This Week in Apps #134 - Is It Finally Happening???

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (30 Day)

Insights

1. The Highest-Earning Apps in September

This week I ranked the highest-earning apps in September in the US, where much of the money is. And I'm happy to report things are pretty consistent.

Maybe happy isn't the right word, but things are definitely consistent.

HBO Max was the highest-earning app (aka. non-game) in the US. According to our App Intelligence, it brought in $51 million of net revenue in September. Pretty much the same as August, an indication that growth and churn are somewhat even.

TikTok and YouTube continued their rivalry, but unlike last month, TikTok had the upper hand in September. The two are very close, though.

Before you tell me the two are totally different - I know! But attention spans are mutually exclusive, so spending time in one likely means not spending time in the other, and revenue is a good proxy for where people spend their time.

The other rivalry of the highest-earning list, Tinder and Bumble, is getting closer, too. I'm going to go deeper into dating apps below.

And lastly, pun not really intended, LinkedIn managed to squeeze into the #10 spot overall. Again. But with slightly higher revenue.

We estimate that together, the top 10 highest earning apps in the US brought in $324 of net revenue, meaning after Apple and Google take their share, in September. A tiny bit higher than August, which isn't enough to get excited over.

FYI - Our revenue estimates are not a multiple on downloads but rather estimates of revenue. That's how we keep the accuracy high.

2. A Battle for Productivity - The Most Downloaded Apps in the World

I started in reverse, but this week I also ranked the most downloaded apps in the world in September. And while I'm going in reverse, total downloads dropped 5% in September when compared to August.

Let's have a look at the list:

TikTok was the most downloaded app in the world in September according to our App Intelligence. It added 54 million new users from the App Store and Google Play in September, which isn't as many as it did in August, but very close. It also got dangerously close to Instagram on Google Play, which should be a warning for Meta.

Meta might not care because it controlled the remaining 4 of 5 top apps with Instagram in the lead followed by Facebook, WhatsApp, and Messenger. Together, the quartet saw 154 million new downloads from the App Store and Google Play.

A few interesting insights in no particular order:

- Google's productivity tools, Sheets and Docs, are outpacing Microsoft's rivals, but not by that much.

- Top Widgets edged its way into the list on the App Store side after being the #1 app in the US for a few days. I suspect the downloads came from ASA.

- Snapchat lost about 4 million downloads in September. Is BeReal to blame?

- CapCut, TikTok's video editor, is back! It made its way into the 6th spot in the combined list with 26 million downloads.

FYI - This is the first time I'm including CapCut's China version in the total which is why it's a bit higher than what you'd expect.

According to our estimates, the top 10 most-downloaded apps in the world made their way into 331 million devices in September. A little under a half belong to Meta. Wow. That's a 5% drop from August's total, which is pretty significant but considering who's at the top, probably has something to do with summer ending.

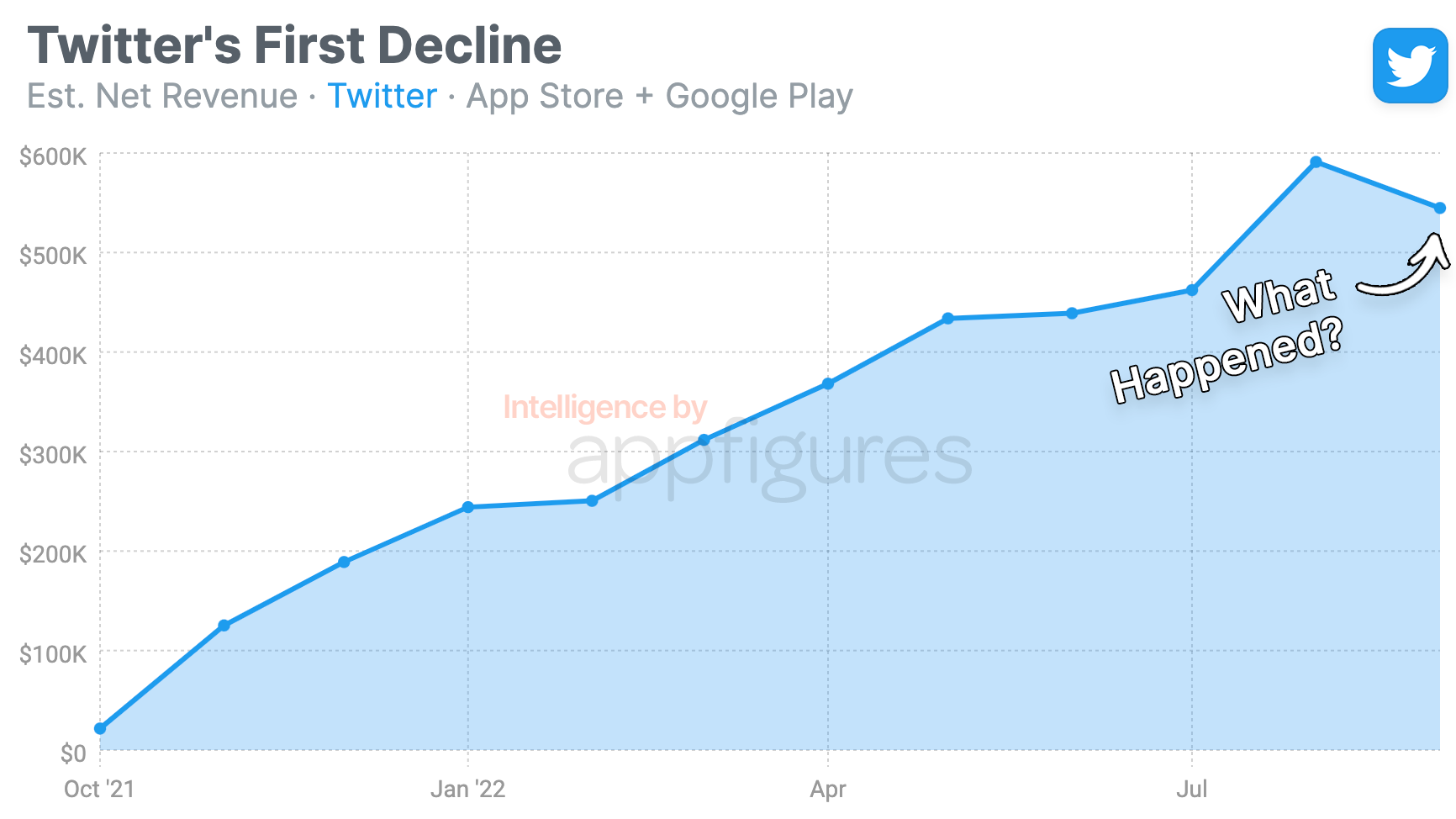

3. The First Year For Twitter's In-App Revenue Was Full of Ups and Downs

Every month I look at Twitter's monthly recurring revenue (MRR), but September was a special month, marking a year of mobile revenue for the platform.

Let's have a look at revenue and then talk about what this means and where (I think) it's going. There's good and bad news.

According to our revenue estimates, Twitter's MRR in September was $545K. If this is the first time you're seeing this number I feel compelled to remind this is thousands and not millions.

And if you remember last month's total you'll notice September was lower, double-digits lower. We've seen Twitter's revenue stagnate over the summer but this is the first recorded decline since its in-app purchases rolled out to all.

That's the bad news.

Why is Twitter's revenue so low? Why is it not growing faster? And why is it going down? All good questions.

I keep wanting to see it go up, but there really isn't a good reason for it to, yet, at least. So far what Twitter rolled out is not very exciting, and to move a userbase that never paid, requires something exciting.

On top of the lack of features, many were also locked under some sort of a private-beta or invite-only system. Traditionally, this could result in hype. That's not the case these days because every rival has something more exciting available, drawing both creators and followers away.

That's the main reason, in my opinion, for these numbers, which you'd expect to see from a new startup, not Twitter. But a parodic saga with Elon Musk and high inflation aren't helping either.

The good news is more wishful thinking than real news, but I believe this is easily fixable. I don't know the inner workings of Twitter, but do know they're very capable when they follow the right strategy.

If Elon acquires the platform this might/will change drastically I'm sure. Still an if.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Dating App Downloads Explode After Years of Stagnation

Dating apps have seen both downloads and revenue grow drastically this year.

Downloads grew a lot in 2020 as lockdowns took over many countries and it was no longer possible to make friends IRL.

But much of that growth was in 2020 and downloads just kept going after. In fact, downloads stayed flat for most of 2020 and 2021. Revenue on the other hand continued to grow. And then grew some more.

In 2022 both downloads and revenue have already grown a lot, and this time it isn't lockdowns to blame thank.

I combined the downloads and revenue for the three most popular dating apps for this analysis. Why? Because they're the top-grossing apps right now and have been for a very long time, and the next app in the list isn't even close in terms of ran (or revenue).

Together, quarterly net revenue of Tinder, Bumble, and Hinge grew 382% since 2018. In more absolute terms, monthly revenue rose from $92M in Q1 of 2018 to $443M in Q3 of 2022, according to our estimates. And this is net revenue, meaning after Apple and Google take their fee.

Growth was fairly constant with 16 of the 19 quarters since the beginning of 2018 having positive revenue growth.

Downloads weren't as exciting, but when compared to 2018 also grew a hefty 88%! In absolute terms, that means 17M downloads from the App Store and Google Play in Q1 of 2018 to 32M in Q3 of 2022.

Note - Although Hinge isn't very strong outside the US, Tinder and Bumble are, so we're looking at global downloads and revenue and not just the US.

But as this field becomes hot again so is the competition. Tinder, Bumble, and Hinge might be the most popular, but the selection is growing. Apps like Fruitz (acquired by Bumble), The Right Stuff, and Fizz are some of the latest entrants trying to get a share of this market by having some unique value.

They join more than 15,000 apps that mention the word "dating" in their name or description. I fully expect more competitors to rise and more consolidation to occur as the bigs attempt to retain their position via M&As.

5. Paramount+'s Mobile Revenue Hit a New Peak

Streamer Paramount+ crossed a new milestone in September. The service, which launched in 2021, hit gross MRR of $20M.

The road to this milestone was long. Although it took Paramount+ only 5 months to hit $10M in gross MRR, doubling to $20M took 19 months, according to our estimates. Of that, Paramount gets to keep $14M as net revenue.

Most of the revenue, as you'd expect, is coming from the App Store. In September, Paramount's big month, the App Store brought in $11M in net revenue vs. $3M from Google Play. It's worth noting that 21% from Google Play is slightly higher than average.

It's also important to mention that Paramount+ is only available in the US, which limits its ability to monetize when compared to someone like HBO Max, the leader of the streamers, which earns that in about a week while being available globally.

Fun fact - HBO Max earns from Google Play just a tiny bit more than Paramount+, which is to say, there's still room for HBO Max to grow its revenue.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.