This Week in Apps - AI Is Everywhere

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. The Battle for AI Supremacy - The Most Downloaded Apps in November

I crunched the numbers and ranked the most downloaded mobile apps in the world. November's ranks didn't change who's on top, but did put more distance between the leaders and everyone else.

Can you guess what I'm talking about?

AI...

ChatGPT was once again the most downloaded app worldwide, reaching 45M new downloads across the App Store and Google Play, according to our estimates. It ranked #1 on Google Play with 36M downloads and #2 on the App Store with 10M, making it one of the few apps dominating both stores at the same time.

And ChatGPT wasn't alone at the top. AI rival Gemini also made the cut again, earning the #4 spot with 31M estimated downloads. What's interesting to see is that Gemini was the #1 app in the App Store in November, ahead of ChatGPT by a few downloads.

The rivalry is clear, and it's why OpenAI just released an update to ChatGPT Images, which takes on Gemini's Nano Banana directly. So far, OpenAI hasn't been able to match Google's creative abilities, but I don't expect them to stop trying.

TikTok, Instagram, and Facebook round out the top 5 in November with minimal movement. TikTok stayed at #2 with 37M estimated downloads, while Instagram climbed to #3 with 35M estimated downloads. Facebook followed with 27M estimated downloads, mostly coming from India - a trend that isn't new anymore.

It's clear that AI is here to stay, at the top, having overtaken the old guard. ChatGPT has the brand, and Google has the reach, but at some point, they will stop subsidizing subscriptions, and the cost will skyrocket (just like streaming apps and Uber).

I think the evolution will be AI making its way into more apps. Those who use it well will rise to the top. Not because they "have AI" but because they have a better user experience.

According to Appfigures Intelligence, the top 10 most downloaded apps saw 277M combined downloads in November, a smidge higher than October's total.

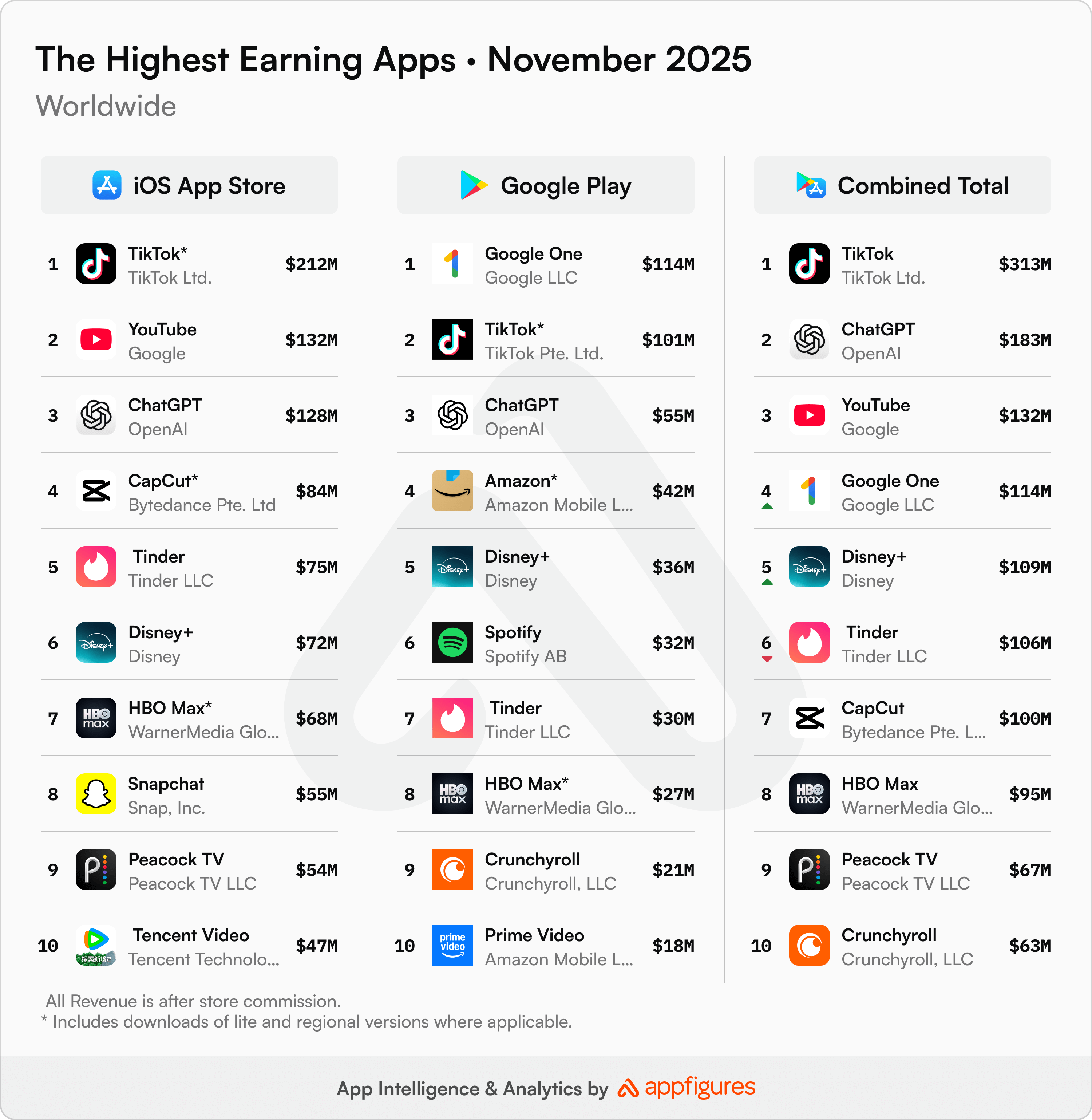

2. Oh So Sticky! The Highest Earning Apps in November

November was an interesting month in terms of earnings. Almost unique. It's not because a new name came out of nowhere to take the lead, nor is it an incumbent continuing mega growth.

Almost everything stayed still, and that consistency is interesting.

Of the 30 positions we rank (10 per store and 10 combined), only one app moved and caused two others to move too. Just three movements in the entire month. That's not common.

It wasn't TikTok that moved. TikTok remained the world's highest earner, raking in $313M in after-fee revenue from the App Store and Google Play, according to Appfigures Intelligence. TikTok's revenue is so ahead of the rest that I don't expect it to lose its #1 rank any time soon, but there's one app that will likely be challenging it later in 2026.

ChatGPT brought in an estimated $183M in after-fee revenue in November to claim the second spot. The gap between it and the #3 rank is so big that I expect it to retain its rank for a while.

YouTube, in #3, brought in an estimated $132M in after-fee revenue which is very close to its average monthly haul. I don't think it'll challenge ChatGPT for second place unless subscription prices go up abruptly in the new year.

Google One and Disney+ round out the top 5 highest earners in the world, both notched one spot up this month vs. October, thanks to Tinder's in-app revenue dropping as the dating king attempts to push users away from in-app purchases.

The degraded experience of web payments looked worth it for a while, but now that Apple can legally charge a fee for that, I don't know if it'll continue to be as lucrative.

All other apps - across both stores and the rest of the overall list - remained where they were in October, showing that the top is still very sticky. Very, very sticky.

Our App Intelligence shows that together, the top earners saw $1.3B after fees from the App Store and Google Play, pretty much the same as October, and about 30% higher than last November.

See Appfigures In Action

Better intelligence to beat the competition faster!

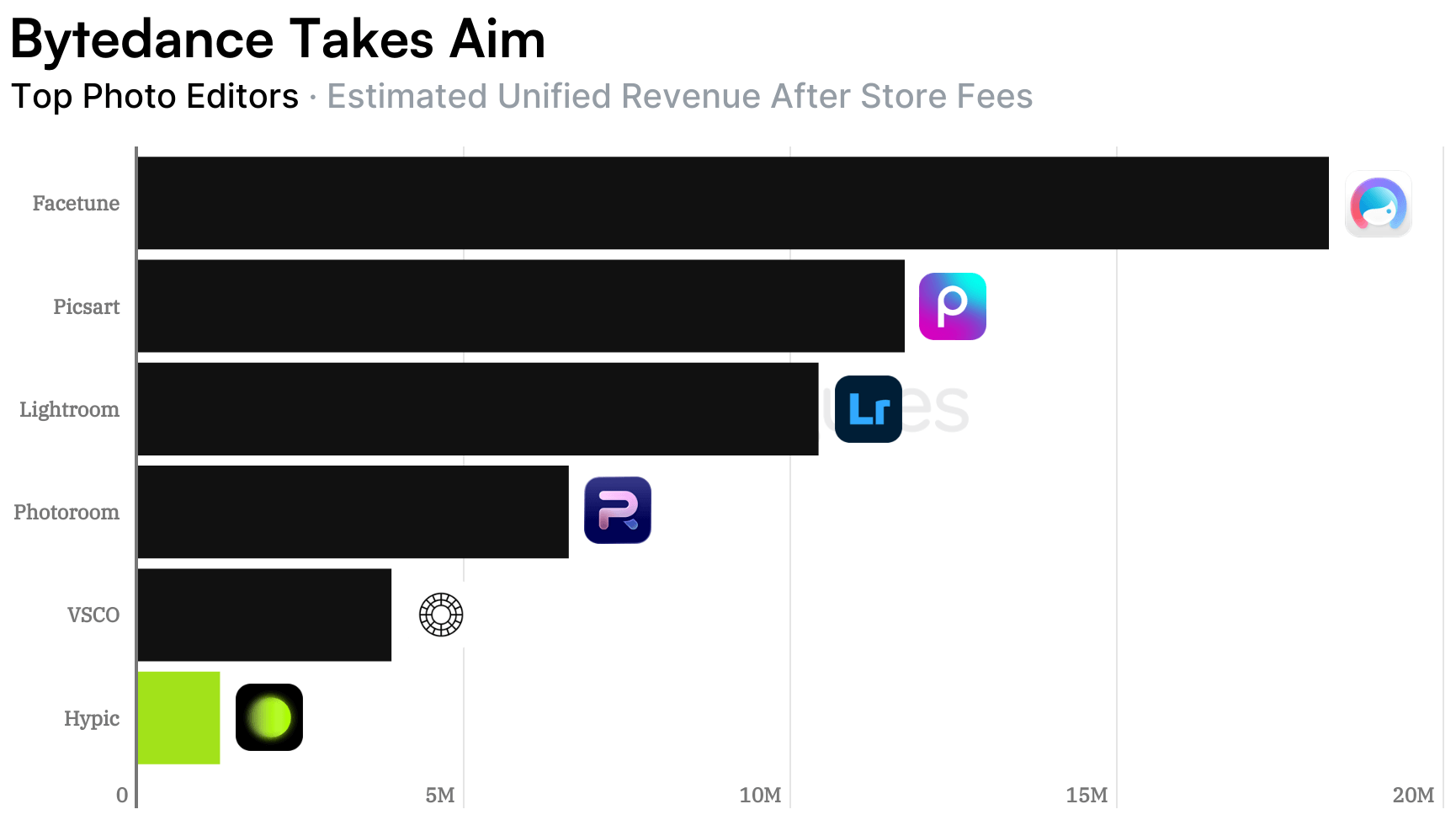

3. ByteDance's Hypic Is Coming for the Photo Editing Market

By now, everyone knows about CapCut, the video editing app from TikTok's parent company, ByteDance, that became the leader in its category and one of the highest-earning apps in the world.

But, ByteDance has another app that's been around for a while, but this year grew exponentially, threatening yet another adjacent niche - a photo editor called Hypic

Hypic was released at the end of 2022 and its downloads rose very quickly, hitting 4M in July of 2023, according to our App Intelligence. Downloads dipped from that peak for the rest of the year, but Hypic still managed to get 19M estimated downloads in 2023.

2024 was much more consistent with 37M estimated downloads, and 2025 is even bigger with an expected 44M estimated downloads.

The majority of those downloads came from Google Play, where Indonesia and Vietnam are the top markets. The US ranks second on the App Store behind Vietnam and 11th on Google Play.

That's good news for Hypic, which is currently #12 in the US App Store. It means there's a lot of growth to be had. But it's also very bad news for popular photo editors like Facetune, Picsart, Photoroom, VSCO, and Lightroom - all of which make multiple millions every month.

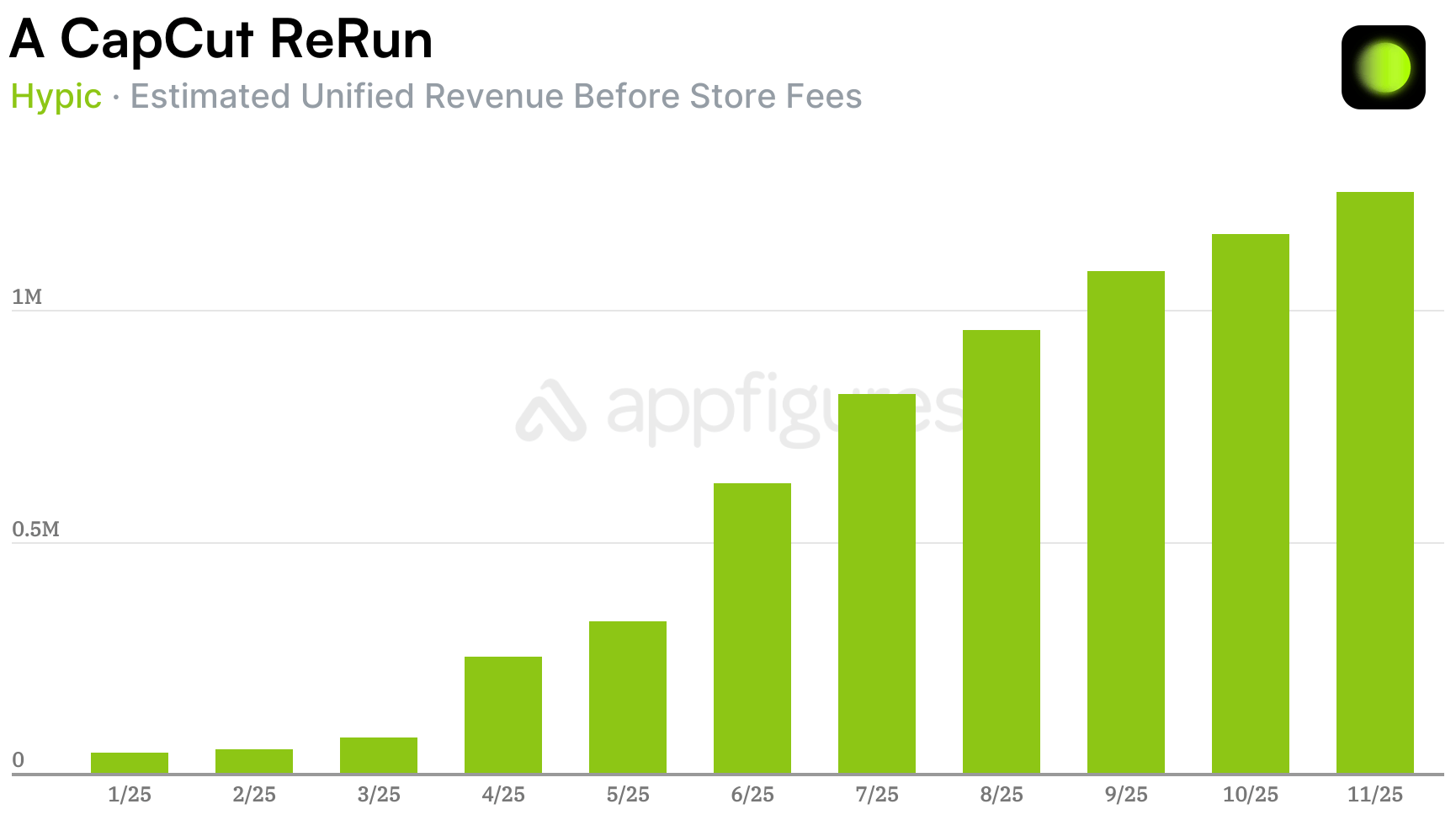

For a long time, Hypic wasn't monetized, which is what led to all those downloads. But just like CapCut, ByteDance eventually started monetizing, and users don't seem to mind.

Are Users Paying?

Our estimates show that consumer spending in the app started rising quickly in 2025, going from under $100K to $250K in April, to just a tad bit under $1M in August, to $1M+ ever since. November was Hypic's best month of revenue with $1.3m of pre-fee revenue.

Summed up, our estimates put Hypic's pre-fee revenue at $6.7M for the year (not including December).

Compared to the competitors I mentioned before, Hypic is the smallest. VSCO, the closest competitor in terms of revenue, is more than 3x larger.

But considering how fast Hypic got to $1M/mo, TikTok's scale, and CapCut's history, I think all competitors should be concerned, and the smart ones will need to get even more competitive.

The real question is, how quickly will Hypic take over the US? I'm going to keep an eye on that.

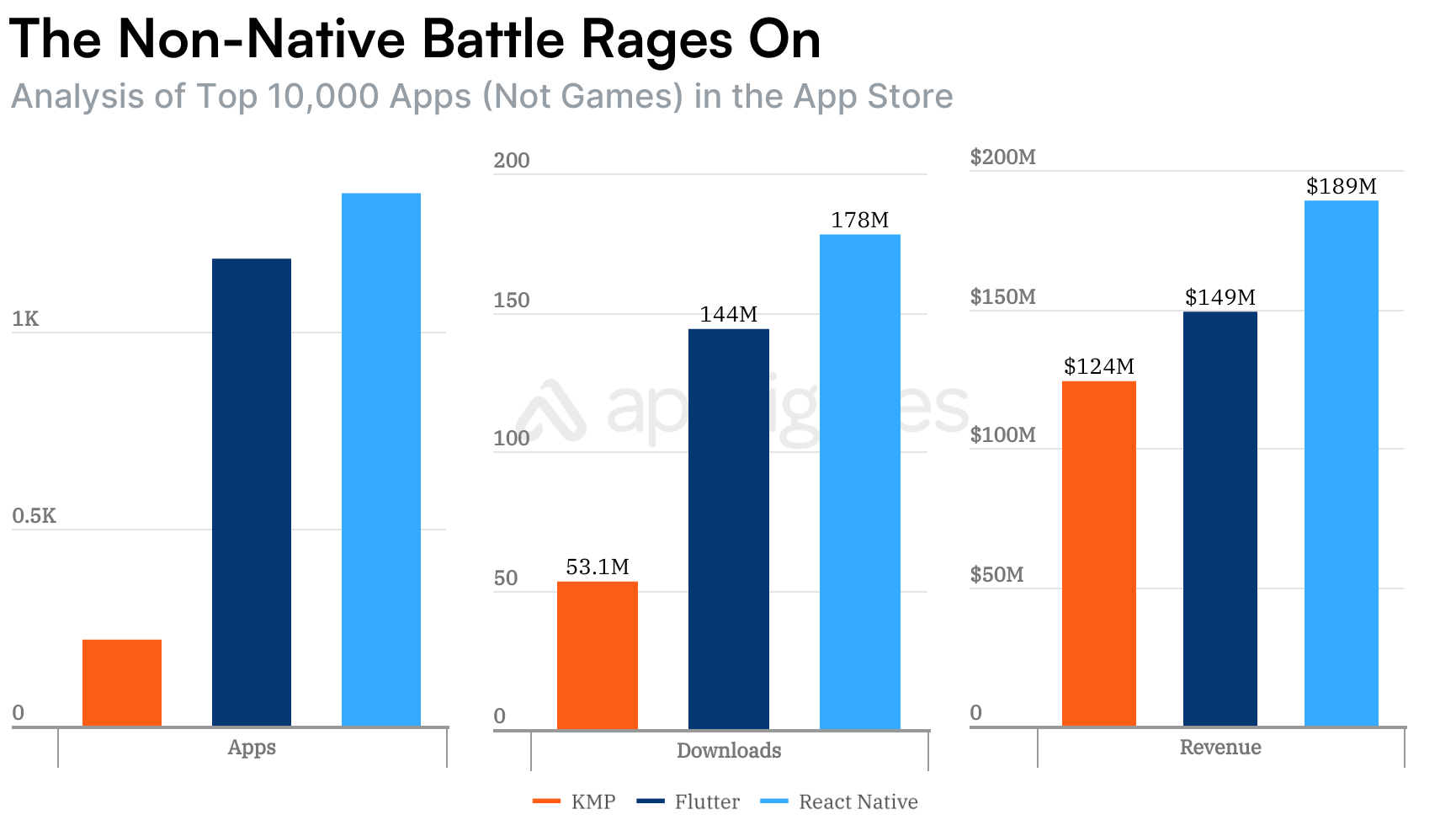

4. React Native's New Rival Is Quietly Eating Its Lunch

I keep writing about AI because it's pretty much everywhere at this point, so let me look at something else that's also interesting - non-native app development on the App Store.

React Native and Flutter have become the de facto standard for non-native app development (not games), but there's a new kid on the block: Kotlin Multiplatform.

Maybe not that new, but new enough.

Kotlin Multiplatform (KMP) was announced all the way back in 2017, but didn't really reach production until late 2023. Two years in, has KMP made it into the mainstream?

I analyzed the top 10,000 apps (not games) on the App Store to answer that question, but before I can do that, I have to give you a number that might surprise (or delight) you: 7%.

That's the share of iOS apps, not including games, that use React Native (RN) or Flutter and are available on the App Store.

With that in mind, let's see how KMP stacks against those two. To keep things serious, I'm going to focus on the top 10,000 apps (not games) by monthly downloads.

Based on data from Appfigures Explorer, 1,350 of the top 10,000 use RN, 1,184 use Flutter, and 218 use KMP. There's a big gap in usage, but what KMP lacks in numbers it makes up for in performance.

FYI - "using" a framework means having it in the app's bundle and not necessarily building the entire app with it.

Together, the three frameworks were responsible for 375M estimated downloads last month. Apps using RN accounted for 47% of those downloads, while Flutter accounted for 38%, and KMP accounted for 14%. RN's dominance is hard to beat, but low double-digits is a great place to be. And when we look at revenue, things look even more interesting.

Apps using these frameworks earned $462M after fees, according to Appfigures Intelligence, and while RN was still the dominant framework, the distribution is a bit different. Apps with RN accounted for 41% of that total, while Flutter accounted for 32% and KMP for a surprising 27%.

KMP still has a long way to grow to get to RN or Flutter adoption levels, but if we zoom out, it's clear that non-native development on the App Store is growing.

Which is your favorite?

P.S. - We started tracking Swift for Android, so if/when it takes off, I'll let you know. Don't hold your breath, though.

Ready to Beat the Competition?

Appfigures has the intelligence you need

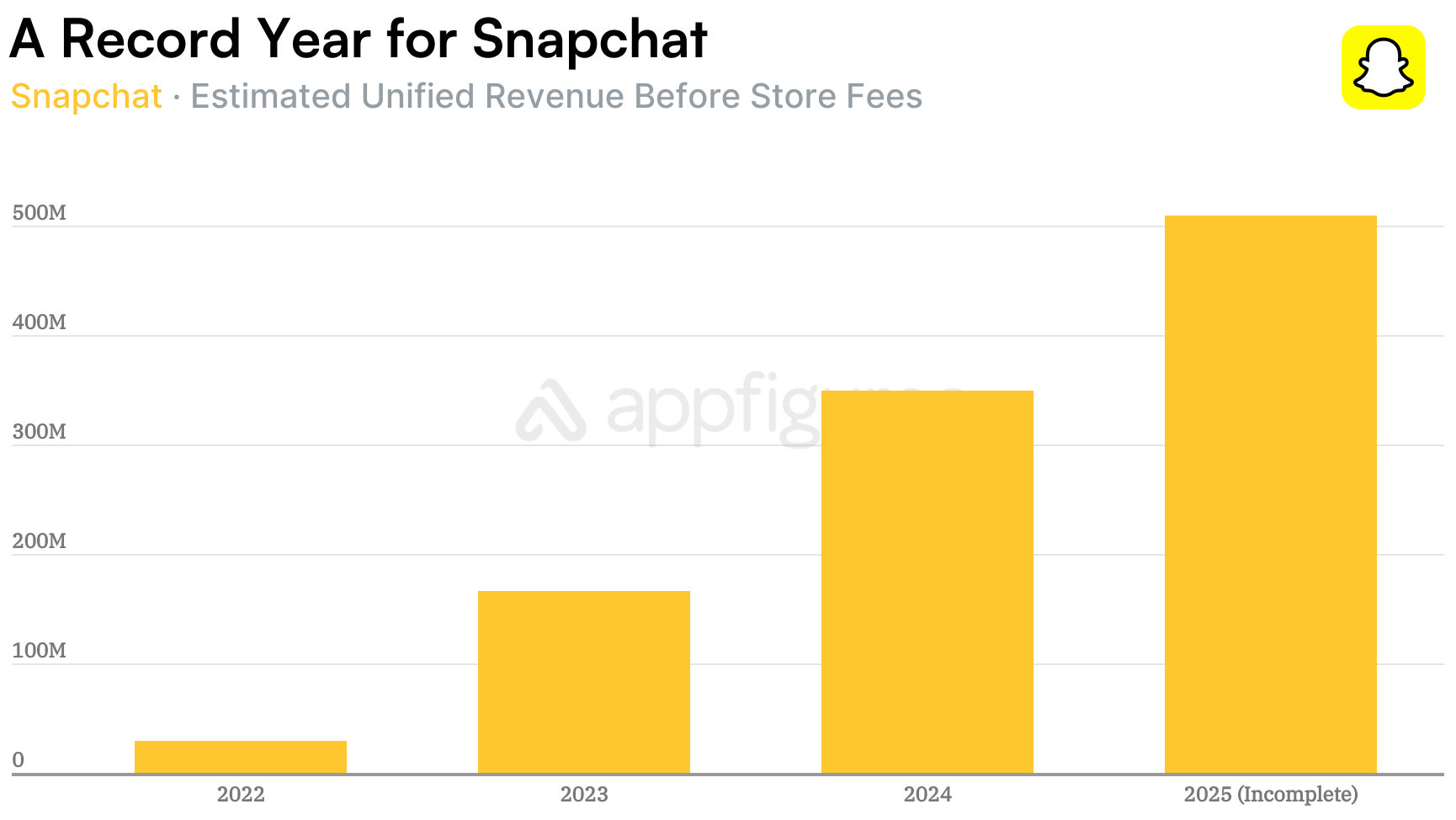

5. Snapchat Cracked the Code: How It's Making More With Fewer Users

Looking at Snapchat's revenue trend, it's very clear something snapped (pun intended), and Snap really figured out monetization in 2025, sending its revenue soaring even though downloads declined.

I've been following Snapchat's revenue ever since it started monetizing its then-free user base. It took some time for things to align, but once Snap started making money, the trend was almost consistently up and to the right.

It moved even faster this year!

Snapchat ended November with $62M of after-fee revenue, according to our App Intelligence, a whopping 63% higher than January's revenue. And that's not all.

Between January and November, our estimates show Snapchat earned $552M from the App Store and Google Play after store fees. That's 58% higher than all of 2024 and more than 2023 and 2024 combined.

Downloads, on the other hand, dropped to 16M in November, down 30% from January, according to our estimates.

Clearly, something's working with Snapchat's monetization.

When Snapchat started charging a subscription, I hypothesized that revenue growth would correlate with the release of features users actually want. It's not that big a stretch, and this year, Snapchat did a lot of that with AI and AR.

But they didn't stop at features, they also released a new subscription called Lens+ that unlocks more of the AR and AI features users already like - and it worked.

Revenue rose faster in 2025 than in any other year, and as a result, Snapchat's after-fee revenue since the introduction of subscriptions has now crossed $1B.

While other social media platforms are still looking for the right feature mix, Snap figured it out and is heading into 2026 with momentum.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.