This Week in Apps - A New Kind of Bet

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Polymarket's Downloads Explode as Wall Street Bets $2B on Prediction Markets

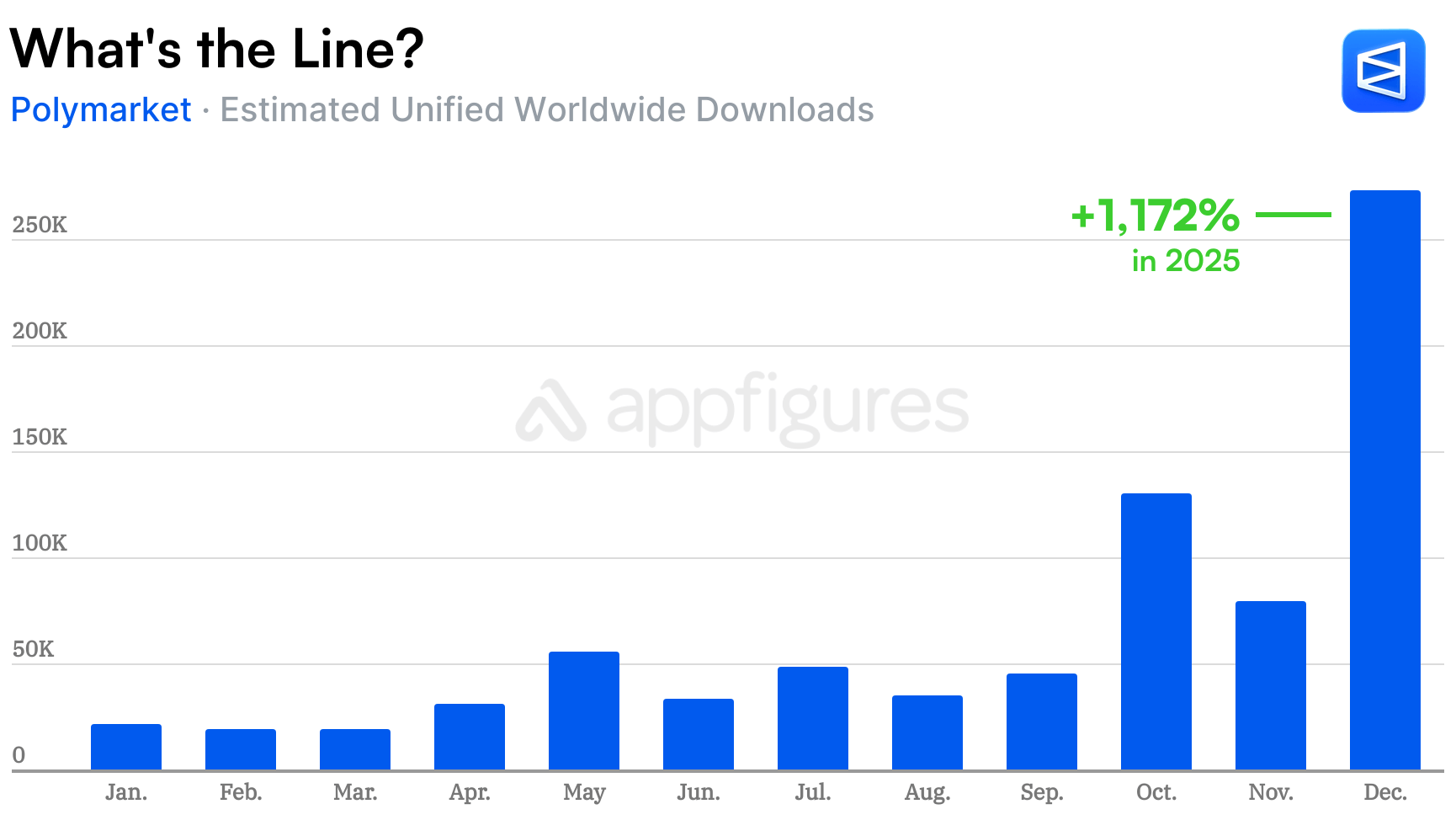

Wall Street doesn't use polls anymore - it's watching where people put their money. And right now, they're watching Polymarket, a betting platform that just saw downloads surge 1,172% after gaining US regulatory approval.

The platform lets users bet on anything, from elections to geopolitics to financial markets and even the App Store, and those bets have become signals for what's coming. In 2025, as uncertainty dominated everything from the stock market to AI and global politics, Polymarket became the place where people put real money behind their predictions.

Polymarket started as a crypto-based betting platform in 2020. After running into regulatory trouble and getting fined by the Commodity Futures Trading Commission (CFTC), it shut down US betting.

But when it relaunched in October 2024, demand was immediate.

Our estimates show that Polymarket's release led to 600K downloads between October and December of 2024, most of which came from the US and likely due to the many bets placed on the US elections. That ended fairly quickly, but demand was still there. According to Appfigures Intelligence, Polymarket saw 20K - 30K downloads/mo for much of the year.

Geopolitics and financial markets drove demand up again at the end of 2025, but then something significant happened.

In October, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced a $2 billion investment in Polymarket, valuing the platform at $9 billion. The deal wasn't just about money - ICE would become a global distributor of Polymarket's event-driven data, turning betting trends into sentiment indicators for Wall Street.

Traditional finance took a bit bet on prediction markets.

To actually re-enter the US market, Polymarket needed more than investor confidence. Polymarket needed regulatory approval, which is got by acquiring QCEX, a CFTC-licensed derivatives exchange and clearinghouse, for $112 million. That acquisition, combined with CFTC approval in November, gave Polymarket what it had been missing since its 2022 ban: the legal foundation to operate in the US with real money (fiat, as some might call it). A year of uncertainty and people using bets on the platform as signals + Wall Street validation + regulatory approval meant downloads were coming. And they did.

Our estimates show Polymarket was downloaded 273K times in December, up 1,172% compared to January and a total of 1.4M times since its release in October 2024. Wall Street's $2 billion bet and regulatory approval were paying off in downloads.

It wasn't a big ad campaign or a viral tiktok that drove these downloads but rather reality, and that means this trend will only get stronger for Polymarket.

There's a small twist that's helped momentum, too. Polymarket is using a phased release, so you can't just sign up and start betting right away. Instead, signing up places you on a waitlist and asks you to share your link to advance. That's a tried and true strategy used by many popular apps to generate hype.

And it's working.

But Not Without Competition

The "bet on everything" niche is small but does have competition.

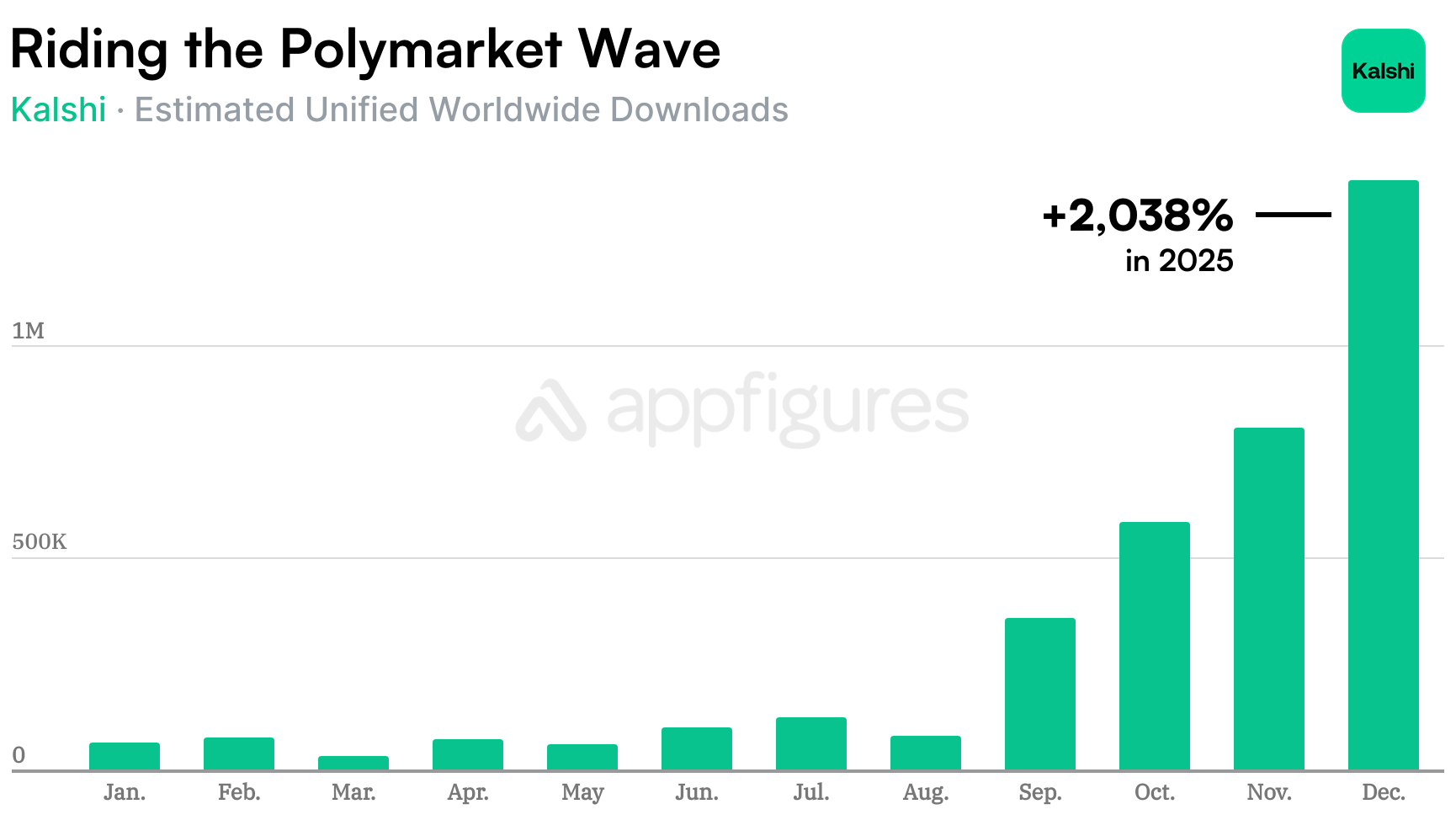

Kalshi is Polymarket's main competitor and it's been approved in the US since the summer of 2024 giving it a massive leg up, however, it didn't gain as much popularity by those looking at bets as a signal as much as Polymarket.

It did get more downloads, 3.7M in 2025 according to our estimates, but looking at the trend, it's clear the popularity of Polymarket is also spilling over to Kalshi, likely because it was available for US users ahead of Polymarket.

That may slow down now that Polymarket is legal in the US, and solidifies my prediction that downloads will grow significantly in 2026. I'll keep watching this trend as it evolves.

P.S. - I'm #617,769 on the waiting list. If you have an invite code you can spare please send it my way.

2. Downloads Down, Revenue Up - The State of Mobile Apps in December 2025

I crunched the numbers and ranked the most downloaded and highest earning apps in December, and while you'd expect the holiday month to deliver across the board, the results tell a more nuanced story about where the mobile app economy is headed.

AI Dominance and the Download Decline

ChatGPT was the most downloaded app in the world in December, pulling in 49.6M downloads globally across the App Store and Google Play, according to our estimates. That's a commanding lead driven largely by Android's 37.4M downloads as ChatGPT continues converting curious users into regular ones.

TikTok came in second with 41.9M downloads. Still massive, but the gap between it and ChatGPT is growing. Instagram rounded out the top three with 40.2M downloads, showing Meta's flagship photo app remains a force even as newer platforms compete for attention.

Google Gemini and Facebook complete the top five. Gemini's 35.7M downloads show Google is making real progress in the AI assistant race, even if it's still trailing ChatGPT by a significant margin.

What's notable here isn't just who won, but the overall trend. Together, the top 10 most downloaded apps brought in 320M downloads in December. Compare that to 327M in December 2024, and you're looking at a 2% decline year-over-year.

That might seem small, but it's the continuation of a trend we've been tracking. November 2025 saw 277M downloads versus 338M in November 2024 - a much steeper drop. December's numbers suggest the decline is real, but the holiday surge softened the blow.

Breaking into the top 10 is harder than ever. But remember, this is just the top 10 - the opportunity for developers is in niche categories and tools that solve specific problems really well. The shift now is toward engagement and monetization, not just user acquisition.

Revenue Told a Different Story

While downloads declined, revenue surged.

TikTok was the highest earning app in December, raking in $284M of net revenue after store fees from the App Store and Google Play according to our estimates. That's an astronomical number that demonstrates just how effectively ByteDance has monetized its user base, but also 9% lower than November. I wonder if that has anything to do with its US ownership changing.

ChatGPT came in second with $229M in net revenue, an impressive 25% increase over November. ChatGPT's growth is a clear signal that users are willing to pay for AI tools and that not just the case for ChatGPT.

YouTube took third place with $148M. While it's "only" third on this list, YouTube's revenue continues growing steadily as premium subscriptions and ad-free viewing become more appealing to users tired of constant interruptions to the tune of 12% month-over-month.

Tinder and Google One round out the top five highest earning apps. Tinder managed to grow a bit while Google One dropped by $14M. Two very different categories and two very different results to end the year.

Together, the top 10 highest-earning apps brought in $1.3B of net revenue in December according to our App Intelligence. That's lower than November but nearly 30% higher than December 2024.

The Download-Revenue Divergence Continues

This split between downloads and revenue isn't new, but December made it impossible to ignore. We started observing this trend back in 2024 and it's accelerating into 2026.

For developers, the implications are clear. User acquisition is getting harder and more expensive. The low-hanging fruit is gone. But monetization opportunities are expanding as users become more comfortable paying for premium features, subscriptions, and digital goods.

This is a maturity signal. The mobile app economy is shifting from growth-at-all-costs to sustainable business models. That's good news for developers who understand their users and can deliver real value. It's challenging news for those still chasing vanity.

The other trend worth noting: AI is everywhere. ChatGPT dominated downloads and earnings. Google Gemini made the download top five. Grok pops into the top charts pretty normally now. The shift toward AI-powered tools isn't just hype, it's fundamentally changing how people interact with their devices.

December's numbers prove that the mobile app economy isn't slowing down, it's just growing up. Downloads might be plateauing, but revenue is climbing, and the apps that understand this shift will be the ones that thrive in 2026.

See Appfigures In Action

Better intelligence to beat the competition faster!

3. Games Unwrapped More Downloads, Fewer Dollars in December – The Top Mobile Games in the World

The December gaming numbers from Appfigures Intelligence have been crunched like the snow and ice under so many feet.

While a couple games received gifts in the way of considerable revenue bumps, the topmost representatives of the category saw their after-fees earnings slip on the ice. Still, although the top 10 lost their footing overall, the data shows that this didn't snowball into games lower on the ranking (especially in the long-tail of more modestly performing titles) seeing similar declines.

Last War was once again the supreme title where gamer spending was concerned, and its player base spent big on it in December to the tune of netting an estimated $136M — $17M more than in November. Publisher Funfly gave players plenty of festive ways to engage and spend more in the title with a number of special events and several holidays-themed mini-games, which clearly delivered as intended.

Monopoly Go had a great December, rising to #2 overall with $121M and earning an estimated $9M over its November total in the process. It also made a big move on iOS, sliding up three places to be the #1 game by revenue on the platform in December. Like Last War, Monopoly Go benefitted from a sleigh-full of live ops events and mini-games deployed, including a special New Year’s Blocks mini-game and rolling bonus opportunities.

Royal Match ($103M), Whiteout Survival ($101M), and Candy Crush Saga ($76M) filled out the remainder of the top five. Whiteout Survival effectively swapped places with Monopoly Go, losing an estimated $14M from its November number in the process.

Altogether, December’s 10 biggest earners across both app stores combined to net an estimated total of $865M worldwide, which works out to about $32M or roughly 3.5% less than November. The entire games category earned about 0.6% less month-over-month, so the overall decline wasn’t as pronounced outside of the top apps. Still, we usually expect December to deliver gains for the category, but that’s not always the case as this data proves.

Setting aside the overall downloads top 10 for a moment, there was a very important launch on iOS last month for a couple of reasons, and the game in question came in at #3 on that ranking, Red Dead Redemption. It’s noteworthy not only because it reached such a high spot on the chart with an estimated 5M first-month downloads, but also because why that was possible.

The game, formerly on consoles and PC, debuted both as a free title for Netflix subscribers and a $39.99 paid title for non-subscribers. Given the Rockstar-developed game’s astonishing pedigree and console-quality content, it’s no wonder Netflix subscribers tapped download in droves to secure a copy.

Back in the top 10 across both platforms, Block Blast didn’t move from #1 — but it did move more installs to hit an estimated 30.4M, 7.3M more than in November. We can imagine what was probably a rather large number of new device owners signing in to the app stores during the holidays, seeing the title atop the free game rankings, and giving it a download for that reason alone.

Roblox, like Block Blast, saw its rank (#2) unchanged from November, and given the game’s almost mythic popularity at this point, we wouldn’t really expect anything less than that — although we would have easily seen it being #1 during the holidays with new devices in new players’ hands. That said, it didn’t gain as much over November as Block Blast, adding just 1.3M to its total from November's figure, for a total of 20.4M, according to our estimates.

Pizza Ready, Subway Surfers, and Vita Mahjong were top downloaded titles #3 to #5, with the first two switching places from November’s ranking and the third stating put. While Subway Surfers (15.5M) and Vita Mahjong (12.7M) didn’t grow their December totals notably over November, Pizza Ready served an estimated 16.5M downloads, which was 2.3M (or 16%) more than a month earlier, per our models.

Adding the rest of the top 10 into the mix, their downloads totaled an estimated 150M, which was 16M more than November’s sum of 134M. That’s an increase of roughly 12% month-over-month and is exactly the kind of sequential growth we expect out of the final month of each year.

The Year Ahead

It’s been a turbulent few years for the mobile games industry: first the pandemic-driven highs of 2020–2021, then the lows brought on by the deprecation of IDFA, followed by a return to “normal”, only for generative AI to arrive, potentially causing more disruption than tangible benefits.

The dust from that latest disruption has begun to settle. While gen AI will likely lead to an increase in lower-performing titles in terms of downloads in 2026, it should also drive a faster overall release cadence across the category.

With noise increasing and downloads already declining in general, gen AI’s most valuable use cases are likely to emerge in optimizing the user acquisition pipeline, particularly when it comes to producing and testing creative assets. Those who deploy it effectively will have a meaningful advantage in keeping CPI down while maximizing retention and, ultimately, lifetime value on fewer installs.

Looking ahead, the winners in 2026 are unlikely to be defined by any single mechanic or technology, but by how well teams balance diversification and focus. Monetization will continue to fragment across IAP, subscriptions, ads, and hybrids, forcing developers to be intentional rather than opportunistic, while community building increasingly shifts from a marketing afterthought to a core retention strategy.

At the same time, the gradual expansion of paid search placements on iOS is poised to put new pressure on organic discovery, raising the bar for ASO and making visibility more expensive for everyone, especially smaller studios without deep acquisition budgets. That dynamic may also accelerate the push toward live ops and IP-driven crossovers, which until now have largely been the domain of the biggest titles, but could begin trickling down as mid-scale games look for ways to stay culturally relevant and sticky over longer lifecycles.

In a market defined by fewer downloads and more noise, sustainable growth will hinge less on chasing scale and more on building resilient systems that keep players engaged, monetized, and connected over time.

4. BambuLab Hit 2M App Downloads by Thinking Like Apple

3D printing went mainstream in 2025 thanks to a company that rose to fame with a very successful Kickstarter campaign back in 2022. Fast forward a few years, and that company, BambuLab, is the most valued 3D printer manufacturer in the world.

I've been into 3D printing for a very long time and have seen their line of printers evolve, and even got myself a few. BambuLab's "it just works" philosophy, slightly higher price point, and a fairly closed ecosystem, remind me a lot of Apple, an approach not many have mastered in the past.

And like Apple, BambuLab understood something crucial: selling hardware is just the beginning. They built an entire ecosystem around their printers, accessible through their mobile app where you can browse ready-to-print designs and start printing from your phone. It's so easy a 6 year old can do it. I've seen it.

That ecosystem strategy paid off in a big way in 2025.

At the tail end of the year, after releasing 3 new printers, everything in BambuLab's online store was out of stock. Printers, parts, and even the plastic for printing. I figured it was related to their Black Friday and end of year sales, but I wasn't sure just how big these two campaigns would be.

The printers require a mobile app for setup, which means I can track just how well that ecosystem strategy performed using Appfigures Intelligence!

So, how many units did it sell?

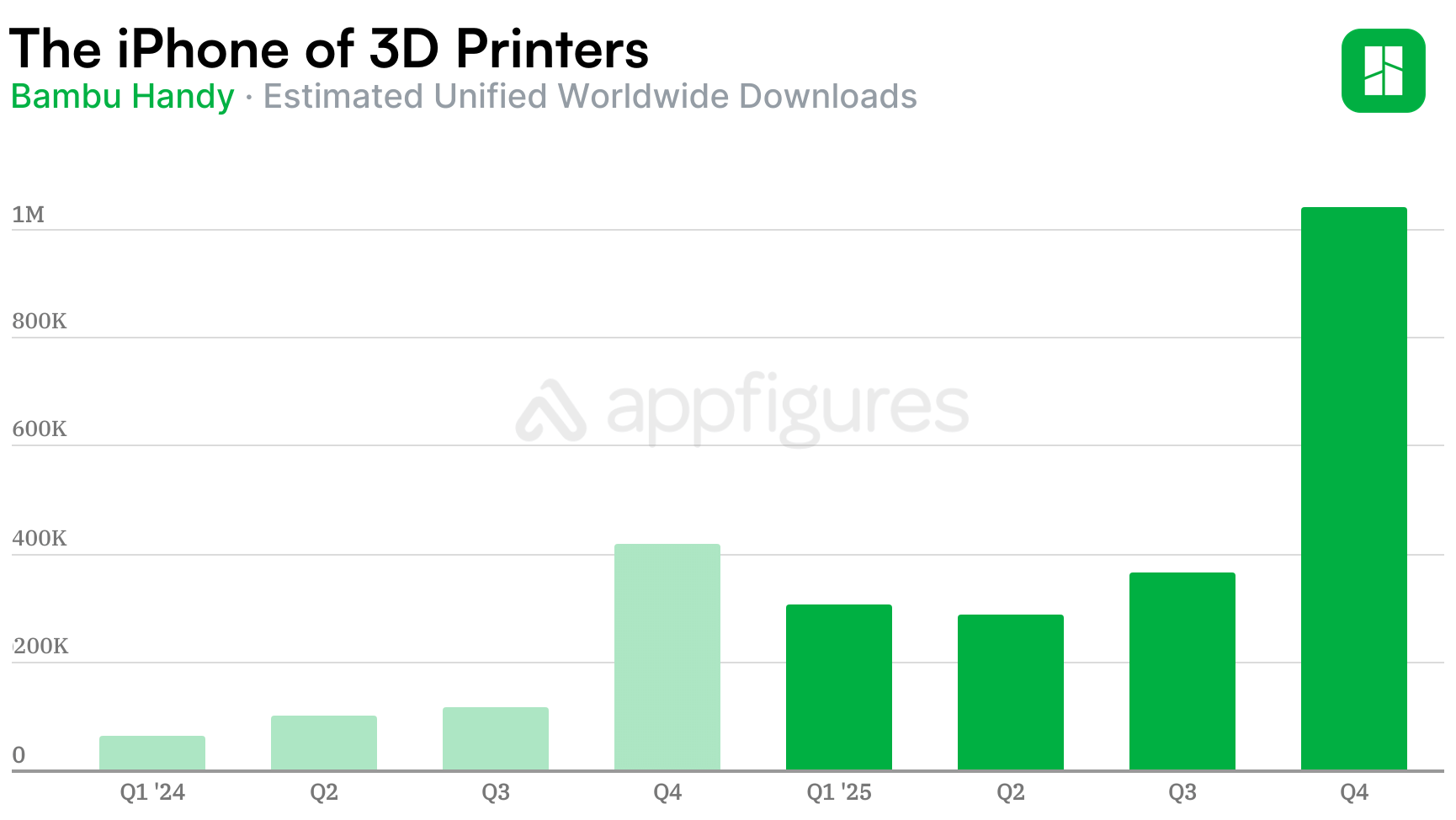

The end of 2024 was the biggest BambuLab has seen up to that point. According to Appfigures Intelligence, BambuLab's app, Bambu Handy, was downloaded 420K times between October and December. One download may not equal exactly one printer, but the number is probably close. That's a lot of 3D printers for a 3-month stretch.

2025 saw the release of the H2 series printer which quickly became a favorite for many. That, combined with an even earlier start to a Black Friday campaign, pushed sales to a new all-time high.

We estimate that Bambu Handy was downloaded a little over 1 million times between October and December of 2025 from the App Store and Google Play. Although downloads rose on both store at the same rate, the App Store contributed a majority of the downloads.

Zooming out, Bambu Handy saw 2M downloads in 2025 according to our estimates vs. 700K in 2024. More than half of those came from the US with Germany second-largest by volume and the rest spanning 100 countries.

This is what an ecosystem looks like in practice: 2M downloads, spanning 100 countries, with users who aren't just buying a printer—they're buying into a platform. BambuLab's success shows that building an ecosystem around your app, service, or game is an investment that pays in dividends. It worked for 3D printers and it can also work for your app.

Ready to Beat the Competition?

Appfigures has the intelligence you need

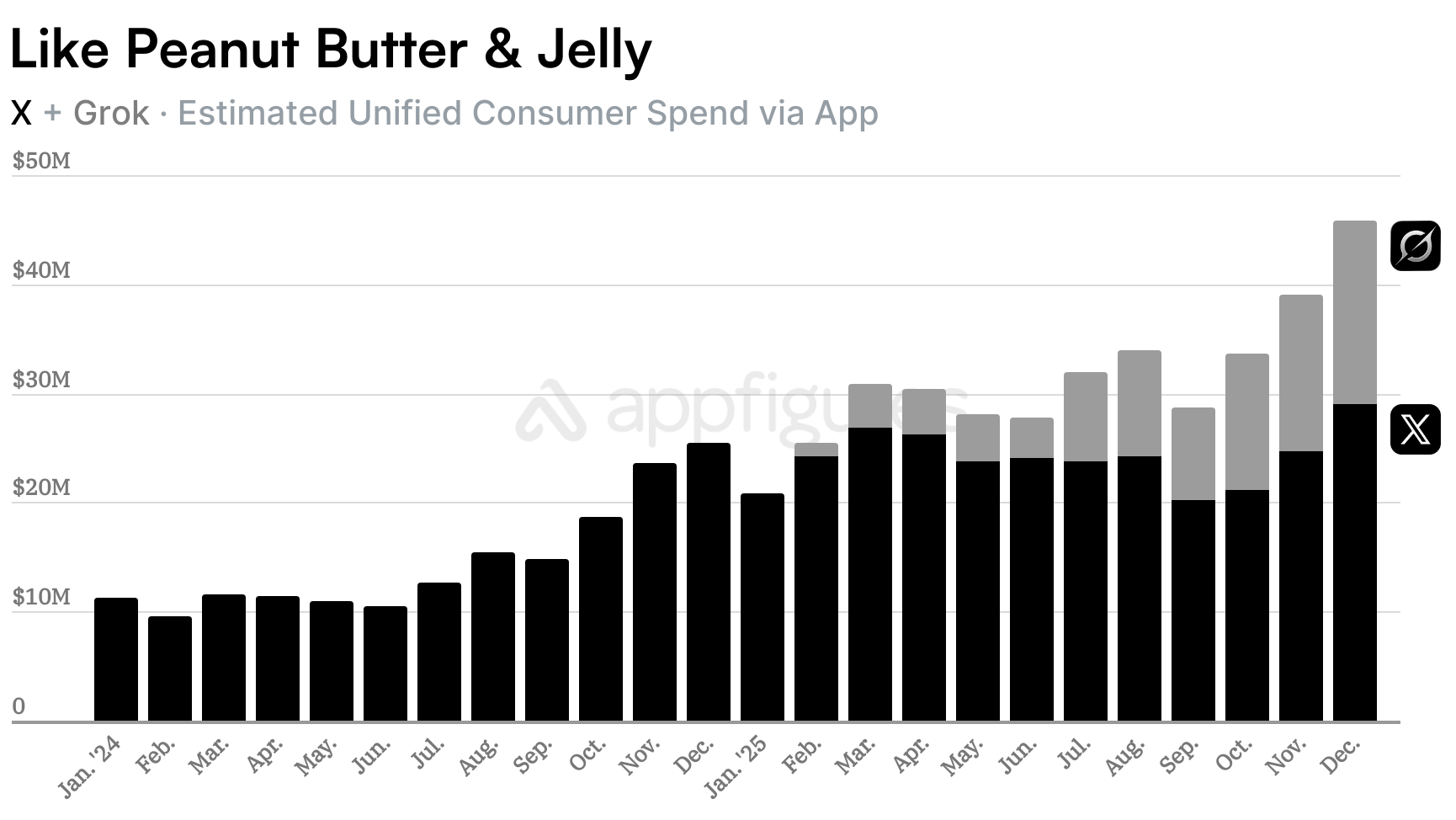

5. X's Revenue Doubled When It Split Grok Into Its Own App

In February, X did something that looked like a mistake: it took Grok, the AI feature driving subscriptions, and split it into its own app with its own paywall.

By December, it was clear why. X ended 2025 with its highest month of revenue ever, and the pair's combined growth tells a story about what's actually driving that success.

Here's December's check-in.

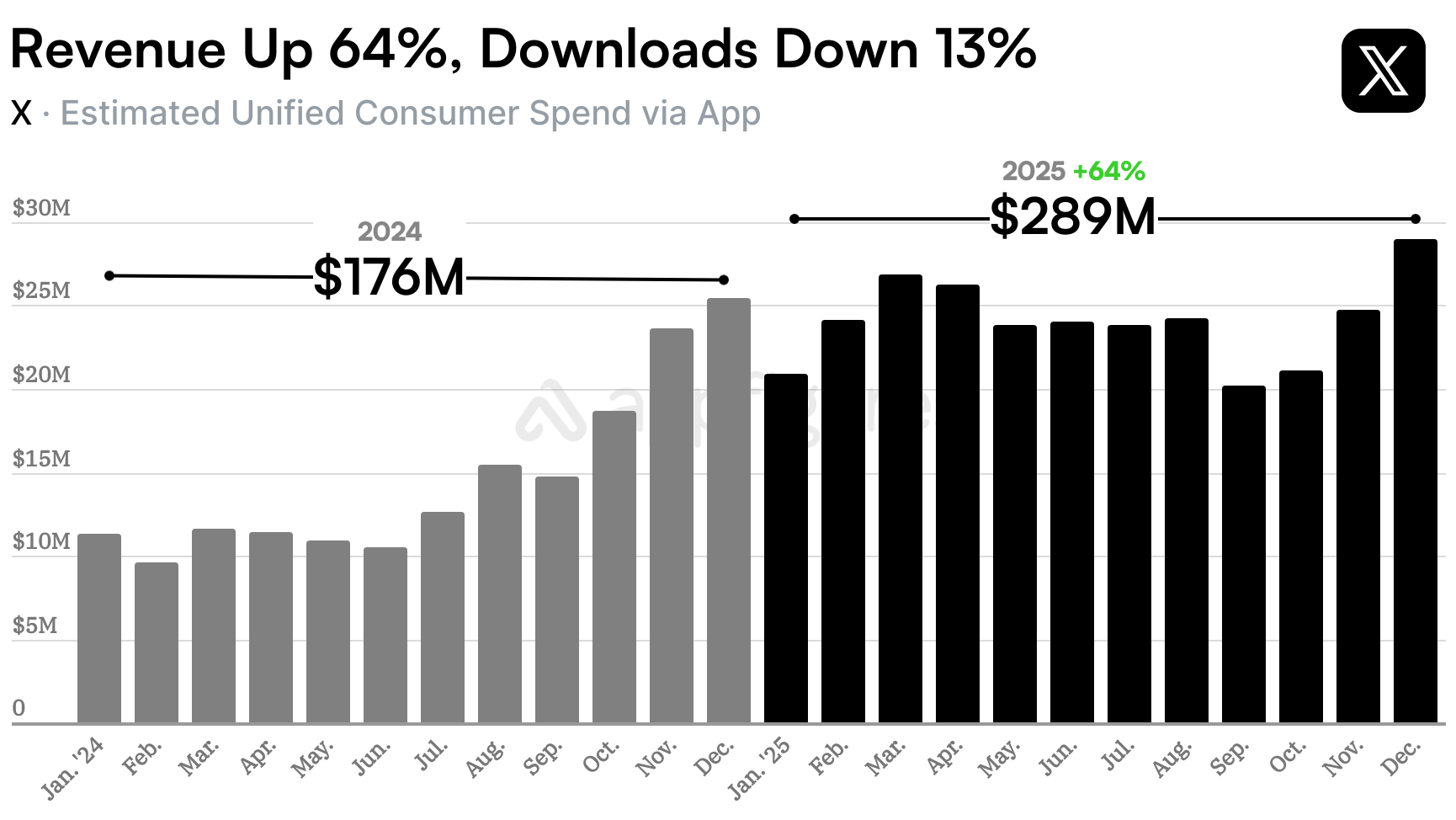

According to Appfigures Intelligence, users spent $29M on X via its mobile app in December, the highest month of revenue the app has ever seen!

December capped off a very good year for X: $289M in before-fee revenue, a 64% increase over 2024's haul and a 2,800% increase over 2022's revenue.

All of that while downloads dropped 13% for the year for a total of 104M, according to our estimates. That's not on X though, it's rather an industry-wide trend that's impacting many big apps.

While revenue was higher, the real acceleration wasn't happening at X. It was happening at Grok.

Here Comes the Grok

Before 2025, X's AI product, Grok, could only be accessed via X and could be unlocked further with an X subscription.

That has been a big contributor to X's revenue growth in 2024. Then, Grok got its own app and its own subscription system in February, and that shifted the growth.

So now you can use Grok as part of your X subscription and also as a standalone subscription, which is growing revenue for both.

Like X, Grok also ended 2025 with a bang. Appfigures Intelligence shows Grok earned $17M in December, up 17% from November.

Stacking the pair's revenue paints a different picture and confirms that X's revenue growth shifted to Grok. Together, the pair earned $46M in December, up 84% from the $25M of before-fee revenue X earned last December, before the Grok split.

I expect to see more cross-over between the two, and to see other social platforms follow suit. Meta is trying cautiously with Meta View. The downloads are growing, but it hasn't made headlines recently.

I'm sure 2026 will be a very interesting year for AI and social platforms.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.