency, most crypto isn't backed by anything serious. Yet, that hasn't stopped companies like Tesla from starting to accept it as payment for goods.

Governments won't sit by idly while this is happening, so expect serious regulations to come, and since the whole idea of cryptocurrency is to be free of those, what it is in a year could be drastically different than what it is now.

5. Browser wars

Do you use the built-in browser on your phone? I do, but looking at downloads, many millions of iOS and Android users don't. So what do they use instead?

A look at our estimates is showing very different behavior on the two platforms.

Chrome, which is the most popular desktop browser these days, is also the most downloaded browser on mobile. This year it earned 22M downloads, 91% of which came from iOS devices. Androids get Chrome pre-installed, so that's not a surprise.

Although Chrome has the lead, it's got stiff competition. Opera is right behind it, with 17.2M estimated downloads, the majority of which, on Android. Firefox, Edge, Brave, and DuckDuckGo saw 19M downloads this year, with a fairly even distribution between them all.

What's your favorite browser? Why? Let me know on Twitter.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.