This Week in Apps #56 - Spotify, Scooters, and Facebook's Latest Move

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

Subscribe in Apple Podcasts · Spotify · Google PodcastsU.S. Index (YTD)

Mobile Download Index: App Store 98.36 (-10.2%), Google Play 68.97 (-27.6%)

Insights

1. March was big!

We just published the Top 10 Most Downloaded Apps in March report, and unless you've been following these closely, it might look like not much has changed. TikTok is the most downloaded app globally, on the App Store, Google Play, and combined.

The rest mainly come from Facebook and Google. We estimate that the top 10 most downloaded apps in March generated 352 million downloads across both platforms.

But there's a much more interesting trend to watch, and that's consumer spending. While downloads remain pretty much the same, consumer spending has continued to increase at a faster rate than ever before.

Last year's lockdowns have forced many to rely on apps. From completing business tasks to taking a break. That convinced more and more consumers to take out their virtual wallets and actually spend money on apps.

According to the Mobile Revenue Index, consumer spending on apps in the US App Store is at an all-time high of 232 points, up nearly 100 points since the beginning of 2020, already up 10 points this year, and on par with the highest peak of last year.

The bottom line: Consumers are becoming more comfortable spending money in-app. Developers who optimize for that should see exponentially higher results, and zooming out a bit, a more sustainable future.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

2. Scooters take over

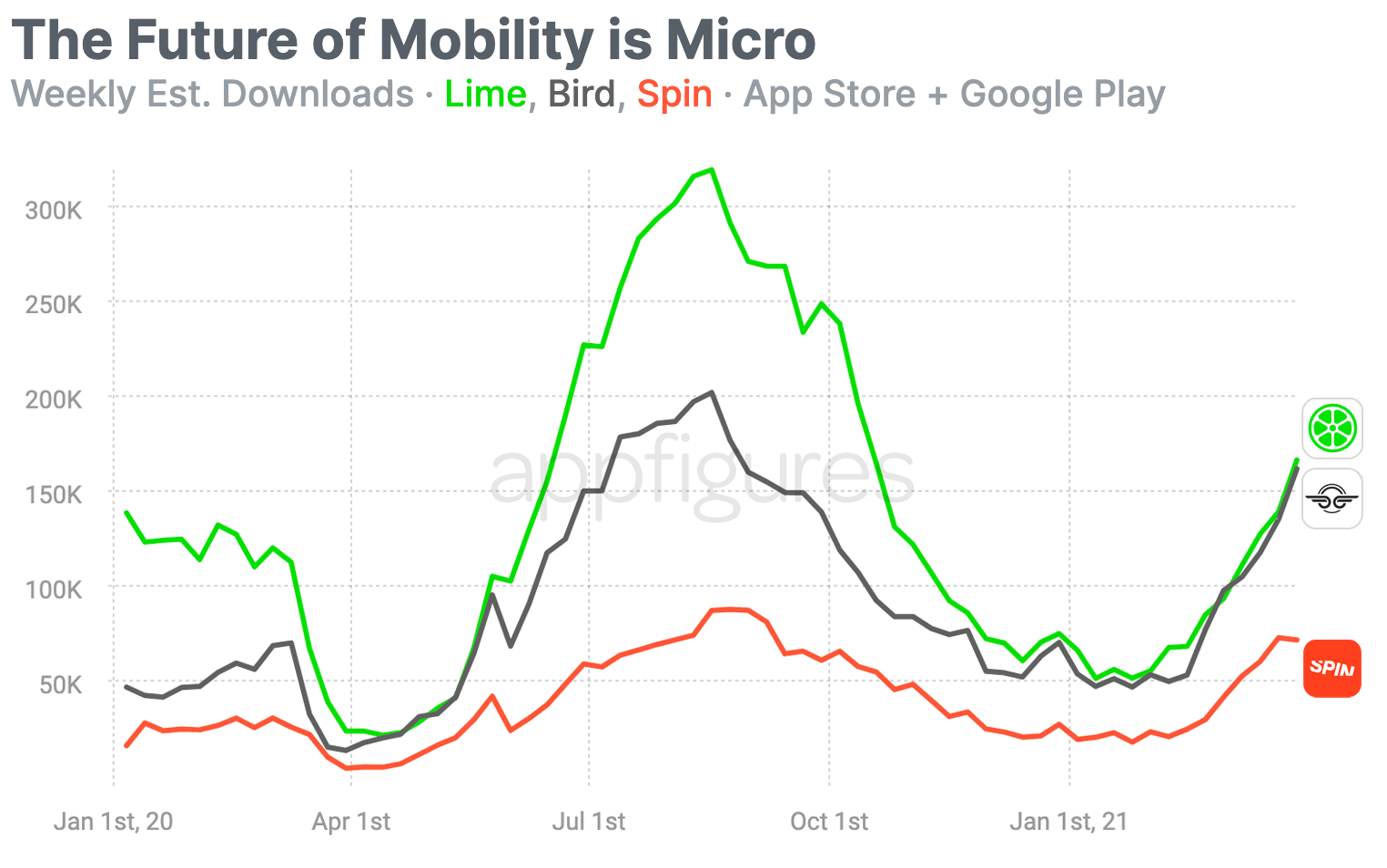

When the pandemic started, I made a prediction that electric scooters will become very popular among those who need to get around in a faster-than-walking-speed but prefer not to get on a bus or into a subway because of COVID.

That prediction was based on my own behavior and also a spike in downloads for scooter rental apps last summer.

A year into the pandemic, and with spring just starting, downloads have spiked again to levels that resemble last summer's spike.

Downloads of Lime, Bird, and Spin, three popular scooter rental services, have been climbing since the beginning of February. The three combined saw about 120K weekly downloads at the end of January. At the end of March, that number climbed to more than 400,000.

If this continues, and there's no sign it won't, demand for scooters this summer will easily eclipse last year's.

If you live in a big city, I bet you're seeing more people on scooters. Here in NYC, even though scooter rentals aren't an option, many have bought their own, me included.

That means more leverage for scooter rental companies like Lime and Bird, who need to convince more cities to let them in. It's also an overall improvement to inter-city mobility, given the low cost of electric scooters.

3. Facebook abandons 416,000 apps

Facebook announced this week that they're ending the Facebook Analytics service this summer. That's it. No explanation why. No replacement.

According to our Top SDK charts, Facebook Analytics is the #2 most installed analytics SDK right after Google's solutions.

That's a lot of people Facebook is saying goodbye to.

According to our SDK Intelligence, Spotify, TikTok, Clash of Clans, Candy Crush, Toon Blast, eBay and Call of Duty, along with more than 416K other apps and games, will now need to find a replacement.

My guess is that the replacement will be Google's Firebase, which is already the dominant free analytics solution.

The real question: Why would a company that's sooo data-hungry give up access to such delicious data?

4. RIP paid apps

Over the last few years, many developers have abandoned the traditional pay-upfront model for freemium and subscription models. Right now, only 4% of apps and games across the App Store and Google Play are a paid download. Last year that number was 15%

Why, you wonder? Because apps that are free to download make more money.

A comparison of the Top Paid and Top Grossing app lists, in the US App Store and on Google Play, shows just how much higher revenue is for free apps.

In the App Store, a top 10 paid app can expect average net revenue of $10K - $1M per week. On Google Play that range is even smaller, at $10K - $300K per week.

A top 10 free app with in-app purchases or subscriptions is much healthier. According to our estimates, on the App Store, weekly revenue is 5x higher at $3M - $5M, and on Google Play, it's more than 10x higher, at $3M - $4M.

Here's the thing: Does that mean the pay-once model is gone and that consumers will be forced to pay for everything on a subscription basis? Unlikely. But considering the amount of extra friction paying before downloading adds, we can expect pay upfront to disappear in favor of some implementation of in-app purchases.

5. Spotify's smart move

I've been looking at Spotify for a while now, trying to understand how its push into podcasts and especially into original content is helping. But even as it added huge names, like the Obamas and Joe Rogen, to its roster, downloads have stayed fairly flat.

Why is that?

When we look at Spotify alone, it's hard to tell why downloads aren't going up, but when you put it in context, it's very obvious.

Pandora, the top-grossing streaming app in the App Store, helps us contextualize the current market for streaming apps. The gist, downloads are declining. Between native alternatives from Apple and Google and overall market saturation, a declining trend is a reality.

Not for Spotify!

Spotify's investment into original and exclusive podcast content boosted downloads so much that while Pandora's weekly downloads got cut in half over the last 3 years, from 650K in 2018 to just 300K in 2021, Spotify's declined just a little but remained steady at 600K.

The bottom line: Spotify is following Netflix's playbook, one that many streamers are now starting to follow as well. What's special here is that podcasts aren't a natural extension of music streaming and weren't as popular when Spotify started their push, which means Spotify was thinking out of the box here instead of letting Apple Music run them out of business. Well done.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.