This Week in Apps - Flutter vs. React Native

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Is Threads Still a Threat to X - Here are the Numbers

After being the most downloaded app in the App Store and Google Play for several days and breaking download records, Threads, Meta's Twitter (now X) competitor, is now back to normal download numbers.

It dipped right after peaking, but has since stabilized and is now seeing the kind of downloads you'd expect from a new social media app.

Now that the hype is mostly over, how do Threads' downloads compare with X?

According to our estimates, Threads saw 32M new downloads since the beginning of August. The split between the App Store and Google Play was pretty even which usually means the app is being pushed hard across both - and that makes a lot of sense.

Threads came out of its dip after about a week, going from being ranked #32 in the US App Store to #2 within a few hours.

How's X compare? Well...

Twitter's big "rebrand" at the end of July really hurt its discovery which resulted in a big drop in downloads, especially from Google Play. I looked at Twitter's discovery problem back in August.

In terms of downloads, X is getting a little more than half the downloads Twitter saw, and I don't think it has anything to do with Threads or any other social platform. X just doesn't have the brand recognition of Twitter.

Since the beginning of August, X saw 15M new downloads from the App Store and Google Play, according to our estimates. And that includes downloads of Twitter Lite which is available in India. That's roughly half that of Threads for the same period.

Threads is in its infancy so outpacing other social platforms is expected, especially given Meta's user base, so that isn't necessarily a concern for Elon and co, but...

Social platforms have a big lock-in. It's why after more than a decade of using Twitter I can't simply switch to Threads. I know some will, but most won't.

Between X's unrecognized brand and Meta's massive push, this could mean bad news for long-term growth. But X has something Threads doesn't - a mature platform, feature-wise, and a monetary reward system for motivated users. Threads doesn't.

It's hard to tell who will win, but looking at the last couple of decades, one has to win. Who do you think it'll be?

2. More App Developers Are Choosing Flutter Over React Native in 2023

The rivalry between Google's Flutter and Meta's React Native has been going on for quite a few years. Both come with a steep learning curve (in my experience) and offer different approaches to building non-native apps and games.

Building a non-native app offers the benefit of not being locked to the platform's framework and language and being able to deploy the app to multiple platforms more easily. It comes at a cost that's more visible in some apps than others - user experience.

I used our SDK Intelligence, where we scan every iOS and Android app and game to see what powers it, to see who's using Flutter and React Native, and how many apps and games started using them every month. Methodology and disclaimers towards the end.

According to the data, Flutter is currently leading in terms of new installs. We count an install when a new app is launched with the SDK or an existing app that wasn't using it before, starts using it.

Between January and July of 2023, 61K apps started using Flutter. In the same period, 32K apps started using React Native.

With a few exceptions, every month twice as many apps start using Flutter over React Native. This trend has been fairly consistent for most of the year.

Also interesting is who's using those. When filtering all apps using Flutter or React Native by the number of downloads, React Native beats Flutter. 704 apps using React Native get more than 100,000 monthly downloads while the number for Flutter is 546. The numbers get close when changing the filter to 1M downloads, where React Native has 60 and Flutter 49.

This race is more than close, and Flutter seems to be a frontrunner.

SDK Scanning Methodology & Disclaimers

Our SDK analysis process compares a human-created fingerprint for every SDK against an app's code. The scanner looks at free apps available for download in the US.

You can see which SDKs your competitors are using with App Intelligence and also find all apps using a particular SDK in Explorer.

3. CapCut, TikTok's Video Editor, is About to Dethrone the Incumbent

When CapCut launched a standalone video editor app it was clear it'd rise to the top and dethrone incumbents that have enjoyed dominance in the rather focused niche earning millions of dollars for over a decade.

A free app competing with freemium/subscription apps is no challenge, but now that CapCut started charging we can quantify its success and the success it's taking away from its competition - in dollars.

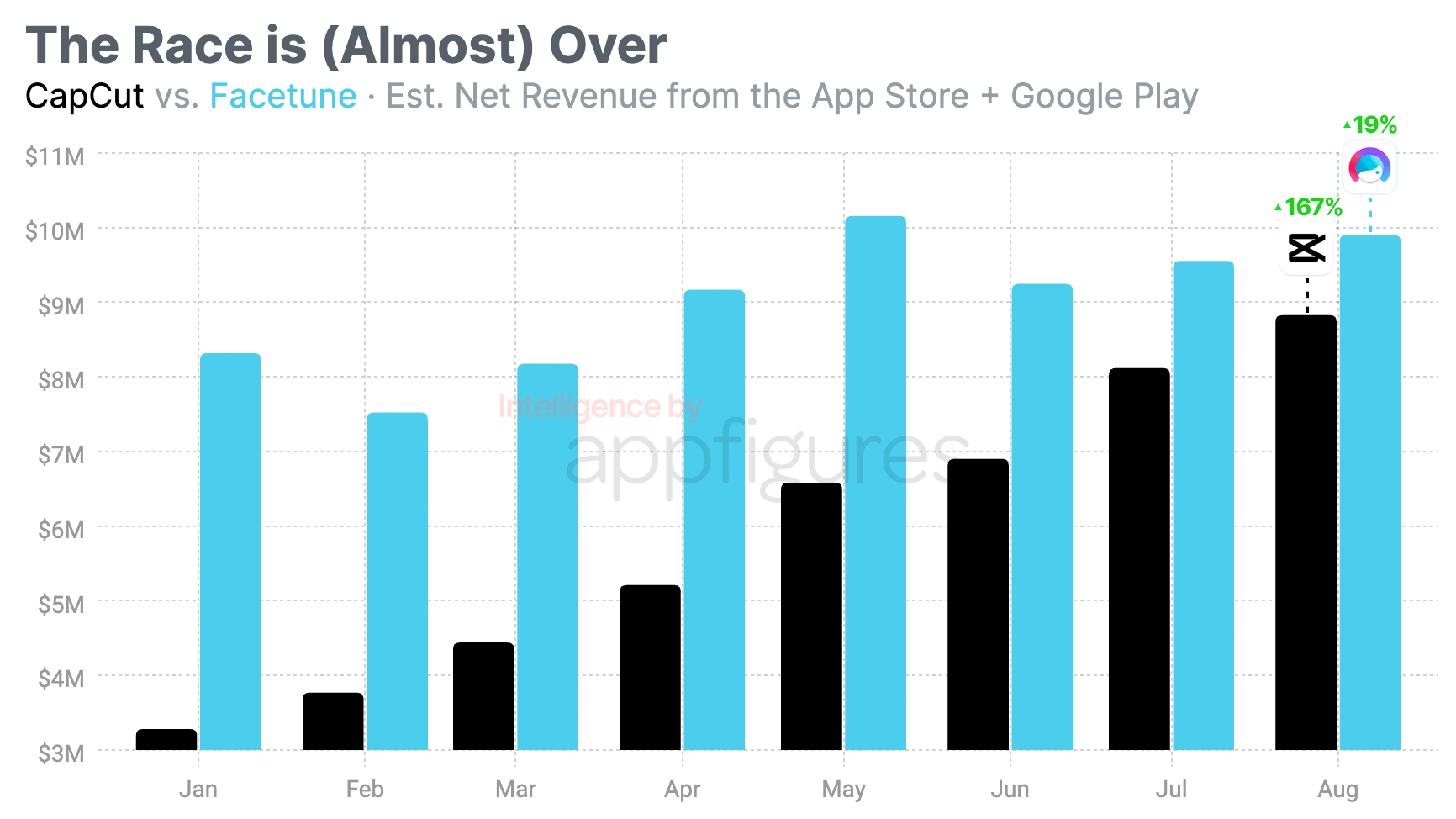

To give context to CapCut's revenue growth I'm going to compare it to one of the longest-running incumbents in the space - Facetune, which also happens to be the highest-earning competitor in the US.

CapCut kicked off 2023 with 3.3M of net revenue from the App Store and Google Play in January, according to our estimates. Facetune saw $8.3M of net revenue in January. Quite a big lead.

By May, CapCut was already at $6.6M! Facetune also saw some growth, earning $10.2M - and that's all net which means what the publishers get to keep after giving Apple and Google their share.

May was Facetune's highest month of revenue this year. In August, Facetune earned $9.9M while CapCut's revenue grew a whopping 33% from May giving CapCut $8.8M in net revenue, according to our estimates.

That big lead from January is now almost all gone. At this growth rate, CapCut will outpace Facetune within a month.

Since January, CapCut's revenue grew 166%. I don't see any reason for it to end, and that's a big problem for the incumbents. The kind that's fought and won with innovation and big ad campaigns.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Is Candy Crush Running Out of Steam?

Candy Crush is undoubtedly one of the most famous mobile games ever in existence. Every mom has heard of it and many even have it on their iPads. It's that well-known.

All the popularity means the casual title that rolled out 11 years ago is making a lot of money. Since 2020, Candy Crush's revenue has been on the rise, but 2023 has been a much more challenging year for the game.

In the last five months, revenue has been dropping month after month. That's a trend Candy Crush hasn't seen even once since 2020.

I analyzed the title's month-over-month growth and looking at the trend, it's very clear revenue has been growing consistently for years! The longest stretch of consistent month-over-month revenue drop was three months, all the way back in 2023, right when Covid hit and most countries went into lockdown. So, that's understandable.

Almost every stretch we look at since is green, meaning revenue has been growing.

In the last 5 months, between April and August, it's all red. Our estimates show that net revenue dropped from $99.5M in April to $69M in August. And that's all net, which means what King gets to keep after giving Apple and Google their fees. I expected the opposite during the summer.

Candy Crush has been a staple in the most downloaded and highest-earning apps and games series we publish monthly, and the drop has already been noticed.

It's amazing to see a title succeed for so long, so I understand and expect revenue to eventually drop. I wonder if this is the beginning of the end or if it's just a temporary dip.

Opinion

5. This Trend Has to Stop - Why Lapse is Doomed to Fail

A new app has managed to claim the #1 spot on the App Store this week.

Many apps managed to do that this year, so what's different about Lapse? Well, not much...

But there is an interesting trend I see here that's worth taking a closer look at. If only to protect unaware investors...

Lapse turns your phone into a disposable camera that can take a limited number of pictures and share them with your friends. In the last few days, the iOS-only app rose to the top of the US App Store.

According to our App Intelligence, Lapse got 176K new downloads on Thursday, the highest number of downloads for the app which averaged just 50 daily downloads earlier in the year. Since launching last summer, Lapse saw 1.2M downloads - most of which came in the last few days.

If you're thinking, "this isn't the first time an app has done that", you'd be 100% right! You probably can't remember which because they all came and went very quickly.

BeReal was the breakout success that paved the way for photo apps that do less. It went viral last year and has managed to make its way into nearly 100M phones, according to our estimates. But its popularity faded fairly quickly as well.

BeReal never managed to monetize, directly or through ads, so all of those downloads and users are enjoying server time sponsored by BeReal's investors. Will those investors get their money back? Maaaaaybe. Probably not.

Poparazzi and Dispo are a couple of other names that tried to do something similar, rose to the top for a brief moment, and then disappeared.

Can you guess where they're now?

Poparazzi was removed from the App Store after daily downloads dropped into the single digits. It raised $15M according to Crunchbase. Dispo has lost most of its momentum and is getting about 800 downloads per day. It raised $24M according to Crunchbase.

Other than the two doing something similar enough to Lapse they also share one more (very bad, in my opinion) trait with Laspe - all three are iOS-only.

For a social network, or really any app that allows you to do something with your friends, being iOS-only is a huge hurdle. This is arguably the reason why Clubhouse lost its shot at social platform glory.

According to Crunchbase, Lapse raised $12.3 from 16 investors, including Google. Sure, Google could lose every penny it put into it and not even realize, but what about the other 15 investors that wanted to ride Google's coattails? I doubt they're getting anything.

I'm not trying to discourage people with ideas, but replicating failure without making any changes is a great money oven. Do your research first, please.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.