This Week in Apps #123 - But Will They Pay?

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (30 Day)

Insights

1. Is Amazon Prime Day Still Worth it (for Amazon)?

Amazon wrapped up its annual Prime Day event here in the US last week, and I was very curious to see how many new mobile shoppers it managed to bring.

I'm curious about Amazon for two reasons. The first is simple: one of the first insights I published oh so many years ago was about Prime Day. The other is that I'm interested in seeing if Amazon hit its peak or if there's more to conquer. A bit more relevant.

Obviously, more demand is great for Amazon, but the way I see it, demand for Amazon really means demand for mobile shopping. It may not be easy for others to compete, but if it were easy, it wouldn't be fun, right?

Just a brief glance at our download estimates answered my question and fast. We estimate that Prime Day 2022 (7/12 - 13) gave Amazon more than 370 thousand new mobile users in the US.

But that wasn't all. Looking at downloads, the excitement started a bit before. Almost a whole week before. Downloads started rising on Friday (7/8) and didn't slow down until last Friday (7/15). Our estimates put the entire week at around 1.5 million new mobile users.

That's a nice number, but the real question is simple. Is this higher or lower than last year? Absolutely! 2020 had a slight bump of just 30 thousand new users above the daily average, and in 2021, downloads barely showed any sign of excitement.

Coming into this, I really expected downloads to be slow and boring, which means Amazon has reached its potential on mobile. It wouldn't mean it's reached the end, but it means it's now growing with the population.

That, however, is not at all the case.

The pandemic managed to change a lot of trends and shopping is one of the top ones. That's great news for Amazon but should also be seen as an opportunity for other retailers. Apple Pay (and upcoming Apple Pay Later) make purchasing easy, higher gas prices make it easier to forgo a trip to the store, and the incredible speed at which goods go from a picture on our phones to a box in our hands are ushering a new wave for mobile shopping.

Not online shopping. Mobile shopping.

2. Snapchat Turns on Subscriptions – But Will They Pay?

Snapchat did it. Last month, the folks at Snap released Snapchat+, a paid subscription that does pretty much nothing. Well, I don't mean to be mean, but it really doesn't... Snapchat+ gives users the ability to become beta testers for new features for a whopping $3.99/mo.

Don't believe me? Check out Snapchat's support page to read it in their language.

When I initially saw this, I expected it to be a total flop. I mean, look at Twitter's numbers... Well, I don't think we can call it a flop once we consider the numbers. Another reminder Twitter could be doing much better, but that's for a different insight.

According to our download estimates, Snapchat's new subscription has earned the yellow ghost about $4.5 million in net revenue since being rolled out two weeks ago. That's right, two weeks. And my usual reminder, this is net revenue, which means what Snapchat gets to keep after Apple and Google take their fees.

Speaking of Apple and Google, most of this revenue came from the App Store. I summed the two up in the chart to make it easy to see, but if I hadn't, you'd barely see the line denoting Google Play. If you prefer numbers, Google Play accounts for roughly 4.5% of the total.

But wait, we're not done just yet. We know the cost of the subscription, and we know the total, which means we can estimate the number of beta testers Snapchat has added with Snapchat+! That calculation means Snapchat+ has 1.6 million paying subscribers right now.

Snapchat has a very unique user base. It's what carried it all these years while it fumbled many opportunities. That user base is still excited about the app, enough to pay to see its future faster. As silly as I think charging for this is, I applaud Snapchat for trying and succeeding.

If you're a Snapchat+ user, do you think it's worth it?

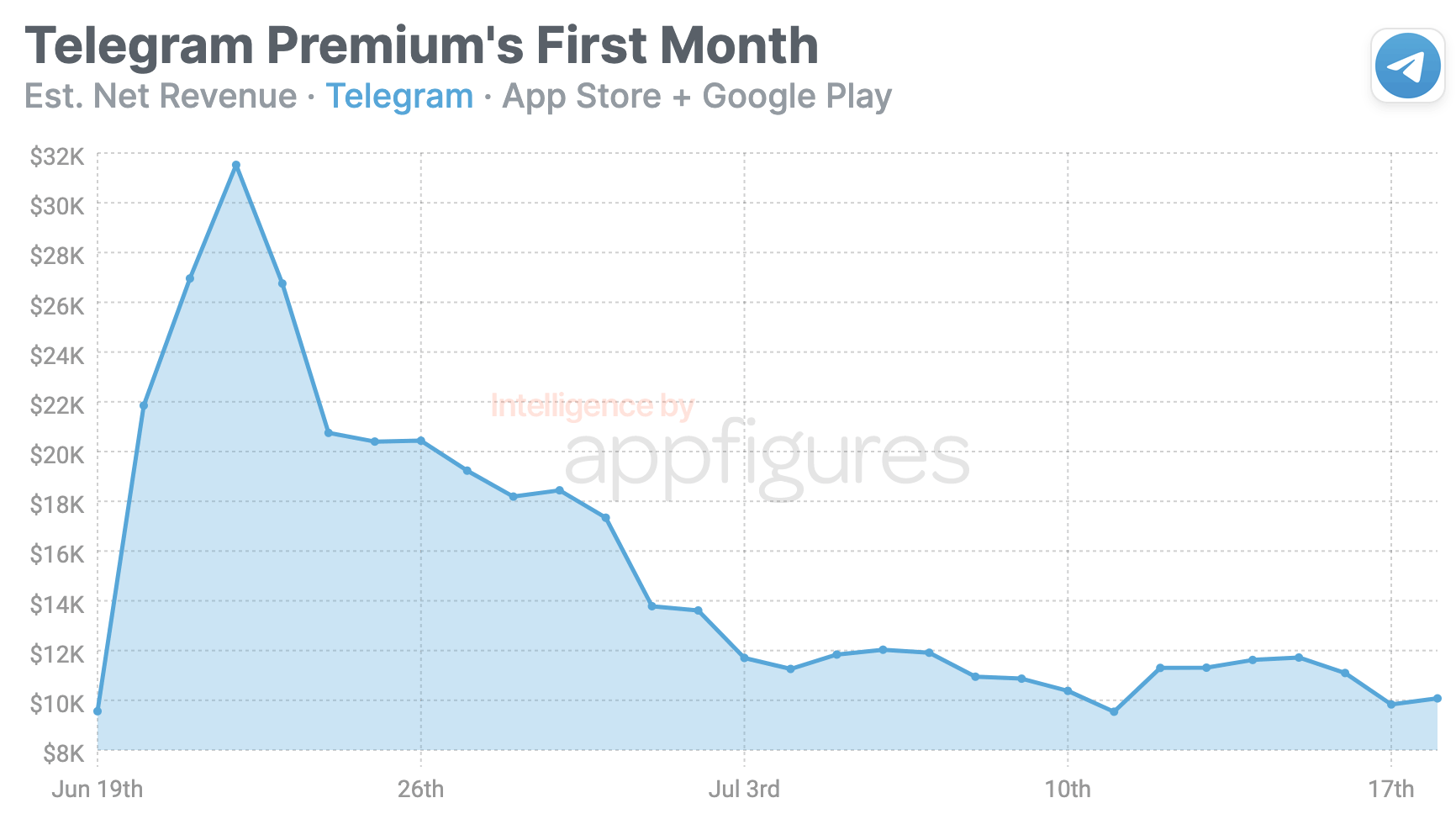

3. Telegram Turns on Subscriptions – But Will They Pay?

Telegram, the messaging tool that became indispensable during the war in Ukraine, decided it was time to start making some money and rolled out a paid subscription tier for power users. Unlike Snapchat+, Telegram Premium actually gives something useful in return for your hard-earned cash. But not useful enough for most users.

Telegram Premium unlocks doubled limits, 4 GB file uploads, faster downloads, exclusive stickers and reactions, and a few more fun features like animated profile pictures.

Considering Telegram's limits are already fairly generous, I don't expect this to be an immediate hit, but let's have a look at the data and see if I'm right.

Since rolling out to users in late June, Telegram has earned $480 thousand in net revenue. Roughly 17% of the total came from Google Play, where Ukraine was the second biggest spender after the US, and the rest came from the App Store, where Ukraine was also the second biggest spender after Russia.

This isn't Snapchat money, but it's a decent start for a subscription tier that's targeting power (and/or bored) users.

Telegram's founder was quoted saying that all it needs is for 2-3% of its users to upgrade and they'd be sustainable. You might be hearing 2% and thinking, "oh, that's nothing, they should be able to get that in no time", consider Telegram also claims to have 700 million users. That's 14 million paying subscribers.

I applaud companies that attempt to become sustainable by charging for their services.

It's no easy task for a few reasons, and the main one is that investors got most of the tech industry to believe running a business is all about getting signups, which in turn got most people to expect everything to be free. This gets even more difficult when a company with an enormous user base that's used to things being free, like Telegram, needs to ask its users for money. It's not working out as well for Twitter.

Starting is hard, and I "blame" that for the low revenue. But give it some time, and I'm sure we'll see changes to what's offered for free that will help revenue grow.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

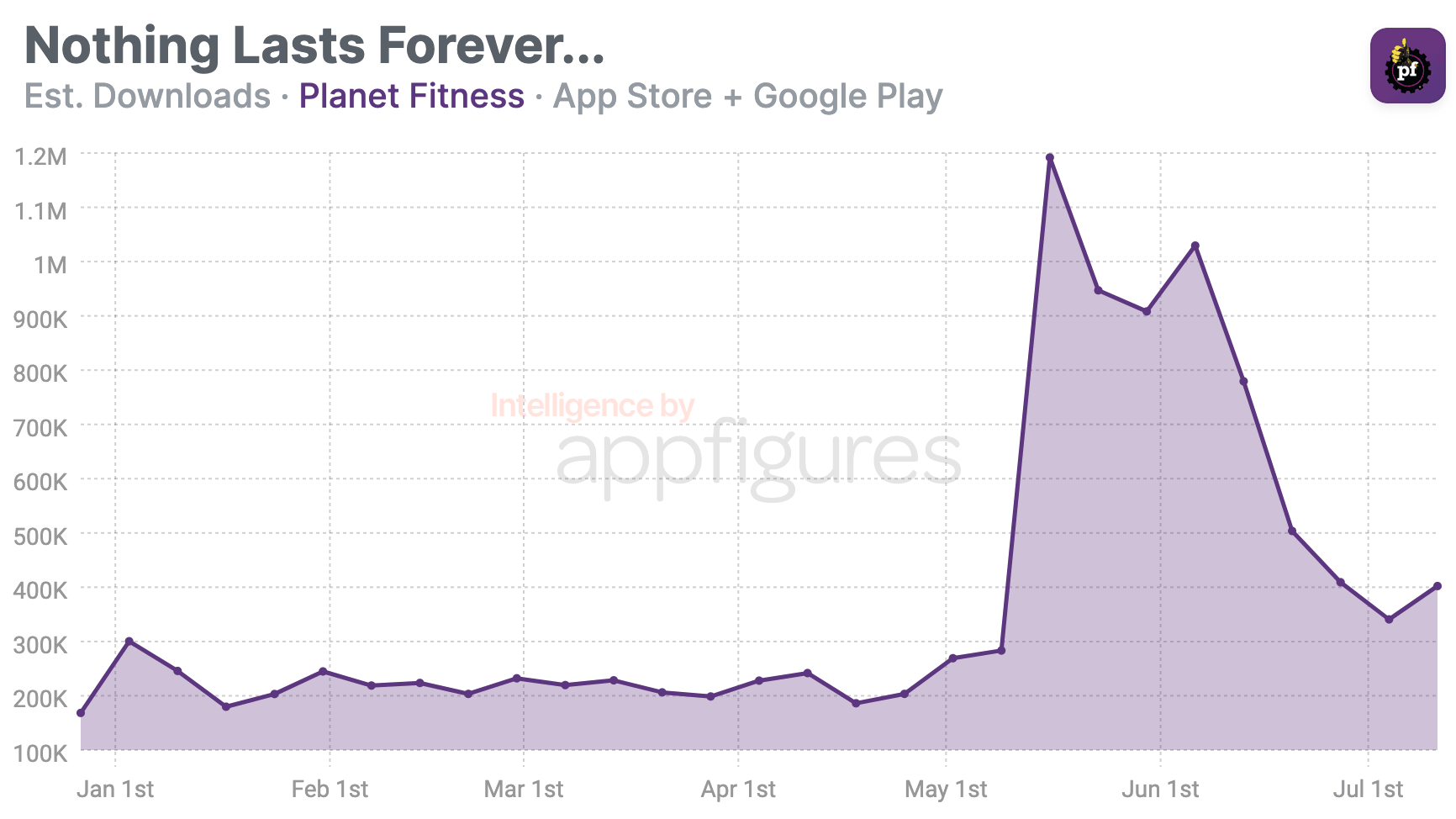

4. Planet Fitness Hit Its Peak, Now Comes the Cooldown

When the summer started, gym franchise Planet Fitness skyrocketed to the top of the App Store after offering access to teens for free for the summer by downloading the app. A campaign I thought was very clever at the time (and still do).

The early results of this campaign were amazing! We're about mid-way through the campaign, and I'm curious how the app is doing right now.

According to our estimates, the campaign has earned Planet Fitness a total of 6.5 million downloads across the App Store and Google Play so far. The App Store was responsible for about 90% of those downloads, with Google Play making up the remaining 10%. Not really surprising.

Looking at the trend, it's easy to see the ride is pretty much over at this point. Downloads, which hit 1.2 million on launch week, have declined to around 400,000 last week. About a third.

With about a month remaining to this campaign, I expect one of two things to happen. Either Planet Fitness will let downloads drop and accept that the fun's done. Or, they'll make a focused push when there's exactly a month to go.

They've done a great job so far, so I expect the latter, in which case, we could see downloads jump back into the millions.

This is a good reminder that it's so important to analyze drops throughout any campaign. It could be fatigue, it could be an overall market trend, but it could just mean that you need to push.

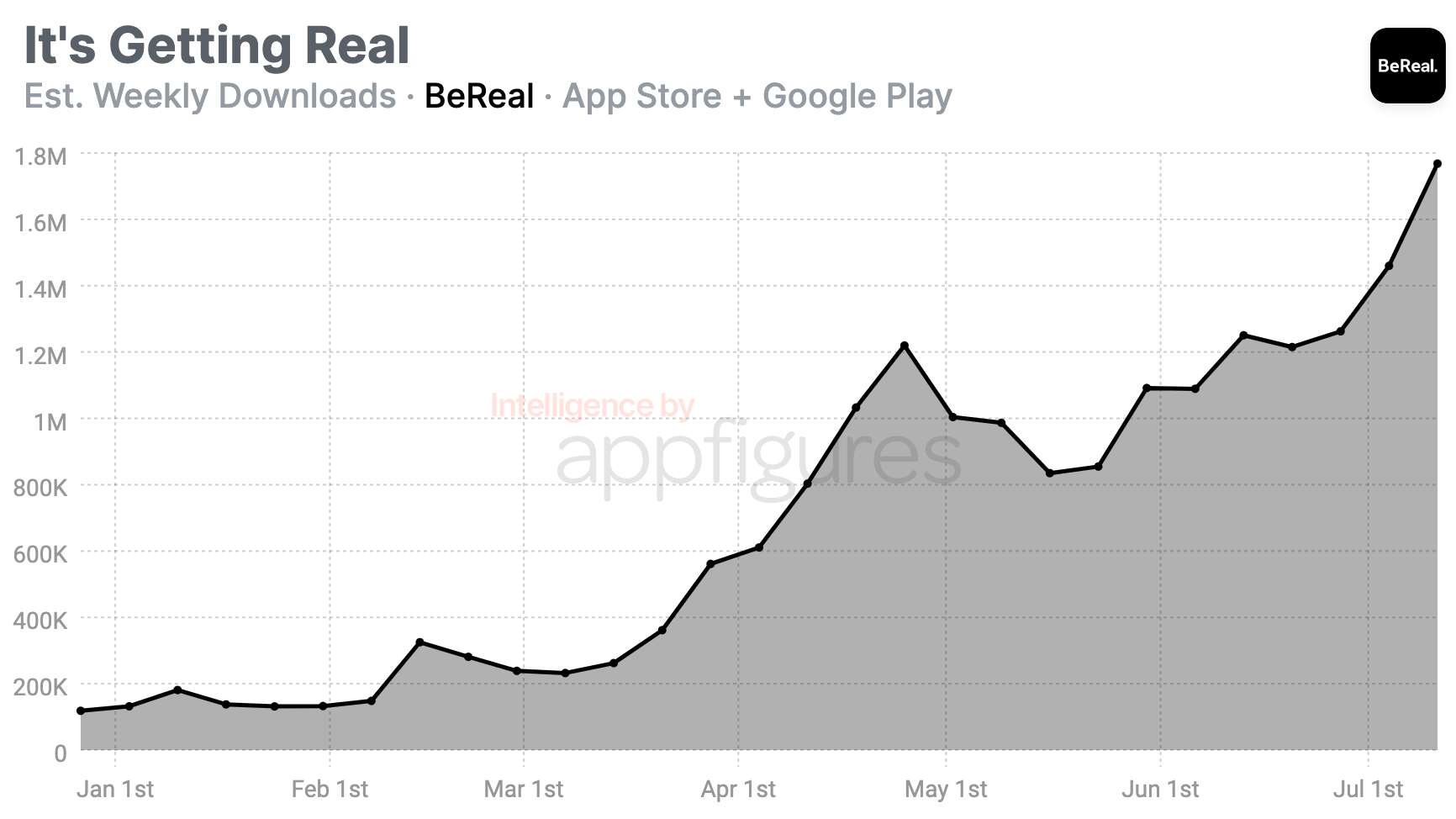

5. BeReal Might Just Be the Next Real Thing...

BeReal is currently the most downloaded app in the US, and it's been at that spot for quite a few days now. Long enough that I have to talk about it even though I've talked about it twice already in the last few months.

The last time I mentioned it, in episode #110, I suggested that if it can remain relevant for just a little bit more, it could become a competitor to established platforms. Fast forward a few weeks, and BeReal tops king TikTok, Instagram, Snapchat, Twitter, and well, it's #1 right now, so pretty much everyone else.

Will BeReal become a real challenger? Let's count those users.

BeReal posted its best week of downloads last week, with 1.8 million new downloads across the App Store and Google Play, according to our estimates. The app's previous best was the week before, and the best before that was... the week before. There were a few dips along the way, but the general shape of BeReal's download curve is up and to the right.

According to our App Intelligence, BeReal added almost 20 million new users since the beginning of 2022. About 85% of those users came through the App Store and the rest through Google Play.

While massive, especially for an app that does one simple thing, this number is unlikely to scare the competition yet, but it opens the door for BeReal to expand beyond its signature feature, and that could make it sticky.

What might it add? I think the answer is obvious. BeReal is all about small circles. Big platforms are all about followers. See where I'm going with this?

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.