This Week in Apps #116 - Where Are They Going???

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (30 Day)

Insights

1. Is Crypto Dead? Coinbase Loses Significant Downloads in 2022

Coinbase enjoyed an amazing couple of years. Uncertainty during lockdowns drove more regular folks towards crypto and Coinbase was the app of choice to buy and sell.

Back in January, it looked like Coinbase was going to become one of the dominant apps across the App Store and Google Play. I even suggested that'll happen in 2022. But I was wrong...

Crypto has been in the news a bunch over the last few weeks after one currency totally collapsed. Bitcoin's value shrinking drastically since February didn't help either.

And the same platform that brought common folks into crypto is now seeing them leave...

Downloads of Coinbase dropped to less than a half so far in 2022. And I'm not even comparing it to the highs of 2021.

In January, Coinbase welcomed a little over 2 million new downloads, according to our estimates. That's been dropping consistently, though. In April, downloads didn't even get to 900,000, a decrease of more than 57%. They rebounded a tiny bit in May at a touch more than 900,000 but aren't looking anything like January and are far from the 3.9 million downloads Coinbase saw in May of 2021.

Is this the end for crypto? Unlikely. I think many companies enjoyed the naivety of the millions who were lured into investing without understanding why and how it really works. And thanks to apps like Coinbase, were able to set their money on fire pretty easily.

That trend is now on ice, and that's a good thing if you ask me.

Regulations, platform changes, and a purge of opportunistic companies will allow crypto to come back into the mainstream. So it isn't a question of if but rather when.

2. Apex Legend Mobile's First Two Weeks in Numbers – They're Big!

A new old game crossed the platform line from console to mobile a few weeks ago and immediately took command of the App Store and Google Play.

If you haven't looked at the top charts in the last couple of weeks, that game is Apex Legends Mobile, a battle royale game that launched on consoles in 2019.

Let's see how it's doing on mobile:

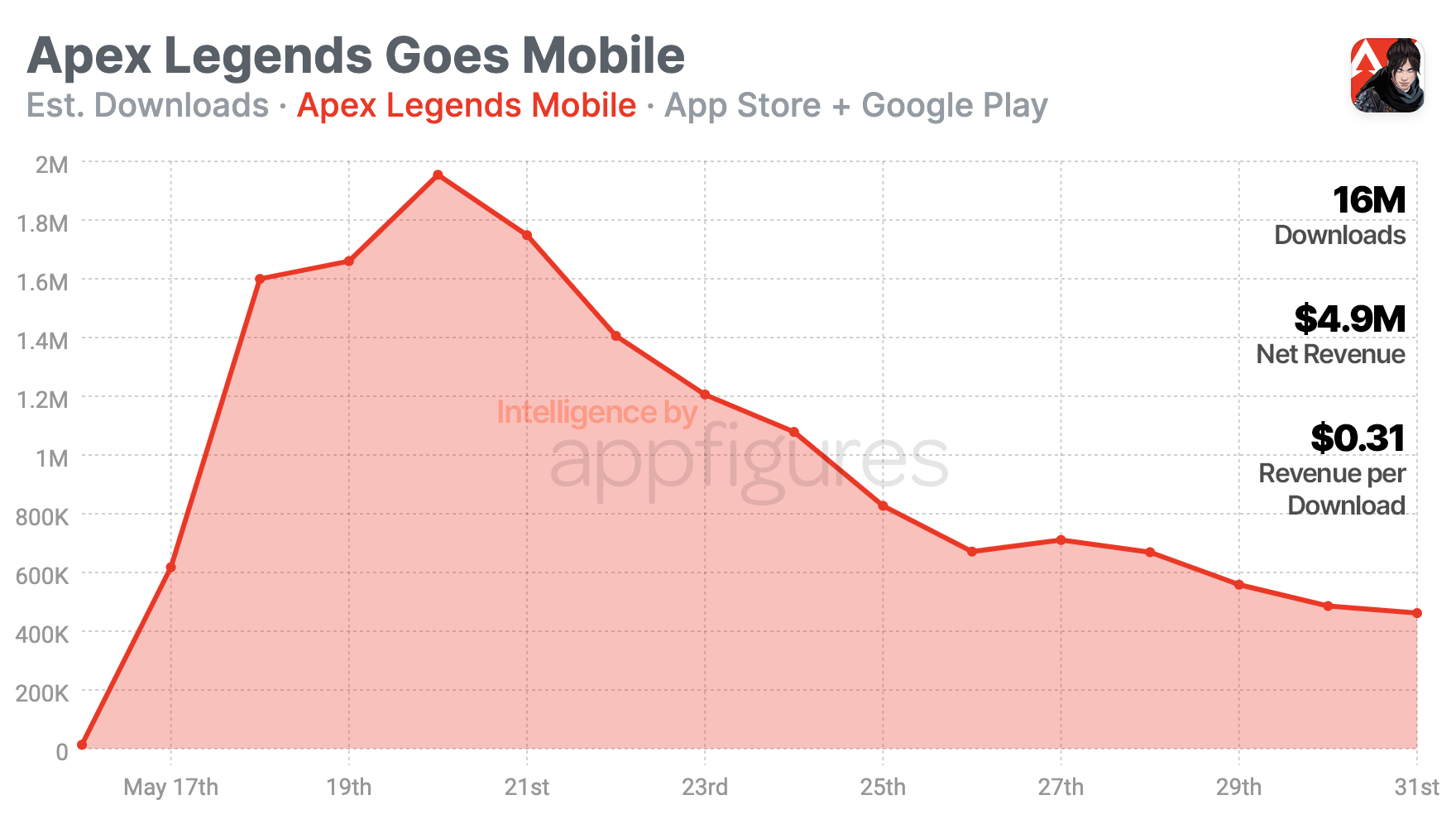

In its first two weeks on the App Store and Google Play, we estimate that Apex Legends Mobile added nearly 16 million new downloads. A little more than 60% of those came from Google Play and the rest from the App Store.

Revenue was the exact opposite. Of the nearly $5 million of net revenue the game has earned so far, 73% came from the App Store and the rest from Google Play. This is pretty normal for a game these days.

The top countries included the US, India, and Brazil. Together, the trio was responsible for about 40% of all downloads.

Let's go a step further and estimate revenue per download, which we can get by dividing revenue by downloads. Since we have data from day one, this simple metric will give us pretty good insight into how good the game is at turning downloads into revenue.

Two weeks in, we estimate the game's net revenue per download is $0.31, which isn't very high... For comparison, Call of Duty Mobile's all-time net revenue per download is $3.22, according to our estimates. PUBG's is lower than CoD, at $1.85, but is still about 6 times more than Apex Legends.

I'm not saying Apex Legends can't get there, but I am saying there's room for growth.

3. Twitter's Monthly Revenue Continues its Modest Growth

Twitter has been through a lot in May... I'm not going to talk about any of that. Instead, I'm going to check in on Twitter's monthly revenue, something I've been doing since Twitter started monetizing in-app.

Did Twitter's in-app revenue grow in May? Did Elon's hostile takeover help? Is Twitter's revenue still unreasonably small?

Let's have a look at our App intelligence:

Numbers first. According to our estimates, Twitter earned $434,000 of net revenue via its mobile apps in May. And, that's net, meaning after store fees. As you'd probably expect, the majority of this revenue, roughly 90%, came from the App Store.

That's an increase of 18% compared to the previous month, the same growth rate Twitter experienced in April. I think it's safe to say that Elon's shenanigans didn't do much for (or against) revenue in May.

But the real question remains - why is Twitter's revenue so tiny and growing so slowly? If you ask me it's because Twitter isn't really doing much to grow it. Twitter Blue is still pretty boring and unappealing, Superfollows are still too exclusive, and worst of all, most of the platform's users don't even know about these features.

I imagine Twitter has a plan. But... with most things frozen while its ownership is determined, I don't expect things to change any time soon. A small win for the competition...

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Peloton's New Direction is Paying Off

Peloton, the high-end exercise bike company that took off during the pandemic and crashed right after, has hit a new milestone with its app – The highest month of revenue.

Why is this interesting? Because, if you recall, Peloton pivoted a "bit" last year to focusing on its content, and that's where app revenue is coming from.

Peloton ended May with the most revenue in a single month the app has ever seen. Our estimates show net revenue hitting $6 million in May. The majority, roughly 92% came from the App Store while the rest came from Google Play. Makes sense!

And that's net revenue, which is what Peloton gets to keep after giving Apple and Google its fees.

That's not only a great milestone for the app that rode its content, pun intended, to success even before it went in-app, but also a great show of strength on mobile. So far, revenue has grown 42% when compared to January, which was a higher than average month

App revenue is a small part of Peloton's total revenue right now, but given this growth so far in 2022, I don't see any reason for it to remain that way. I don't see inflation getting in the way, either.

5. Gooooooal! Paramount+ Sees Most Downloads Since Launch

Last week Paramount+ had the most downloads it's ever had in a single day. In the past, new movies or TV shows led to a short-term bump, but not this time.

We estimate that on Saturday, downloads hit 169,000, the highest they've ever gone since the app relaunched in March of 2021. Paramount has seen quite a few spikes, but the closest one to this Saturday's was less than a half!

So, what's the reason for this spike? Paramount+ was streaming the Champions League final between Liverpool and Real Madrid, European soccer's ultimate game. Also, Paramount+ offers a free trial. That's an important component here.

Also also, the downloads did not come from Europe, an incorrect but understandable guess. Why? Because Paramount+ isn't available in Europe yet. It's expanding into the UK and other countries later this month. So all of those downloads were from the US.

One thing I'm planning to watch is whether those downloads turn into revenue. Big events are a great way to capture downloads, but as HBO Max learned last year, offering a free trial on top of big content is not a good way to make money, which is why they dropped that offering.

It's too early for Paramount+ to strictly optimize for revenue, but if it continues to find the right content to stream, it just might. And overall, that's what I expect to see from all streamers as the industry normalizes.

Update: A previous version had an incorrect revenue per download for Apex Legends.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.