This Week in Apps - Streaming Shakeup

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Download Index (YTD)

Check out the full index, which was recently redesigned, for more countries and categories →

Insights

1. ChatGPT Breezes Past a Quarter Million Dollars Within Days of Launch

The official ChatGPT app rolled out last week and has been one of the most downloaded apps in the US, the only country it was available in, since it launched. It's currently sitting pretty at #3.

As funny as it may sound, ChatGPT is kind of late to the ChatGPT-on-mobile game, which is currently owned by apps like Genie and Ask AI. But a week in, it's showing signs of good healthy growth.

Let's start by looking at downloads:

In its first week on the App Store, ChatGPT made its way into 779K iPhones, according to our estimates. Since the first week was only the US and only the App Store there isn't really much to break down here.

Trend-wise, ChatGPT's downloads rose to a peak of 132K downloads on Saturday and fell a bit after, ending Wednesday with 95K downloads, according to our estimates.

A pretty standard launch trend overall.

Let's continue to revenue, where things get interesting.

In its first week on the App Store, ChatGPT already earned $347K of net revenue from its ChatGPT Plus in-app purchase. And that's net, meaning what OpenAI gets to keep after Apple takes its share.

Given the cost of the in-app purchase, we estimate that there are a little over 20K mobile subscribers as of Wednesday of this week.

If the trend continues, ChatGPT could do the same revenue as 3rd party competitors Genie and Ask AI by the end of its first 30 days.

Seeing these numbers strengthens my conclusion from last week's opinion segment - the next (successful) wave of AI apps using ChatGPT will add functionality on top.

FYI - ChatGPT is expanding beyond the US. This week OpenAI announced rollouts in 44 countries. I'll cover those as soon as we have a few days of data, so make sure you're subscribed to the newsletter.

2. Goodbye HBO, Hello Max - Big News For Streaming?

It's finally here.

A few months ago, HBO announced it will merge content from HBO Max and the recently-acquired Discovery Channel into a single app. I talked about why this makes sense a few weeks ago, but the gist is that more content in one app makes it easier to get downloads.

Max, the combo app, rolled out this week and did so in a way that confused a lot of folks.

Instead of renaming the HBO Max app, the new Max is a new app, and HBO Max was removed from the App Store and Google Play roughly 24 hours after Max launched.

Very confusing!

There's a lawyer out there who would guess it has something to do with streaming rights in and out of the US, but that lawyer isn't me so I'll move on.

Pulling HBO Max, which was one of the highest-earning apps in the US sounds like a massive headache because those users would have to resubscribe to Max to "keep" their subscription (aka. to keep paying HBO).

But would they? Or would they see this as an opportunity to drop a subscription they got for that one big movie and forgot to cancel?

In its first two days on the App Store, Max earned a total of $1.6M of net revenue, and that's after Apple's cut. For context, on an average day earlier in the week, HBO Max earned about $1.8M, and that's without the surge of users having to switch over.

So, maybe not everyone got the memo or is using HBO Max as much to switch right away. Two days aren't enough to know what'll happen, so we'll have to wait and see.

Two things to keep in mind are that HBO didn't rebrand. HBO Max did. Company vs. app. That's important. And also, Max is only available in the US right now while HBO Max is still available outside the US. It'll be interesting to see how that rollout impacts revenue when it happens.

3. Meta Sold GIPHY at a Huge Loss After Regulatory Pressure, But... Downloads Tell another Story

Are you into gifs? If so you must know Giphy, the search engine for gifs. A few short years ago Facebook's Meta bought Giphy, something most people don't realize and for a good reason - Meta didn't really do anything with it.

Meta finally decided it was time to let go and sold Giphy to Shutterstock this week. A new home where it could probably offer more value. That + the UK government really didn't want the original sale to go through...

What's interesting here is the price Meta paid and then received - interesting because they bought high and sold looooow.

Meta paid a whopping $315M for the engine and sold it for just $53M. And no, I didn't forget a 0.

Given where Giphy is going its not inconceivable that Giphy will disappear as a service and get bundled into Shutterstock's platform. Which begs the question - is Giphy even used anymore?

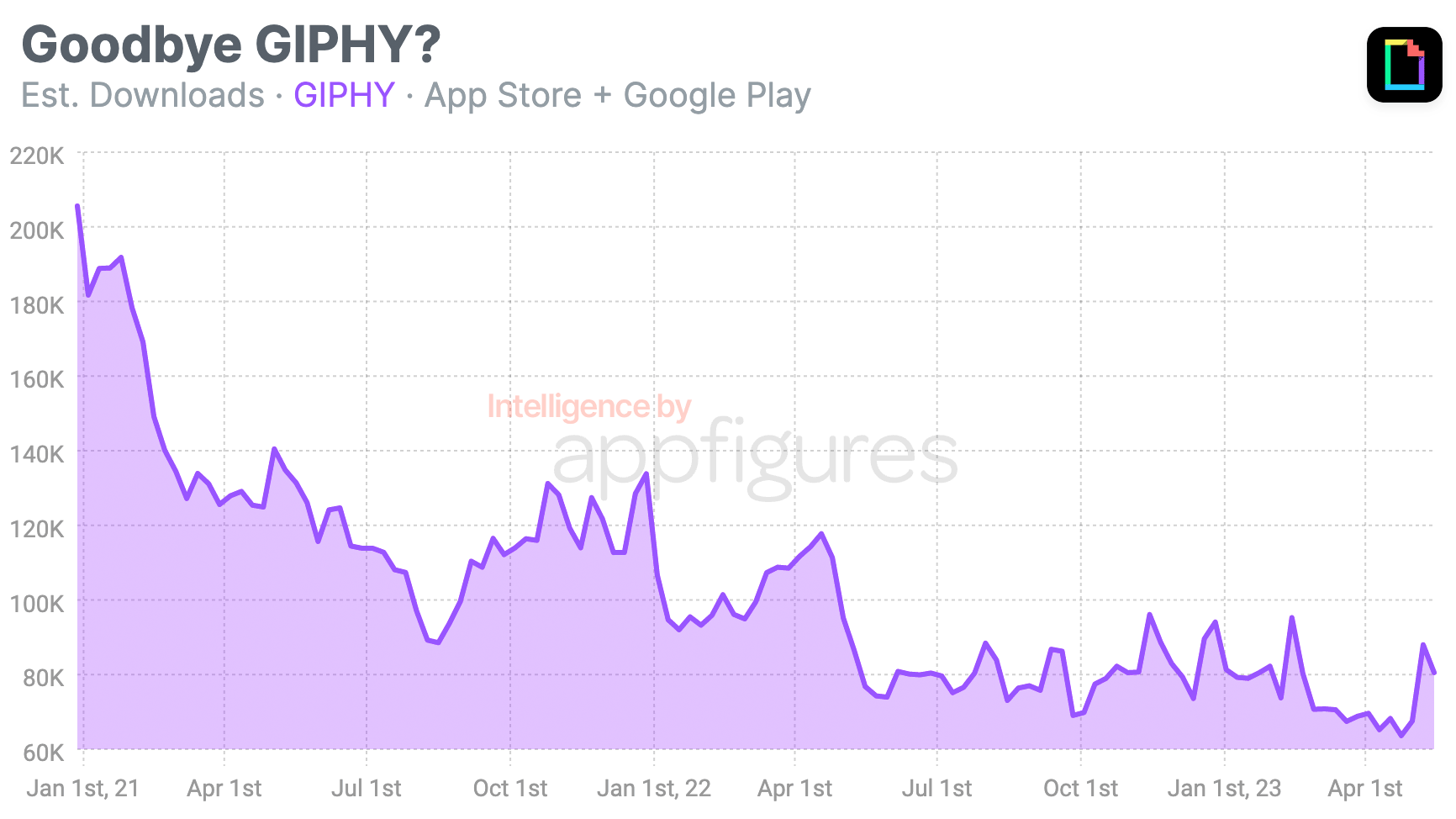

Looking at downloads the answer is no more than a grunt. Going back to 2021, Giphy saw roughly 200K downloads every week. That's while it was in Meta's hands. But that 200K dropped to 180K, and within a few weeks 160K, and by the end of 2021, Giphy was averaging around 110K downloads, according to our estimates.

2022 wasn't kind to Giphy either. Over the year, weekly downloads dropped to just 80K. And 2023 was even worse. Weekly downloads dropped to around 60K in April. That's a 70% drop.

To answer my question with words this time - Giphy is used but growth is completely gone and given another year or so it could drop so low it will be gone as well.

That's why Meta had to let it go, even at a huge loss.

And before you jump at me to say Giphy is already integrated into a bunch of services like Slack so the app isn't a true proxy - I know, but when you look at the trend and consider the drop, I think it's safe to say it does.

This acquisition was less likely a product one and more likely a content one. Shutterstock, a stock photography and art company, is likely looking to cement its place as the owner of proprietary data that can be used to train AI.

That's a lot of money of a dataset, but the future of AI depends on training sets, and will be less about the models and more about the data use to train them, so in the long term this isn't a bad bet.

Also, expect an AI gif generator coming soon. It'll probably take the fun away from gifs, but let's see.

4. Peloton is (Finally) Going All-In on Mobile Fitness

Peloton has been trying to highlight and monetize its in-app content for a while now. That should help the company weather a market that's no longer as interested in hyper-expensive workout bikes as it was during lockdown.

And strategically, it's a great move that can easily be backed up by data, or rather revenue, lots and lots of mobile revenue coming from fitness apps!

This week, Peloton took another step towards splitting its fitness content from its hardware by introducing new subscription tiers that are only for content, no bike required.

The real question I have isn't "why?" but rather "why so late???"

Downloads of Peloton's app rose drastically early into the pandemic hitting an all-time high in April, where the app made its way into 430K iPhones and Android devices, according to our estimates.

That was back when the app was hardware-first and content kind of second, so it wasn't really monetizing those users. But downloads are good for later, which was the case here.

Downloads dropped after the peak because the app didn't have that much to offer to non bike owners, but all of 2020 was massive in terms of downloads, averaging more than 250K downloads every month. About 5x the downloads of 2019.

2021 is when troubles started brewing and downloads dropped, but at the same time the app started getting more content and revenue started rising.

So, downloads were on the decline and revenue was on the rise. Fast forward to 2023 and both are now on the decline or just keeping up.

Daily downloads for Peloton have dropped significantly since 2022. Peloton started the year with around 8K daily downloads and ended April with just 2.5K, according to our estimates. But news of the new tiers spread fast, and so far downloads are up significantly -- 6K on Wednesday.

Revenue is moving a bit differently.

Peloton started 2022 with a little over $3.7M of net revenue from the App Store in January. Net meaning after Apple takes its cut. They rose to $4.5M in April of 2022, but by November dropped to under $2.5M.

It recovered a bit in 2023 ending April with $3.7M, but overall the trend is barely growing, and that's on a good day.

All of this makes sense. Overall, Peloton is still a hardware company in most minds. Which is a shame because they create so much content! This new push could be what changes those minds and could set Peloton up for big success in the fitness space. But!

There is a but... I don't think Peloton can do it with its flagship app. It needs a new app that's focused on fitness and nothing else. Focusing the flagship app won't have the same impact. It has to be something else.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

5. Shopping is Becoming Political - PublicSq. Takes Over the App Store

Before I dive into the next one I have to put a disclaimer that this isn't about the politics behind this app and is only about the numbers. I'm sure some of you will still write to complain about my position, from both sides, but again, this is just about the numbers.

With that out of the way, let's talk about PublicSq. Don't know the name? I didn't either until I saw it rising to the top of the App Store!

To get you up to speed, PublicSq is a shopping directory that only includes businesses that follow Pro-Life, Pro-Family, and Pro-Freedom values.

In the last 30 days, downloads of the fairly new app have been on the rise. They were getting 1K downloads in late April, double by early May, and triple about a week later.

According to our App intelligence, this week saw the biggest growth to date as downloads ballooned to more than 43K on Wednesday, the highest they've ever been!

The app has since risen in rank and is now the 4th most downloaded app in the US App Store, which means that number will more than double.

Since launch, the app was downloaded 735K times across the App Store and Google Play, according to our estimates, and given this new popularity will cross a million downloads in a week or so.

Driving this seemingly instant growth is a battle between conservatives and progressives over marketing campaigns from Bud Light that aimed to target both sides but caused a boycott and backlash from both sides.

We time and time again see the impact politics has on apps. A good reminder for how fundamental the App Store and Google Play are for daily lives that they can be politicized.

Tidbits

- 13,091 new apps and games were released this week, 16% are games. 57% of the new apps went to the App Store and the rest Google Play.

- Character.ai, a new AI app, launched this week and rose to the top of the charts.

- 61,575 iOS apps use App Tracking Transparency (ATT) right now but only 9,379 are games. 84 get > 1M downloads monthly.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.